Question

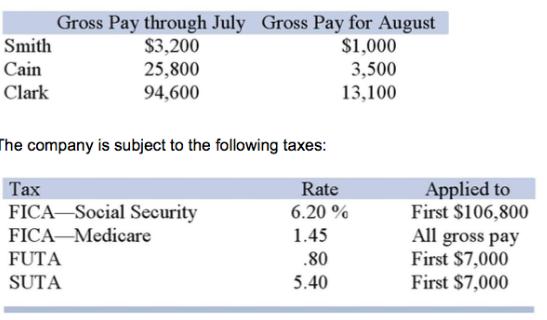

Mission Company has three employees: What are Mission Company's total August payroll taxes for Clark? and what is the amount that Mission Company will withhold

Mission Company has three employees:

What are Mission Company's total August payroll taxes for Clark? and what is the amount that Mission Company will withhold from Smith's August gross pay?

Gross Pay through July Gross Pay for August $1,000 Smith $3,200 Cain 25,800 3,500 13,100 Clark 94,600 The company is subject to the following taxes: Applied to First $106,800 All gross pay First $7,000 First $7,000 Rate FICA-Social Security 6.20 % FICA Medicare 1.45 FUTA .80 SUTA 5.40

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Payroll taxes for Clark FICASocial security 7564 1068009460062 FI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

26th edition

128574361X, 978-1305446052, 1305446054, 978-1285743615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App