Question

Mitch owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $15,000). On April 27, 2021, he sells 400 of these shares for

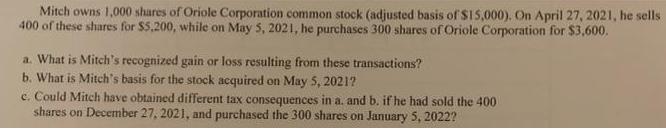

Mitch owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $15,000). On April 27, 2021, he sells 400 of these shares for $5,200, while on May 5, 2021, he purchases 300 shares of Oriole Corporation for $3,600. a. What is Mitch's recognized gain or loss resulting from these transactions? b. What is Mitch's basis for the stock acquired on May 5, 2021? c. Could Mitch have obtained different tax consequences in a. and b. if he had sold the 400 shares on December 27, 2021, and purchased the 300 shares on January 5, 2022?

Step by Step Solution

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution a To the extent of the substantially identical shares purchased during the 61...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

19th Edition

978-0324379556, 324379552, 978-1111579876

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App