Question

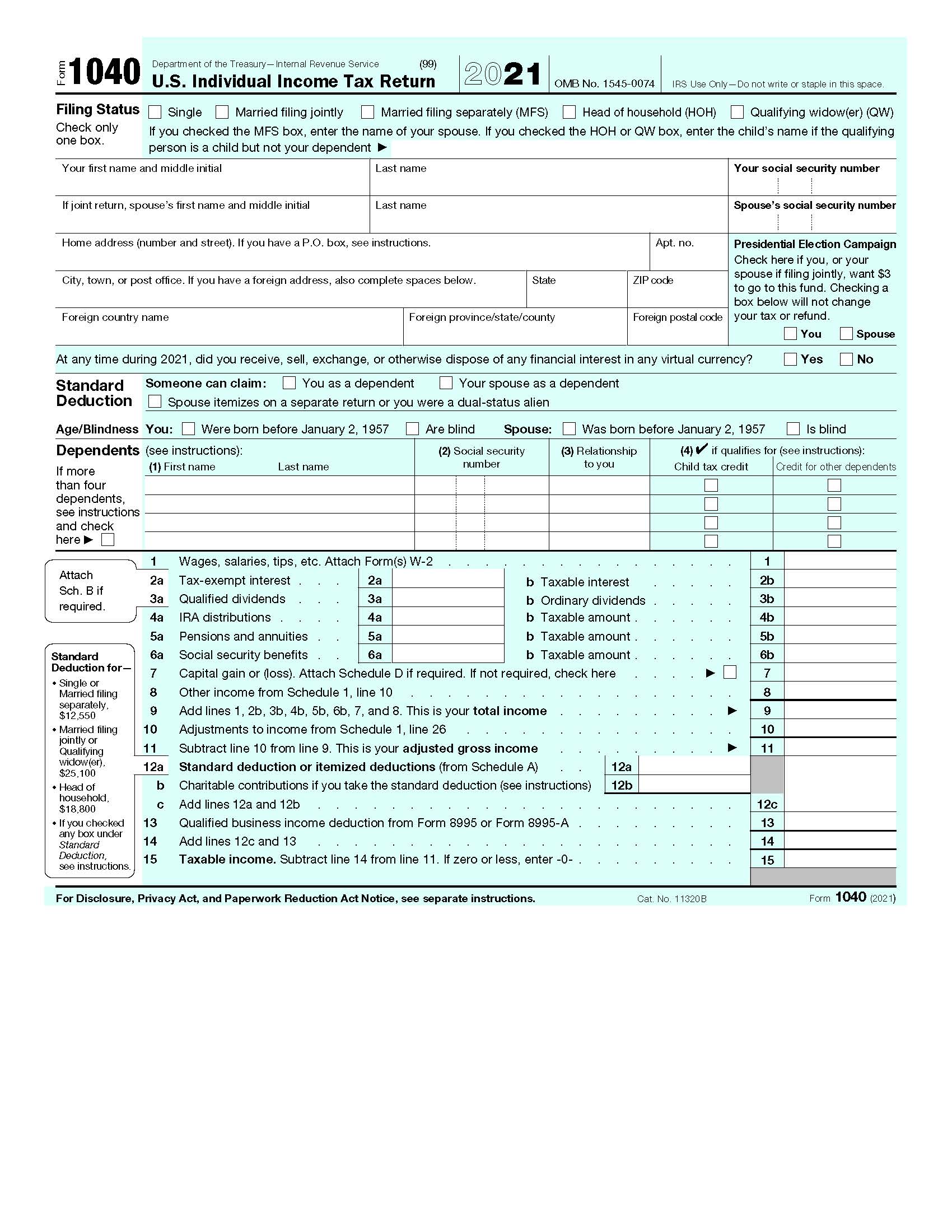

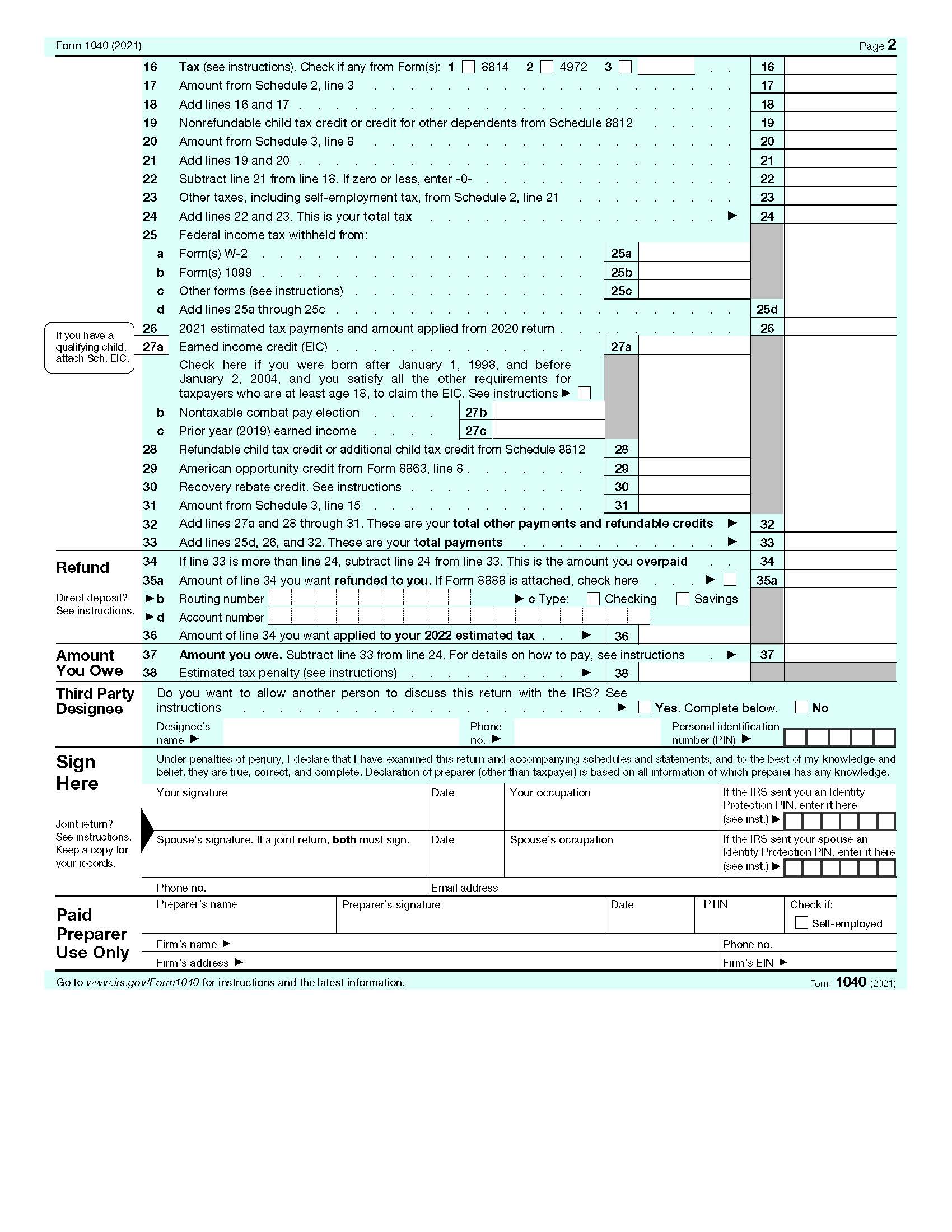

Mitch Trubearsky (SSN 123-06-1234) who lives at 2 E Oak St, Apt 6, Chicago, IL 60611, played for the Bears and earned income as per

Mitch Trubearsky (SSN 123-06-1234) who lives at 2 E Oak St, Apt 6, Chicago, IL 60611, played for the Bears and earned income as per below for 2021. He got engaged to Julie McCaskey (SSN 321-06-4321), and they wed in 2021. They do not have any dependents and do not want to file separately. They participate in their real estate rental. She has a legitimate TV show business. A detail of their 2021 transactions are as follows:

His Wages: $125,000

Her Wages: $15,000

Federal Income Tax Wage Withholding: $20,000

Interest Income from a Savings Account

at Chase Bank: $1,500

Interest Income from City

of Chicago municipal bonds: $5,000

A gift from his dad: $2,500

Loss on Sale of personal car to his dad: $(1,000)

A transfer from his savings to checking: $10,000

A car he won from a Car dealership: $25,000

Home mortgage Interest Exp $2,000

Charitable contributions $2,000

Real estate Taxes $4,000

State income Taxes $3,000

Her Schedule C TV Show 1099 Income: $50,000

Schedule C legal expenses: $10,000

Schedule C business travel: $15,000

Real estate rental property income: $10,000

Real estate rental property interest expense $15,000

(Real estate is fully depreciated)

