Answered step by step

Verified Expert Solution

Question

1 Approved Answer

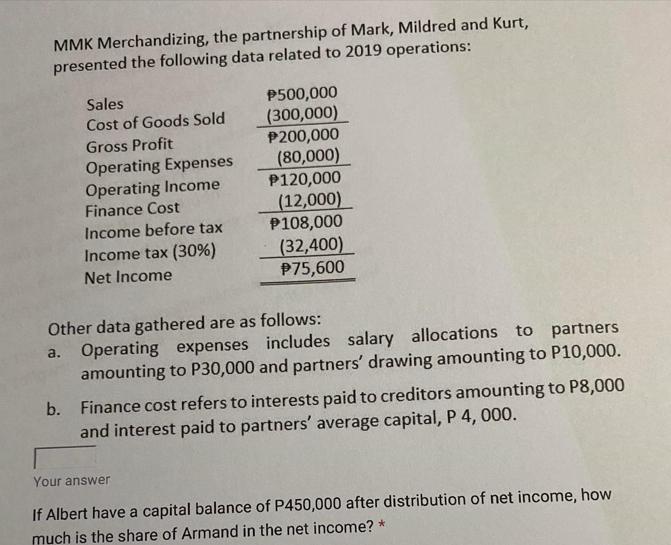

MMK Merchandizing, the partnership of Mark, Mildred and Kurt, presented the following data related to 2019 operations: Sales Cost of Goods Sold Gross Profit

MMK Merchandizing, the partnership of Mark, Mildred and Kurt, presented the following data related to 2019 operations: Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Income Finance Cost Income before tax Income tax (30%) Net Income P500,000 (300,000) $200,000 (80,000) P120,000 (12,000) P108,000 (32,400) P75,600 Other data gathered are as follows: a. Operating expenses includes salary allocations to partners amounting to P30,000 and partners' drawing amounting to P10,000. b. Finance cost refers to interests paid to creditors amounting to P8,000 and interest paid to partners' average capital, P 4, 000. Your answer If Albert have a capital balance of P450,000 after distribution of net income, how much is the share of Armand in the net income? *

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We can find the share of Armand in the net income by dividing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started