Question

MISHA Bhd manufactures and distributes reusable, eco-friendly bamboo utensils in Malaysia. The following information were extracted from the accounting record of MISHA Bhd for the

MISHA Bhd manufactures and distributes reusable, eco-friendly bamboo utensils in Malaysia. The following information were extracted from the accounting record of MISHA Bhd for the year ended 31 December 2020.

1. The taxable profit for the year ended 31 December 2020 was RM5,000,000. Current tax rate applied was 24 %.

2. The deferred tax liability brought forward at 1 January 2020 was RM50,000.

3. MISHA Bhd acquired a building costing RM1 million with an estimated useful life of 20 years on 5 January 2016. The building was depreciated on a straight line basis. On 29 December 2020, the building was revalued to RM1.5 million. Based on current tax rule, the building is entitled for capital allowance at a rate of 20% in the first year and 10% in the remaining years.

4. MISHA Bhd capitalised development costs amounted to RM2,000,000 during year 2020 in accordance with MFRS 138. No amortisation recorded for the year ended 2020. Current tax laws allowed all development costs to be written off immediately in computing taxable profit.

5. MISHA Bhd recorded unearned rent for a 2-year period totalling RM100,000 on 1 January 2020. Of this amount, RM50,000 was reported as unearned at 31 December 2020.

6. Product warranties were estimated to be RM40,000 in 2020. Actual repair and services costs related to the warranties in 2020 were RM20,000. The remainder is estimated to be paid evenly in 2021 and 2022.

7. Interest earned from fixed deposit investment during 2020 was RM25,000.

8. A donation of RM15,000 was made to Inland Revenue Board?s approved charity fund organised by the local community during the year.

9. Entertainment expenses amounted RM2,000 was incurred on 2 June 2020.

10. Trade and other payables include an accrual for compensation of RM10,000 to be paid to employees after the financial year ends.

11. Legal expense of RM5,000 was deducted for financial reporting. It will be deducted for income taxes when paid in a future year.

12. A penalty of RM4,000 was imposed by the government on the company in current financial year.

REQUIRED:

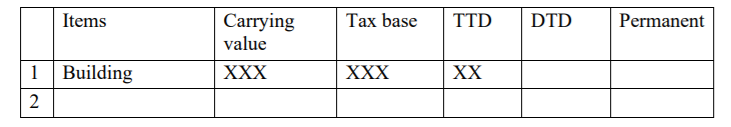

(a) Determine the carrying values and tax base for each item discussed in the case. Calculate the amount of taxable temporary difference (TTD), deductible temporary difference (DTD), or permanent difference for each item. Prepare your answer in the following format:

(b) Calculate the amount of tax expense and deferred tax for the year 2020.?

(c) Prepare necessary journal entries related to the above transactions.

(d) There are two types of differences in computing deferred tax which are timing and permanent differences. Explain both differences.

Items 1 Building 2 Carrying value XXX Tax base XXX TTD XX DTD Permanent

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Item Carrying Value Tax base TTD DTD Permanent 1 Building depreciation RM1125000 RM75000 RM...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63637da86b3d8_233165.pdf

180 KBs PDF File

63637da86b3d8_233165.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started