Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Missouri Tennis, Inc. is negotiating for the purchase of a new piece of equipment for its current operations. Missouri Tennis, Inc. has received an

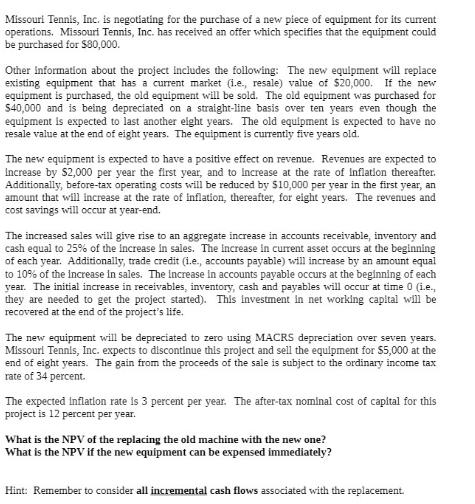

Missouri Tennis, Inc. is negotiating for the purchase of a new piece of equipment for its current operations. Missouri Tennis, Inc. has received an offer which specifies that the equipment could be purchased for $80,000. Other information about the project includes the following: The new equipment will replace existing equipment that has a current market (i.e., resale) value of $20,000. If the new equipment is purchased, the old equipment will be sold. The old equipment was purchased for $40,000 and is being depreciated on a straight-line basis over ten years even though the equipment is expected to last another eight years. The old equipment is expected to have no resale value at the end of eight years. The equipment is currently five years old. The new equipment is expected to have a positive effect on revenue. Revenues are expected to Increase by $2,000 per year the first year, and to Increase at the rate of Inflation thereafter. Additionally, before-tax operating costs will be reduced by $10,000 per year in the first year, an amount that will increase at the rate of inflation, thereafter, for eight years. The revenues and cost savings will occur at year-end. The increased sales will give rise to an aggregate increase in accounts receivable, inventory and cash equal to 25% of the increase in sales. The increase in current asset occurs at the beginning of each year. Additionally, trade credit (i.e., accounts payable) will increase by an amount equal to 10% of the Increase in sales. The increase in accounts payable occurs at the beginning of each year. The initial increase in receivables, inventory, cash and payables will occur at time 0 (i.e., they are needed to get the project started). This investment in net working capital will be recovered at the end of the project's life. The new equipment will be depreciated to zero using MACRS depreciation over seven years. Missouri Tennis, Inc. expects to discontinue this project and sell the equipment for $5,000 at the end of eight years. The gain from the proceeds of the sale is subject to the ordinary income tax rate of 34 percent. The expected inflation rate is 3 percent per year. The after-tax nominal cost of capital for this project is 12 percent per year. What is the NPV of the replacing the old machine with the new one? What is the NPV if the new equipment can be expensed immediately? Hint: Remember to consider all incremental cash flows associated with the replacement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay here are the steps to solve this problem 1 Calculate residual value of old equipment 20000 2 Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started