His share of Loss from Hot Dog Stand

partnership (passive business) ($8,000)

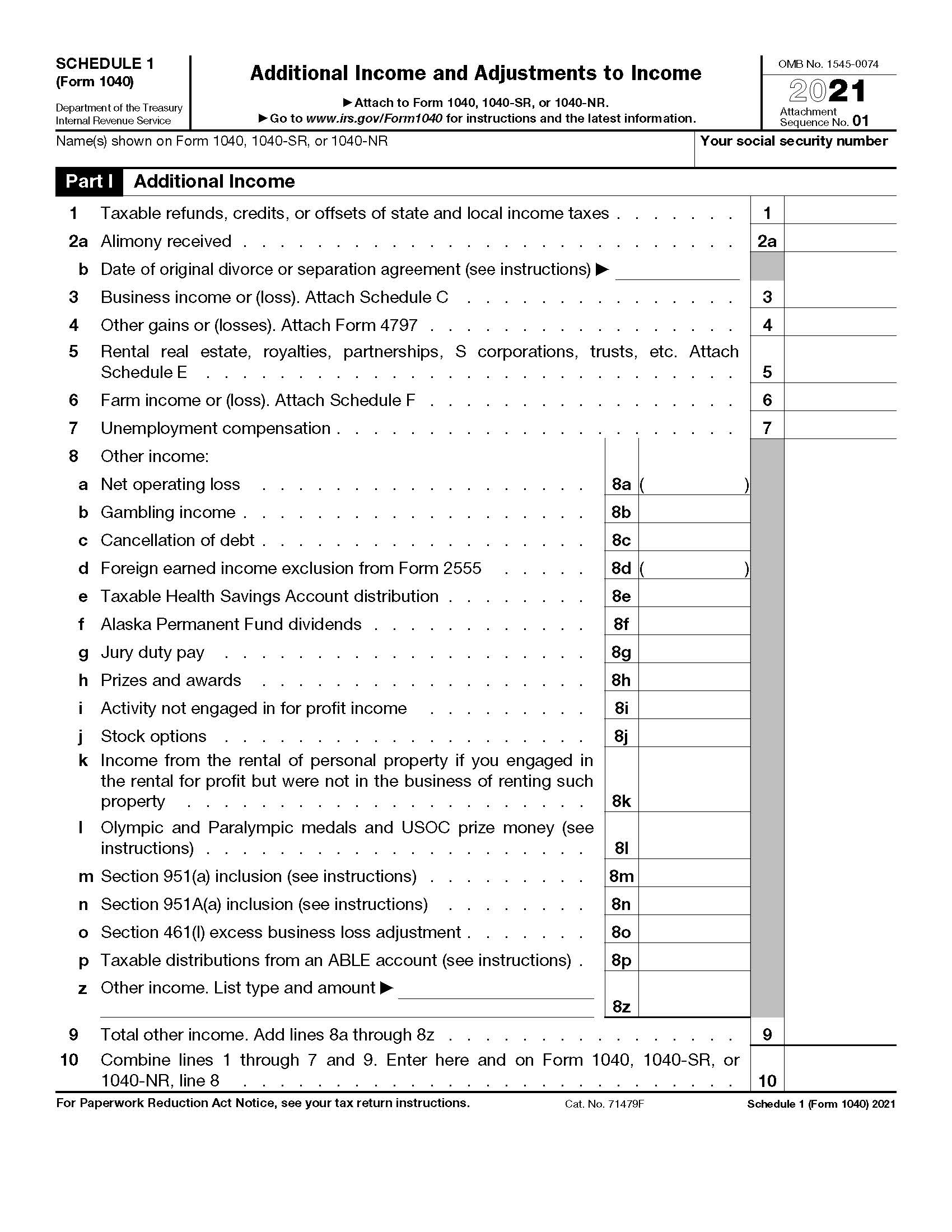

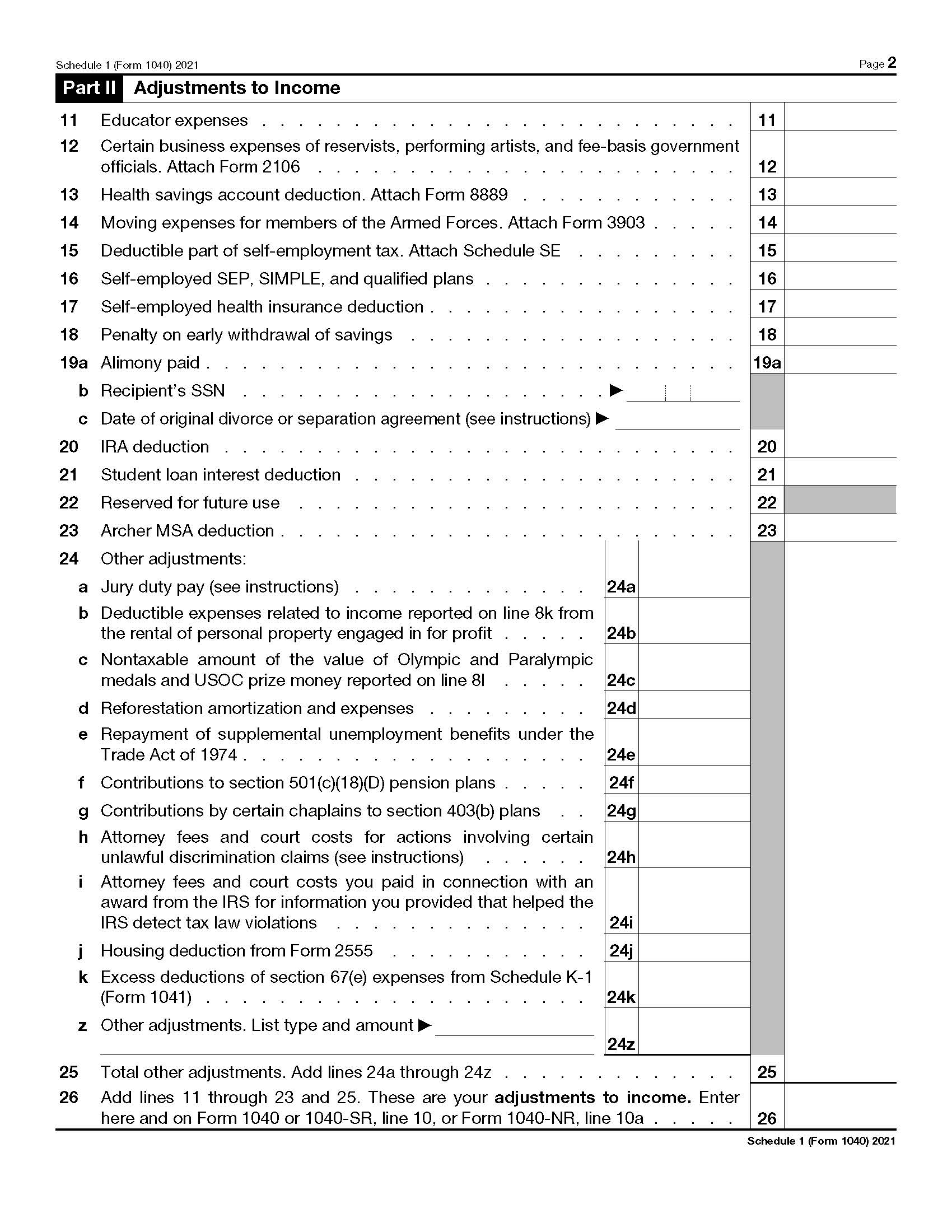

Could you please help me fill out the 2021 Form 1040 and Form 1040 Schedule 1 for Mitch Trubearsky.

HINT: AMT is not applicable.

