MNC Mining Corporation is a mining company operating an underground mine in Zambia. The company is engaged in the extraction of copper. The company

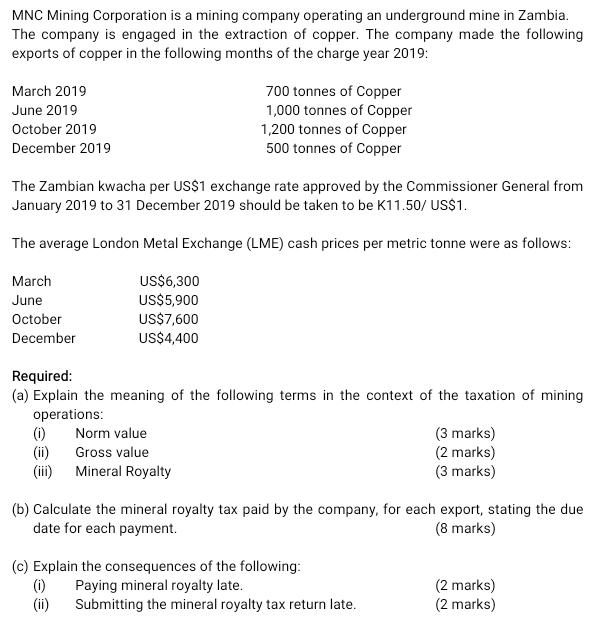

MNC Mining Corporation is a mining company operating an underground mine in Zambia. The company is engaged in the extraction of copper. The company made the following exports of copper in the following months of the charge year 2019: March 2019 June 2019 October 2019 December 2019 The Zambian kwacha per US$1 exchange rate approved by the Commissioner General from January 2019 to 31 December 2019 should be taken to be K11.50/ US$1. The average London Metal Exchange (LME) cash prices per metric tonne were as follows: US$6,300 US$5,900 US$7,600 US$4,400 March June October December Required: (a) Explain the meaning of the following terms in the context of the taxation of mining operations: (1) (ii) (iii) 700 tonnes of Copper 1,000 tonnes of Copper 1,200 tonnes of Copper 500 tonnes of Copper Norm value Gross value Mineral Royalty (1) (ii) (b) Calculate the mineral royalty tax paid by the company, for each export, stating the due date for each payment. (8 marks) (c) Explain the consequences of the following: Paying mineral royalty late. (3 marks) (2 marks) (3 marks) Submitting the mineral royalty tax return late. (2 marks) (2 marks)

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a The norm value is the average value of the mineral over a period of time used to ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started