Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MNO Inc. is a calendar year S corporation. At the beginning of the year, it had AAA balance of $64,000 and AE&P of $9,000

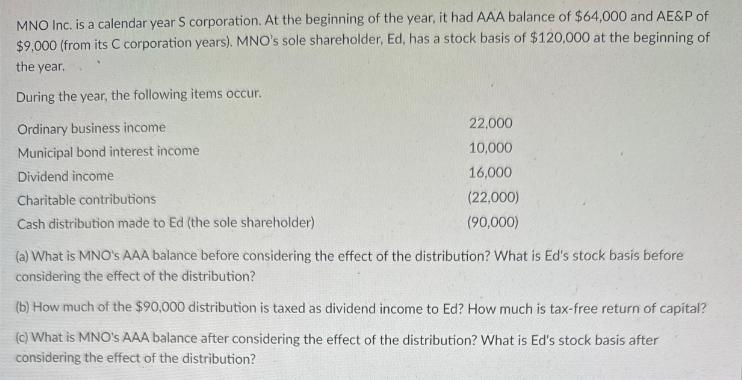

MNO Inc. is a calendar year S corporation. At the beginning of the year, it had AAA balance of $64,000 and AE&P of $9,000 (from its C corporation years). MNO's sole shareholder, Ed, has a stock basis of $120,000 at the beginning of the year. During the year, the following items occur. Ordinary business income Municipal bond interest income Dividend income Charitable contributions Cash distribution made to Ed (the sole shareholder) 22,000 10,000 16,000 (22,000) (90,000) (a) What is MNO's AAA balance before considering the effect of the distribution? What is Ed's stock basis before considering the effect of the distribution? (b) How much of the $90,000 distribution is taxed as dividend income to Ed? How much is tax-free return of capital? (c) What is MNO's AAA balance after considering the effect of the distribution? What is Ed's stock basis after considering the effect of the distribution?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Before considering the effect of the distribution MNOs AAA balance is 64000 and Eds stock basis is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started