Question

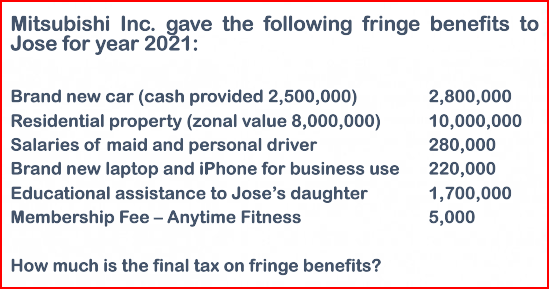

Mitsubishi Inc. gave the following fringe benefits to Jose for year 2021: Brand new car (cash provided 2,500,000) Residential property (zonal value 8,000,000) Salaries

Mitsubishi Inc. gave the following fringe benefits to Jose for year 2021: Brand new car (cash provided 2,500,000) Residential property (zonal value 8,000,000) Salaries of maid and personal driver Brand new laptop and iPhone for business use Educational assistance to Jose's daughter Membership Fee - Anytime Fitness How much is the final tax on fringe benefits? 2,800,000 10,000,000 280,000 220,000 1,700,000 5,000

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the final tax on fringe benefits we need to determine the taxable value of each fringe benefit and then apply the appropriate tax rate Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Taxation 2015

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler, Jinhee Trone

8th Edition

1259293092, 978-1259293122, 1259293122, 978-1259293092

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App