Question

MIX Inc. is a service business incorporated on January1, 2020 to provide personal training for athletes aspiring to play college sports. The following is a

MIX Inc. is a service business incorporated on January1, 2020 to provide personal training for athletes aspiring to play college sports.

The following is a simplified list of accounts and amounts reported in its accounting records at the beginning of its second quarter of operations on April 1, 2020 (the amounts are in thousands of dollars). The accounts have normal debit or credit balances.

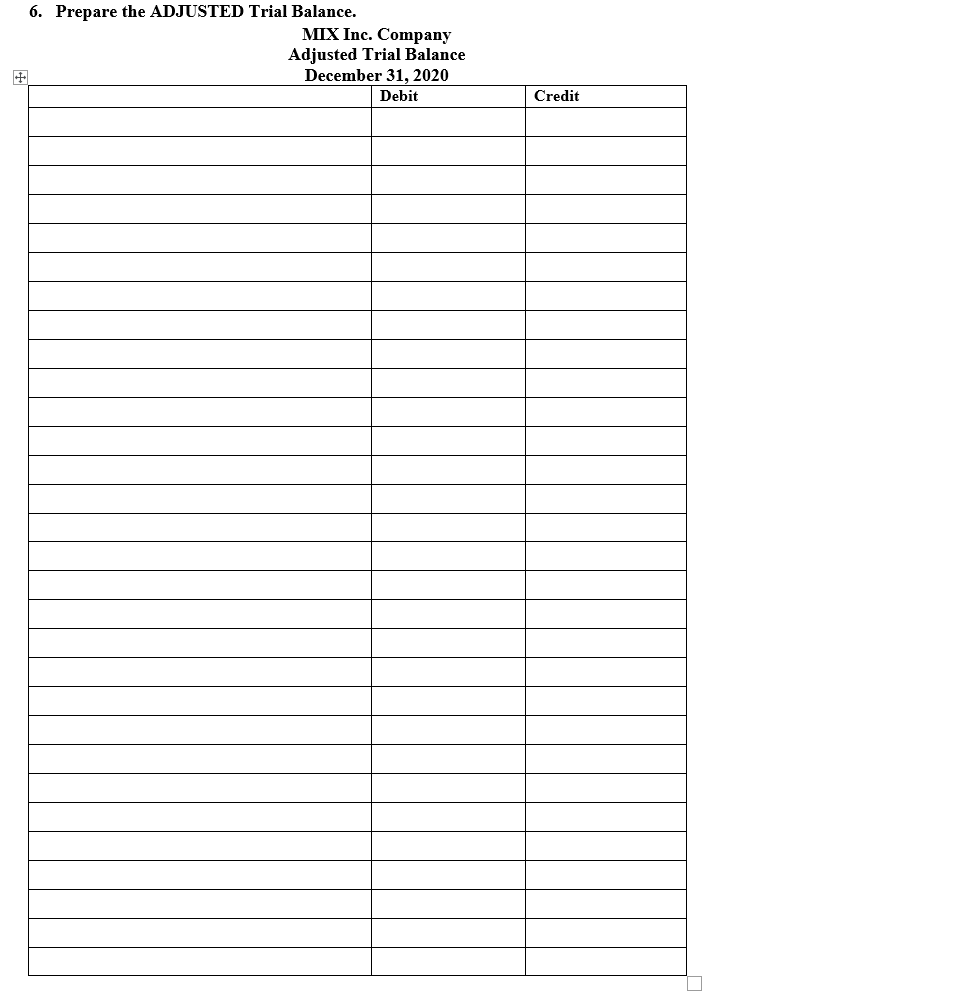

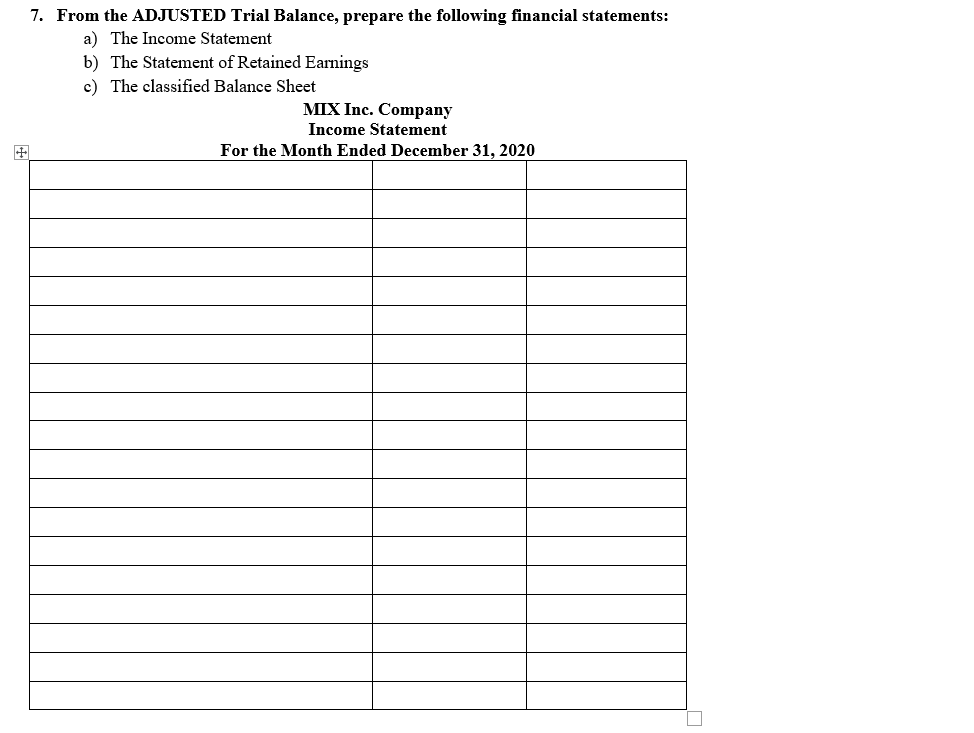

| Accounts Payable | $ 600 | Notes Payable (long-term) | $ 200 |

| Accounts Receivable | 300 | Notes Payable (short-term) | 500 |

| Accumulated Depreciation | 900 | Prepaid Rent | 100 |

| Cash | 300 | Rent Expense | 400 |

| Common Stock | 200 | Retained Earnings | 1,500 |

| Deferred Revenue | 200 | Salaries and Wages Expense | 2,200 |

| Depreciation Expense | 300 | Service Revenue | 6,200 |

| Equipment | 3,200 | Supplies | 500 |

| Income Tax Expense | 300 | Supplies Expense | 200 |

| Interest Revenue | 100 | Travel Expense | 2,600 |

After the first quarter, MIX had the following transactions:

- Issued additional shares of common stock for $50 on April 15.