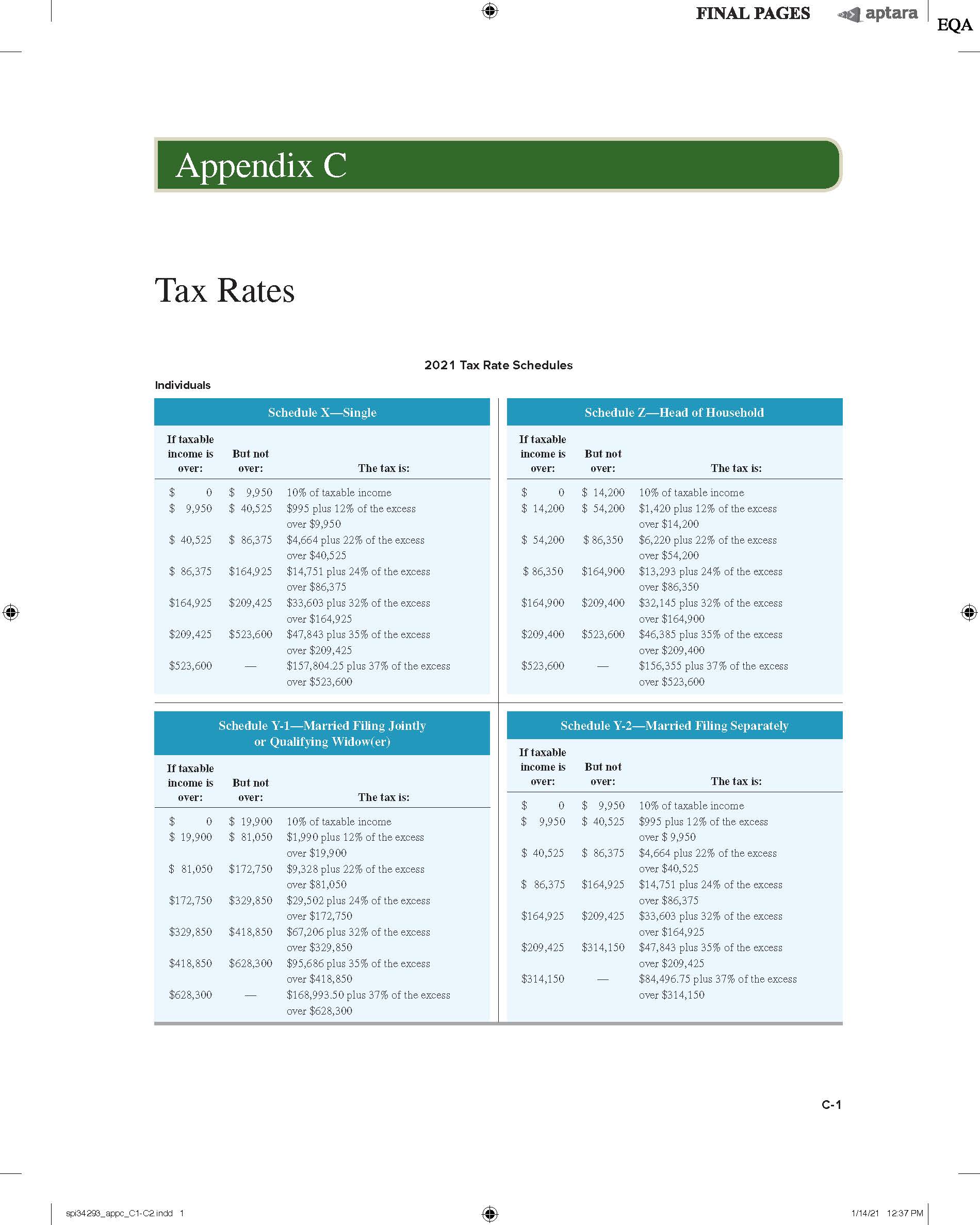

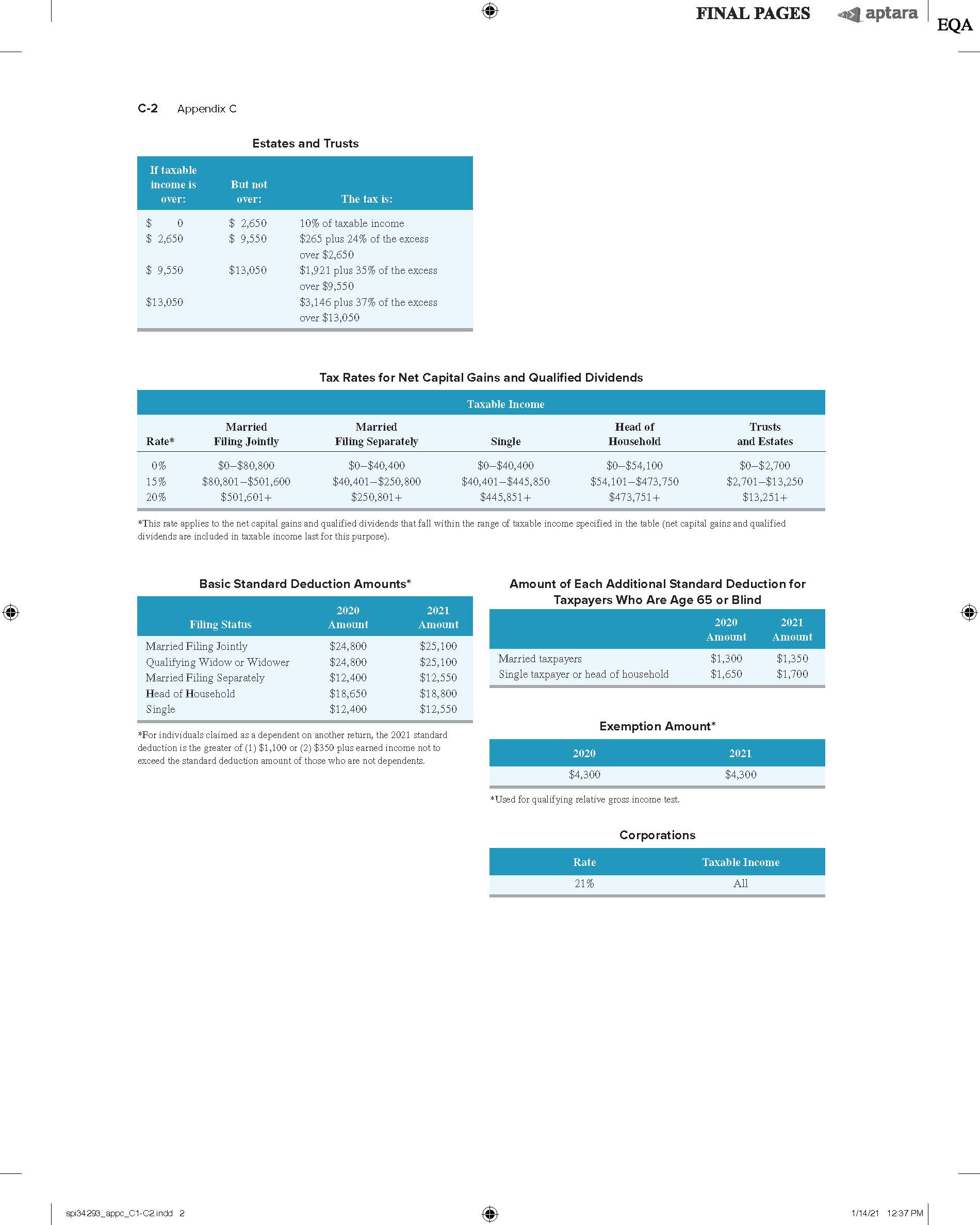

Appendix C Tax Rates Individuals If taxable income is over: $ $ 9,950 $ 40,525 $ 86,375 $523,600 $ 86,375 $164,925 If taxable income is over: But not over: $164,925 $209,425 Schedule X-Single $ 19,900 $ 9,950 $ 40,525 $628,300 spi34293_appc_C1-C2 indd 1 $209,425 $523,600 $47,843 plus 35% of the excess over $209,425 But not over: $329,850 $418,850 The tax is: $418,850 $628,300 10% of taxable income $995 plus 12% of the excess over $9,950 2021 Tax Rate Schedules $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) $33,603 plus 32% of the excess over $164,925 $ 19,900 $ 81,050 10% of taxable income $1,990 plus 12% of the excess over $19,900 $9,328 plus 22% of the excess over $81,050 $172,750 $329,850 $29,502 plus 24% of the excess $ 81,050 $172,750 over $172,750 $67,206 plus 32% of the excess over $329,850 $157,804.25 plus 37% of the excess over $523,600 The tax is: $95,686 plus 35% of the excess over $418,850 $168,993.50 plus 37% of the excess over $628,300 If taxable income is over: $ $ 14,200 $ 54,200 $ 86,350 $164,900 $209,400 $523,600 If taxable income is over: $ 0 $ 9,950 $ 40,525 $ 86,375 $209,425 Schedule Z-Head of Household But not over: $314,150 $ 14,200 $ 54,200 $ 86,350 $164,900 $209,400 $523,600 Schedule Y-2-Married Filing Separately But not over: $ 9,950 $ 40,525 $ 86,375 $164,925 $209,425 $164,925 FINAL PAGES $314,150 The tax is: 10% of taxable income $1,420 plus 12% of the excess over $14,200 $6,220 plus 22% of the excess over $54,200 $13,293 plus 24% of the excess over $86,350 $32,145 plus 32% of the excess over $164,900 $46,385 plus 35% of the excess over $209,400 $156,355 plus 37% of the excess over $523,600 The tax is: 10% of taxable income. $995 plus 12% of the excess over $9,950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $84,496.75 plus 37% of the excess over $314,150 C-1 aptara 1/14/21 12:37 PM EQA O

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations to complete Form 1040 and Schedule 1 for Mitch Trubearsky for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started