Question

Mo Meek, Lu Ling, and Barb Beck formed the MLB Partnership by making capital contributions of $81,000, $315,000, and $504,000, respectively. They predict annual partnership

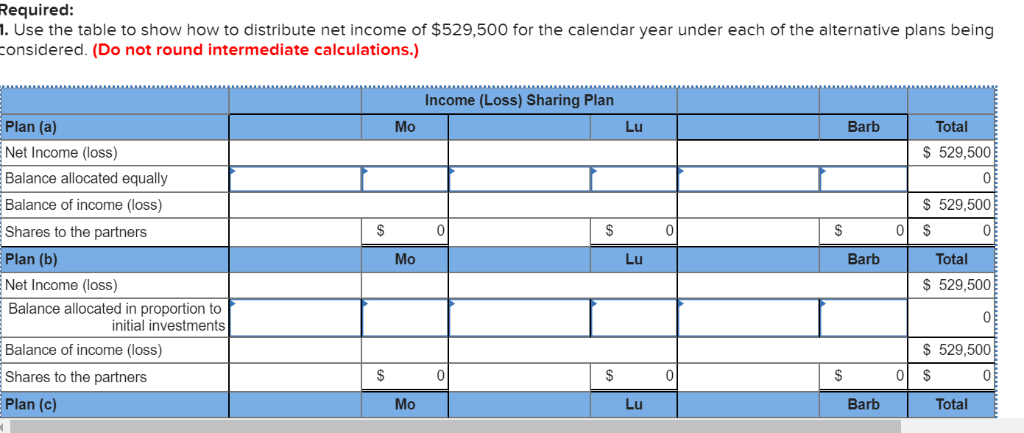

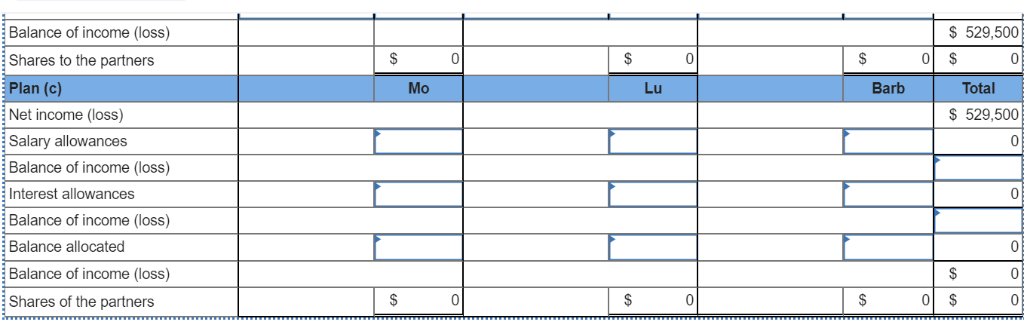

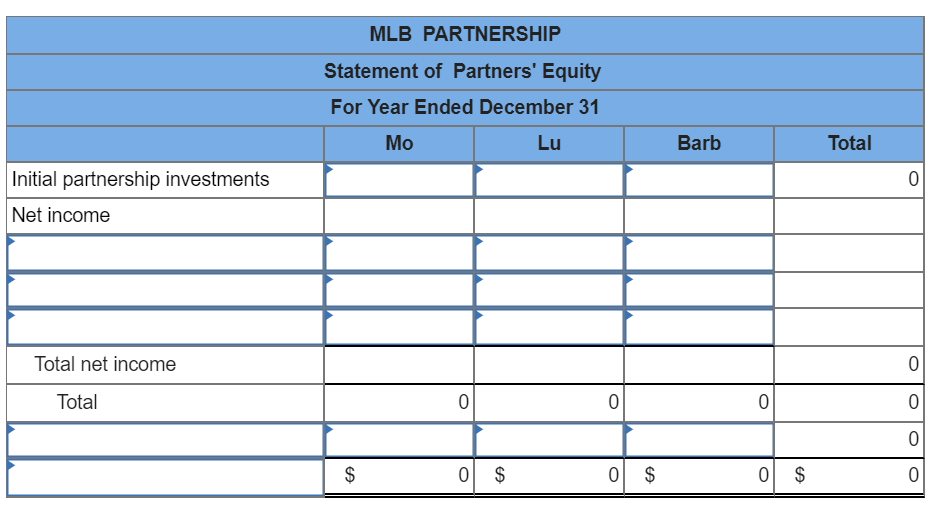

Mo Meek, Lu Ling, and Barb Beck formed the MLB Partnership by making capital contributions of $81,000, $315,000, and $504,000, respectively. They predict annual partnership net income of $529,500 and are considering the following alternative plans of sharing income and loss: (a) equally; (b) in the ratio of their initial capital investments; or (c) salary allowances of $86,000 to Mo, $64,500 to Lu, and $97,500 to Barb; interest allowances of 10% on their initial capital investments; and the balance shared as follows: 20% to Mo, 40% to Lu, and 40% to Barb.

Required: 1. Use the table to show how to distribute net income of $529,500 for the calendar year under each of the alternative plans being considered. (Do not round intermediate calculations.)

2. Prepare a statement of partners equity showing the allocation of income to the partners assuming they agree to use plan (c), that income earned is $529,500, and that Mo, Lu, and Barb withdraw $42,900, $56,900, and $72,900, respectively, at year-end. (Do not round intermediate calculations. Enter all allowances as positive values. Enter losses as negative values.)

3. Prepare the December 31 journal entry to close Income Summary assuming they agree to use plan (c) and that net income is $529,500. Mo, Lu, and Barb withdraw $42,900, $56,900, and $72,900, respectively, at year-end. Also close the withdrawals accounts.

Required . Use the table to show how to distribute net income of $529,500 for the calendar year under each of the alternative plans being onsidered. (Do not round intermediate calculations.) Income (Loss) Sharing Plan Plan (a) Net Income (loss) Balance allocated equally Balance of income (loss) Shares to the partners Plan (b) Net Income (loss) Balance allocated in proportion to Mo Lu Barb Total $ 529,500 $ 529,500 0 $ Lu Barb Total S 529,500 initial investments Balance of income (loss) Shares to the partners Plan (c) $ 529,500 0 S Mo Lu Barb Total Balance of income (loss) Shares to the partners Plan (c) Net income (loss) Salary allowances Balance of income (loss) Interest allowances Balance of income (loss) Balance allocated S 529,500 0 0 0 Mo Lu Barb Total S 529,500 0 Balance of income (loss) 0 Shares of the partners MLB PARTNERSHIP Statement of Partners' Equity For Year Ended December 31 Mo Lu Barb Total Initial partnership investments Net income Total net income Total 0$ 0 S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started