Answered step by step

Verified Expert Solution

Question

1 Approved Answer

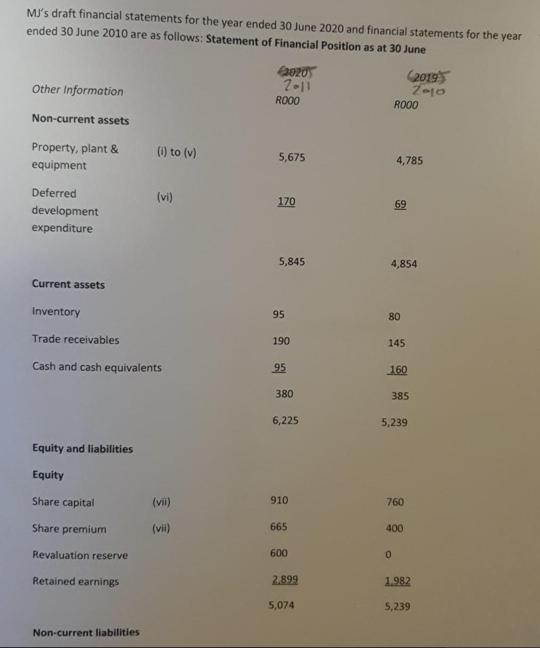

MJ's draft financial statements for the year ended 30 June 2020 and financial statements for the year ended 30 June 2010 are as follows:

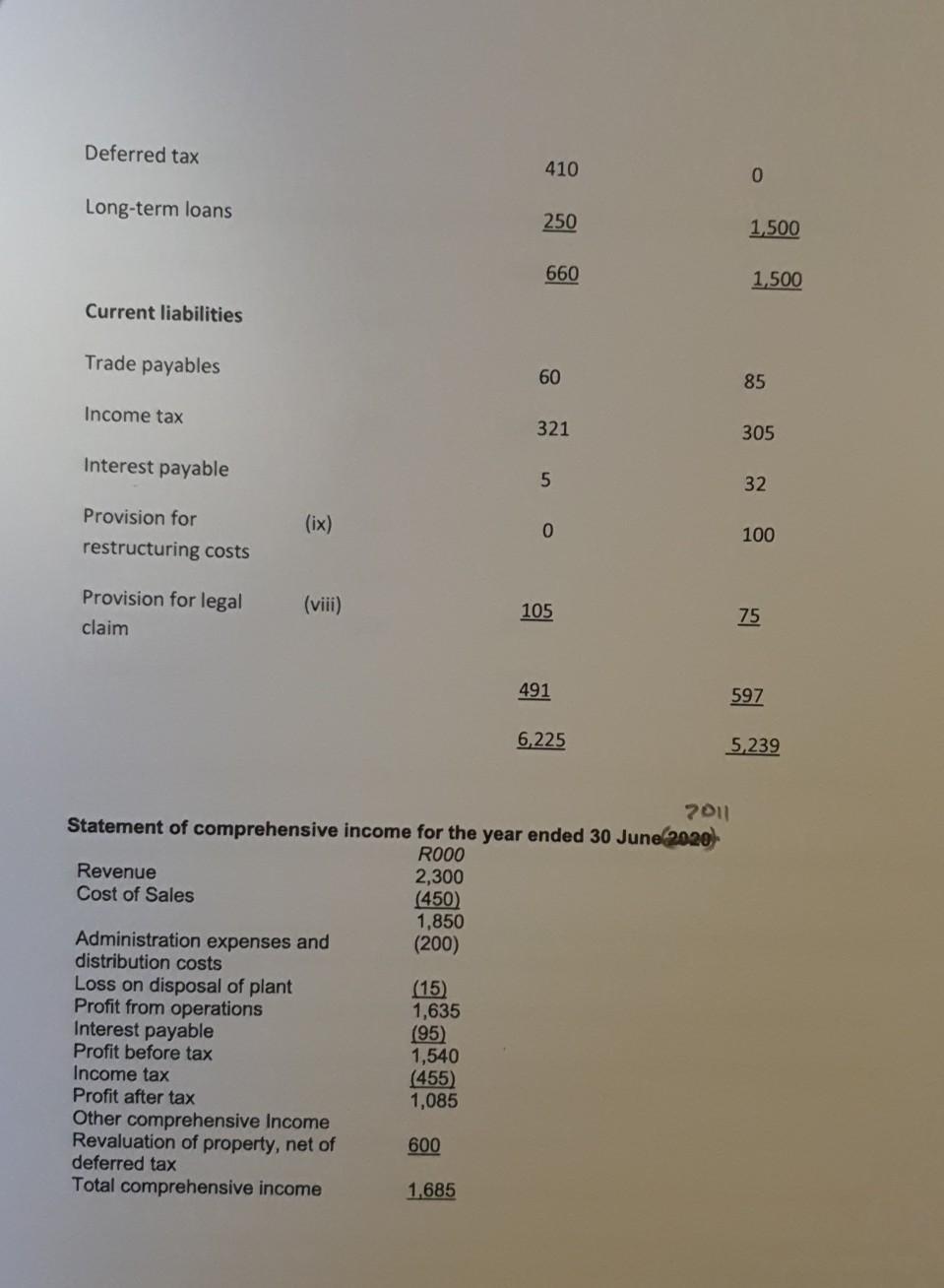

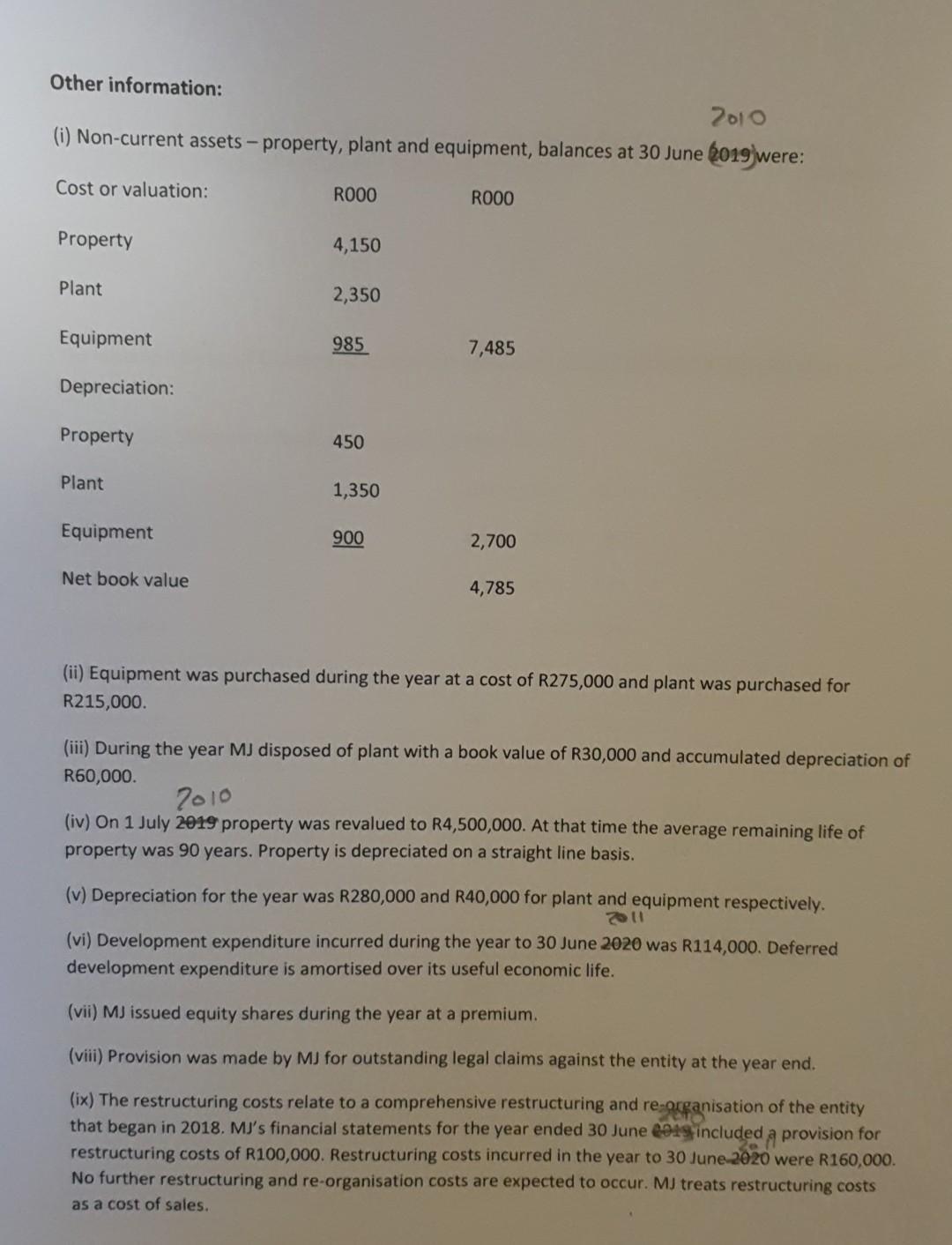

MJ's draft financial statements for the year ended 30 June 2020 and financial statements for the year ended 30 June 2010 are as follows: Statement of Financial Position as at 30 June Other Information Non-current assets Property, plant & equipment Deferred development expenditure Equity and liabilities Equity Share capital Share premium Current assets Inventory Trade receivables Cash and cash equivalents Revaluation reserve Retained earnings (i) to (v) Non-current liabilities (vi) (vii) (vii) 43020 2-11 R000 5,675 170 5,845 95 190 95 380 6,225 910 665 600 2,899 5,074 R000 4,785 69 4,854 80 (2019) 2010 145 160 385 0 5,239 760 400 1.982 5,239 Deferred tax Long-term loans Current liabilities Trade payables Income tax Interest payable Provision for restructuring costs Provision for legal claim (ix) Revenue Cost of Sales (viii) Administration expenses and distribution costs Loss on disposal of plant Profit from operations Interest payable Profit before tax Income tax Profit after tax Other comprehensive Income Revaluation of property, net of deferred tax Total comprehensive income (15) 1,635 (95) 1,540 (455) 1,085 600 410 1,685 250 660 60 321 5 0 2011 Statement of comprehensive income for the year ended 30 June 2020) R000 2,300 (450) 1,850 (200) 105 491 6,225 0 1,500 1,500 85 305 32 100 75 597 5,239 Other information: 2010 (i) Non-current assets-property, plant and equipment, balances at 30 June 2019 were: Cost or valuation: Property Plant Equipment Depreciation: Property Plant Equipment Net book value ROOO 4,150 2,350 985 450 1,350 900 ROOO 7,485 2,700 4,785 (ii) Equipment was purchased during the year at a cost of R275,000 and plant was purchased for R215,000. (iii) During the year MJ disposed of plant with a book value of R30,000 and accumulated depreciation of R60,000. 2010 (iv) On 1 July 2019 property was revalued to R4,500,000. At that time the average remaining life of property was 90 years. Property is depreciated on a straight line basis. (v) Depreciation for the year was R280,000 and R40,000 for plant and equipment respectively. (vi) Development expenditure incurred during the year to 30 June 2020 was R114,000. Deferred development expenditure is amortised over its useful economic life. (vii) MJ issued equity shares during the year at a premium. (viii) Provision was made by MJ for outstanding legal claims against the entity at the year end. (ix) The restructuring costs relate to a comprehensive restructuring and re-organisation of the entity that began in 2018. MJ's financial statements for the year ended 30 June 2013 included a provision for restructuring costs of R100,000. Restructuring costs incurred in the year to 30 June-2020 were R160,000. No further restructuring and re-organisation costs are expected to occur. MJ treats restructuring costs as a cost of sales. Required: 2011 Prepare a statement of cash flows, for MJ for the year ended 30 June-2020)using the indirect method, in (25 marks) accordance with the requirements of IAS 7 Statement of Cash Flows.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

MJ Statement of Cash Flows For the Year Ended 30 June 2020 Using the Indirect Method R000 Cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started