- Purchased equipment for $250 cash on May 1

- Received $400 cash for future services on May 25.

- Borrowed $220 cash on July 1, 2020, signing a six-month note payable.

- Paid two-year insurance premium on equipment in the amount of $600 on July 1, 2020, and debited in full to Prepaid Insurance on that date. Coverage began on July 1.

- Purchased software on July 4, $30 cash.

- Purchased supplies on July 5 on account for future use, $7.

- Recorded revenues on December 6 of $550, including $80 on credit and $470 received in cash.

- Recognized salaries and wages expense on December 7 of $30; paid in cash.

- Collected accounts receivable on December 8, $90.

- Paid accounts payable on December 9, $100.

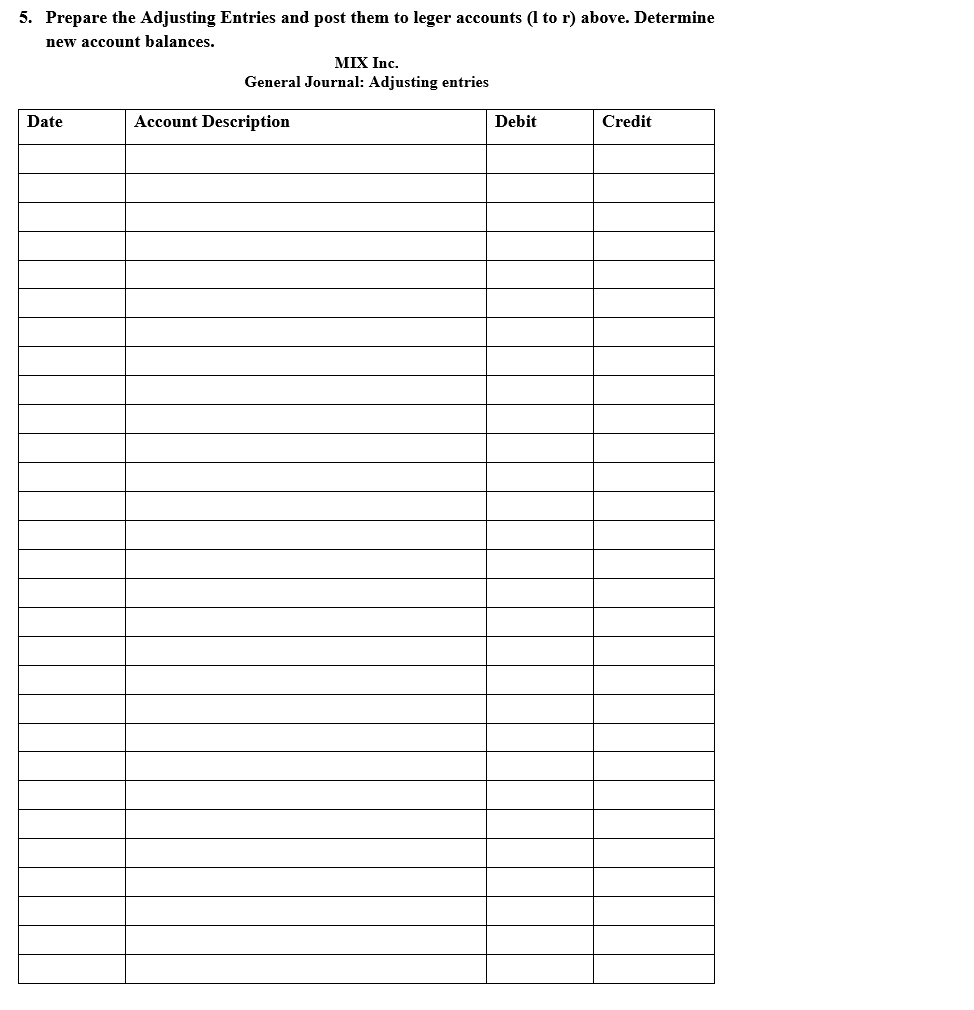

Data for adjusting journal entries on December 31:

- Amortization for 2020, $5.

- A physical count of supplies on December 31 showed Supplies costing $300 were still on hand.

- Depreciation for 2020, $40.

- Accrued interest of $5 on notes payable.

- Salaries and wages incurred but not yet paid or recorded, $30.

- Service provided but to be collected in January 2021, $45

- Income tax expense for 2020 was $4 and will be paid in 2021.

- Six months of insurance on equipment has been used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started