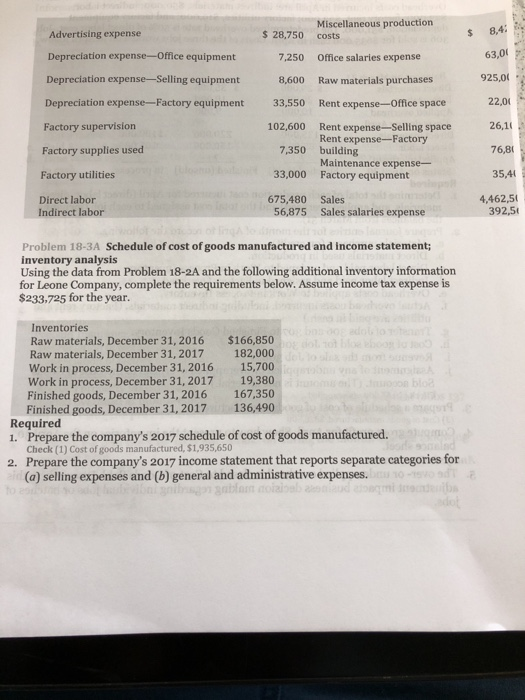

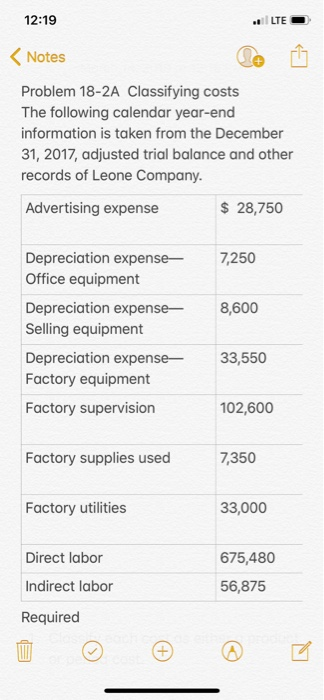

Miscellaneous production 8,4: 63,00 925,0 Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense- Factory equipment33,550 Factory supervision Factory supplies used $ 28,750 costs 7,250 Office salaries expense Raw materials purchases Rent expense-Office space 8,600 22,00 26,1 76,8 35,4 102,600 Rent expense-Selling space Rent expense-Factory 7,350 building 33,000 Factory equipment 56,875 Sales salaries expense Maintenance expense- Factory utilities Direct labor Indirect labor 675,480 Sales 4,462,5 392,5 Problem 18-3A Schedule of cost of goods manufactured and income statement; inventory analysis Using the data from Problem 18-2A and the following additional inventory information for Leone Company, complete the requirements below. Assume income tax expense is $233,725 for the year. Inventories Raw materials, December 31, 2016 $166,850 Raw materials, December 31, 2017 182,000 Work in process, December 31, 2016 15,700 Work in process, December 31, 2017 19,380 Finished goods, December 31,2016 167,350 Finished goods, December 31, 2017136,490 Required 1. Prepare the company's 2017 schedule of cost of goods manufactured. Check (1) Cost of goods manufactured, $1,935,650 Prepare the company's 2017 income statement that reports separate categories for (a) selling expenses and (b) general and administrative expenses 2. 12:19 Notes Problem 18-2A Classifying costs The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company. Advertising expense $ 28,750 Depreciation expense7,250 Office equipment Depreciation expense8,600 Selling equipment Depreciation expense33,550 Factory equipment Factory supervision 102,600 Factory supplies used 7,350 Factory utilities 33,000 Direct labor Indirect labor Required 675,480 56,875 12:19 LTE Notes Problem 18-2A Classifying costs The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company Advertising expense $28,750 Depreciation expense- Office equipment Depreciation expense- Selling equipment Depreciation expense- Factory equipment Factory supervision 7,250 8,600 33,550 102,600 Factory supplies used 7,350 Factory utilities 33,000 Direct labor 675,480 Indirect labor 56,875