Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mister Ang is 60 years old. He just received his retirement benefits amounting to 1,000,000. He is planning to buy a small farmland so

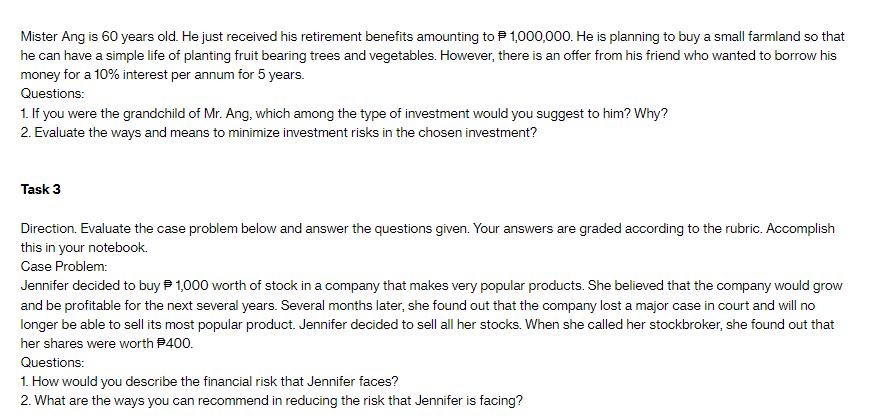

Mister Ang is 60 years old. He just received his retirement benefits amounting to 1,000,000. He is planning to buy a small farmland so that he can have a simple life of planting fruit bearing trees and vegetables. However, there is an offer from his friend who wanted to borrow his money for a 10% interest per annum for 5 years. Questions: 1. If you were the grandchild of Mr. Ang, which among the type of investment would you suggest to him? Why? 2. Evaluate the ways and means to minimize investment risks in the chosen investment? Task 3 Direction. Evaluate the case problem below and answer the questions given. Your answers are graded according to the rubric. Accomplish this in your notebook. Case Problem: Jennifer decided to buy 1,000 worth of stock in a company that makes very popular products. She believed that the company would grow and be profitable for the next several years. Several months later, she found out that the company lost a major case in court and will no longer be able to sell its most popular product. Jennifer decided to sell all her stocks. When she called her stockbroker, she found out that her shares were worth $400. Questions: 1. How would you describe the financial risk that Jennifer faces? 2. What are the ways you can recommend in reducing the risk that Jennifer is facing?

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 As the grandchild of Mr Ang I would suggest that he invest in buying a small farmland for his desired simple life of planting fruitbearing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started