Answered step by step

Verified Expert Solution

Question

1 Approved Answer

mmm Bank A originates 2,000 bullet loans with a total gross carrying amount of CU 500,000. Bank A segments its portfolio into borrower groups (Groups

mmm

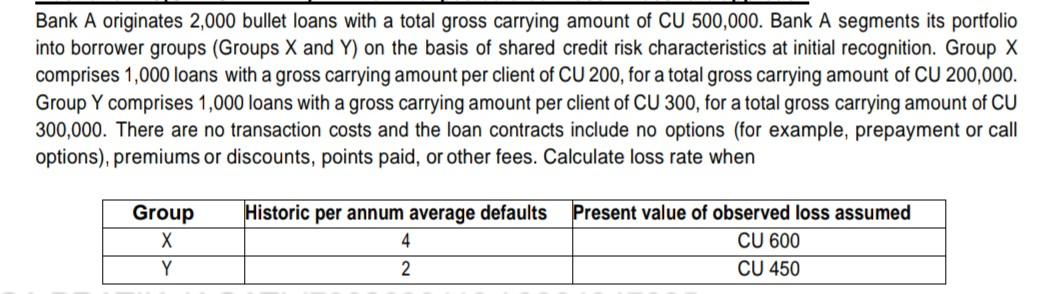

Bank A originates 2,000 bullet loans with a total gross carrying amount of CU 500,000. Bank A segments its portfolio into borrower groups (Groups X and Y) on the basis of shared credit risk characteristics at initial recognition. Group X comprises 1,000 loans with a gross carrying amount per client of CU 200, for a total gross carrying amount of CU 200,000. Group Y comprises 1,000 loans with a gross carrying amount per client of CU 300, for a total gross carrying amount of CU 300,000. There are no transaction costs and the loan contracts include no options (for example, prepayment or call options), premiums or discounts, points paid, or other fees. Calculate loss rate when Group Y Historic per annum average defaults 4 2 Present value of observed loss assumed CU 600 CU 450Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started