Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 MNO Ltd. Is a canadian controlled private corporation that sells motors. It owns 60% of the outstanding shares of PQR Ltd. During the

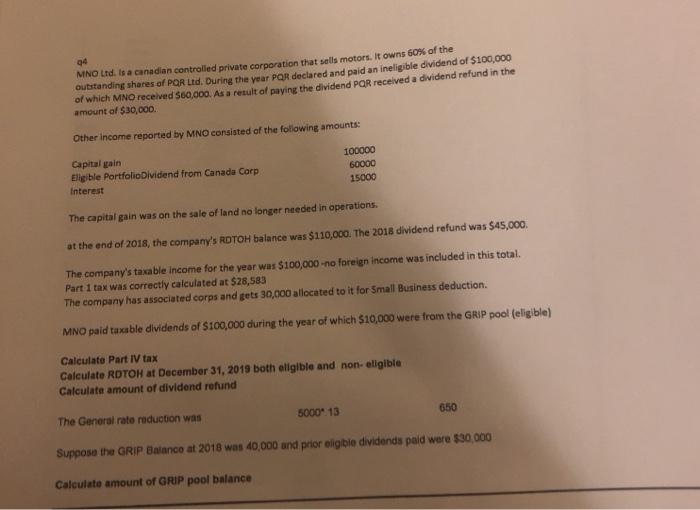

Q4 MNO Ltd. Is a canadian controlled private corporation that sells motors. It owns 60% of the outstanding shares of PQR Ltd. During the year PQR declared and paid an ineligible dividend of $100,000 of which MNO received $60,000. As a result of paying the dividend PQR received a dividend refund in the amount of $30,000. Other income reported by MNO consisted of the following amounts: Capital gain Eligible PortfolioDividend from Canada Corp Interest 100000 60000 15000 The capital gain was on the sale of land no longer needed in operations. at the end of 2018, the company's RDTOH balance was $110,000. The 2018 dividend refund was $45,000. The company's taxable income for the year was $100,000-no foreign income was included in this total. Part 1 tax was correctly calculated at $28,583 The company has associated corps and gets 30,000 allocated to it for Small Business deduction. MNO paid taxable dividends of $100,000 during the year of which $10,000 were from the GRIP pool (eligible) Calculate Part IV tax Calculate RDTOH at December 31, 2019 both eligible and non- eligible Calculate amount of dividend refund The General rate reduction was Suppose the GRIP Balance at 2018 was 40,000 and prior eligible dividends paid were $30,000 Calculate amount of GRIP pool balance 5000 13 650

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Part IV tax we need to determine the taxable amount of ineligible dividends received by MNO from PQR Taxable amount of ineligible div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started