Answered step by step

Verified Expert Solution

Question

1 Approved Answer

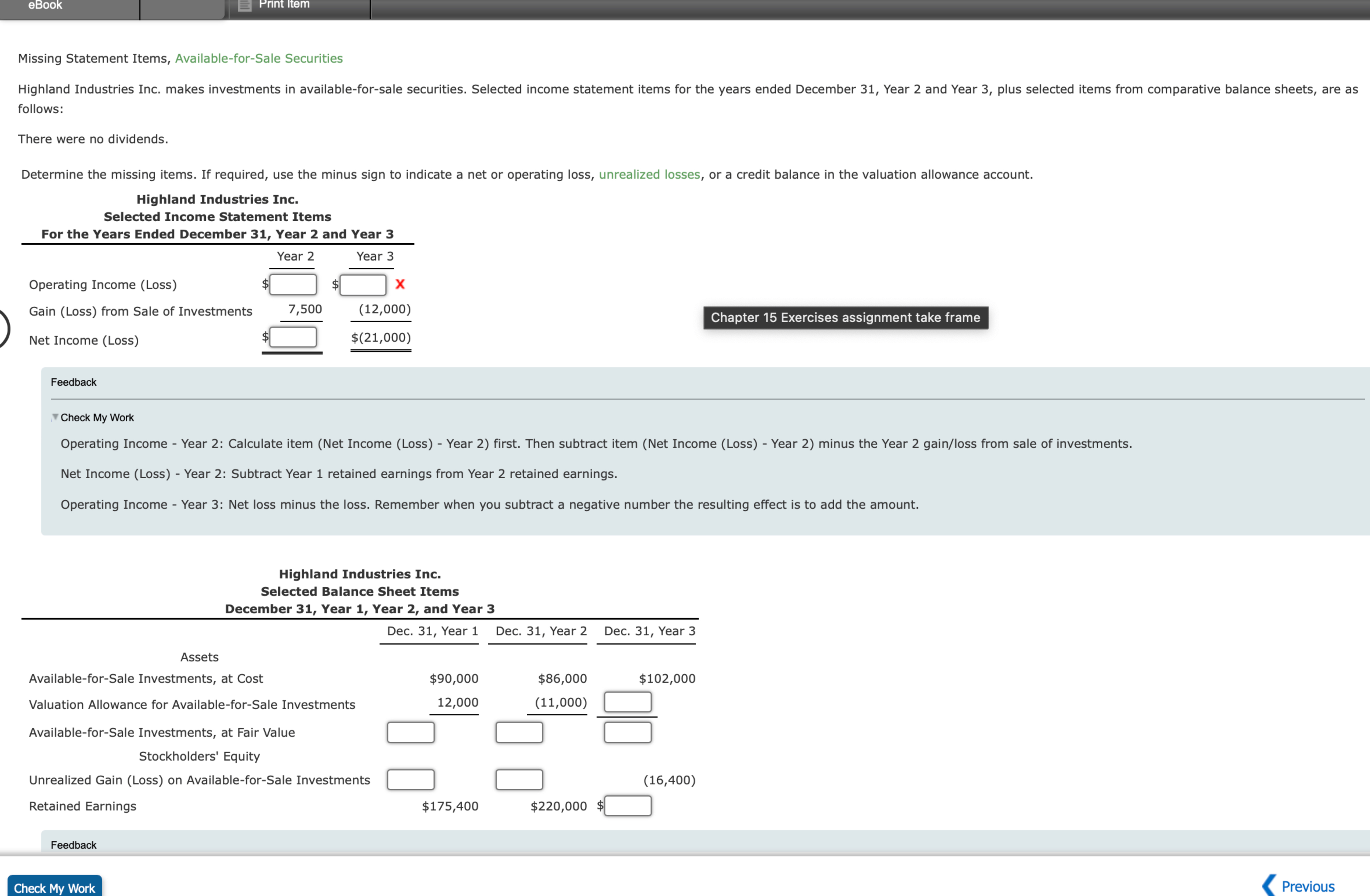

Missing Statement Items, Available - for - Sale Securities Missing Statement Items, Available - for - Sale Securities follows: There were no dividends. Determine the

Missing Statement Items, AvailableforSale Securities Missing Statement Items, AvailableforSale Securities

follows:

There were no dividends.

Determine the missing items. If required, use the minus sign to indicate a net or operating loss, unrealized losses, or a credit balance in the valuation allowance account.

Highland Industries Inc.

Selected Income Statement Items

For the Years Ended December Year and Year

Feedback

V Check My Work

Operating Income Year : Calculate item Net Income Loss Year first. Then subtract item Net Income Loss Year minus the Year gainloss from sale of investments.

Net Income Loss Year : Subtract Year retained earnings from Year retained earnings.

Operating Income Year : Net loss minus the loss. Remember when you subtract a negative number the resulting effect is to add the amount.

Highland Industries Inc.

Selected Balance Sheet Items

December Year Year and Year

Highland Industries Inc. makes investments in availableforsale securities Selected income statement items for the years ended December Year and Year plus selected items from comparative balance sheets, are as follows:

There were no dividends.

Question Content Area

Determine the missing items. If required, use the minus sign to indicate a net or operating loss, unrealized losses, or a credit balance in the valuation allowance account.

Highland Industries Inc.

Selected Income Statement Items

For the Years Ended December Year and Year

Year Year

Operating Income Loss $fill in the blank cccffad $fill in the blank cccffad

Gain Loss from Sale of Investments

Net Income Loss $fill in the blank cccffad $

Question Content Area

Highland Industries Inc.

Selected Balance Sheet Items

December Year Year and Year

Dec. Year Dec. Year Dec. Year

Assets

AvailableforSale Investments, at Cost $ $ $

Valuation Allowance for AvailableforSale Investments fill in the blank efaefdfff

AvailableforSale Investments, at Fair Value fill in the blank efaefdfff fill in the blank efaefdfff fill in the blank efaefdfff

Stockholders' Equity

Unrealized Gain Loss on AvailableforSale Investments fill in the blank efaefdfff fill in the blank efaefdfff

Retained Earnings $ $ $fill in the blank efaefdfff

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started