Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ML Clyde starts a landscaping business in January of 2024. During the first month of operations of her business, the following events and transactions

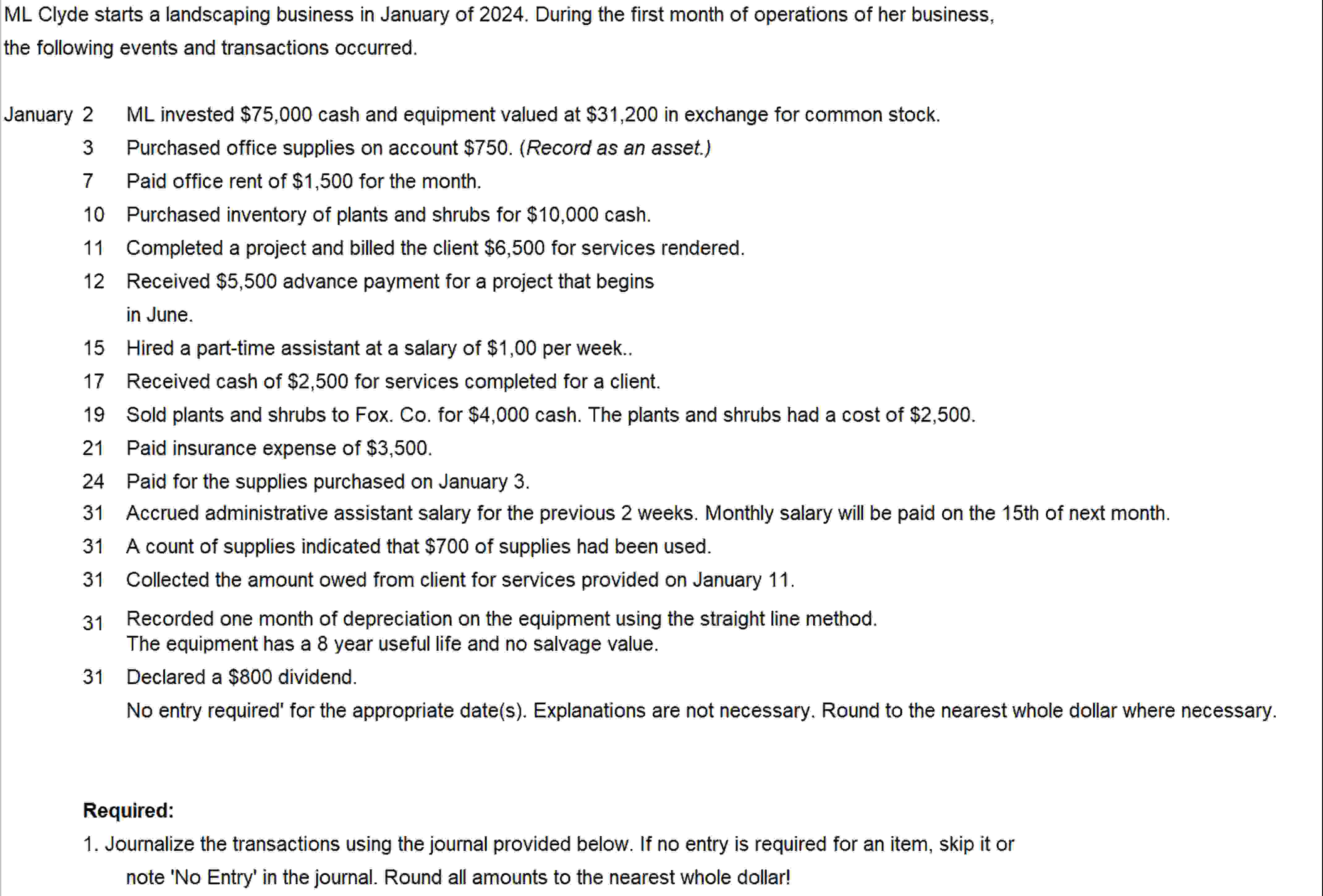

ML Clyde starts a landscaping business in January of 2024. During the first month of operations of her business, the following events and transactions occurred. January 2 3 7 ML invested $75,000 cash and equipment valued at $31,200 in exchange for common stock. Purchased office supplies on account $750. (Record as an asset.) Paid office rent of $1,500 for the month. 10 Purchased inventory of plants and shrubs for $10,000 cash. 11 Completed a project and billed the client $6,500 for services rendered. 12 Received $5,500 advance payment for a project that begins in June. 15 Hired a part-time assistant at a salary of $1,00 per week.. 17 Received cash of $2,500 for services completed for a client. 19 Sold plants and shrubs to Fox. Co. for $4,000 cash. The plants and shrubs had a cost of $2,500. 21 Paid insurance expense of $3,500. 24 Paid for the supplies purchased on January 3. 31 Accrued administrative assistant salary for the previous 2 weeks. Monthly salary will be paid on the 15th of next month. 31 A count of supplies indicated that $700 of supplies had been used. 31 Collected the amount owed from client for services provided on January 11. 31 Recorded one month of depreciation on the equipment using the straight line method. The equipment has a 8 year useful life and no salvage value. 31 Declared a $800 dividend. No entry required for the appropriate date(s). Explanations are not necessary. Round to the nearest whole dollar where necessary. Required: 1. Journalize the transactions using the journal provided below. If no entry is required for an item, skip it or note 'No Entry' in the journal. Round all amounts to the nearest whole dollar!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Date Account Titles and Explanation Debit Credit Jan 2 Cash 75000 Equipment 31200 Common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started