Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be

Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year.

- Moab Incorporated sold a machine that it used to make computerized gadgets for $27,300 cash. It originally bought the machine for $19,200 three years ago and has taken $8,000 in depreciation.

- Moab Incorporated held stock in ABC Corporation, which had a value of $12,000 at the beginning of the year. That same stock had a value of $15,230 at the end of the year.

- Moab Incorporated sold some of its inventory for $7,000 cash. This inventory had a basis of $5,000.

- Moab Incorporated disposed of an office building with a fair market value of $75,000 for another office building with a fair market value of $55,000 and $20,000 in cash. It originally bought the office building seven years ago for $62,000 and has taken $15,000 in depreciation.

- Moab Incorporated sold some land held for investment for $28,000. It originally bought the land for $32,000 two years ago.

- Moab Incorporated sold another machine for a note payable in four annual installments of $12,000. The first payment was received in the current year. It originally bought the machine two years ago for $32,000 and has claimed $9,000 in depreciation expense against the machine.

- Moab Incorporated sold stock it held for eight years for $2,750. It originally purchased the stock for $2,100.

- Moab Incorporated sold another machine for $7,300. It originally purchased this machine six months ago for $9,000 and has claimed $830 in depreciation expense against the asset.

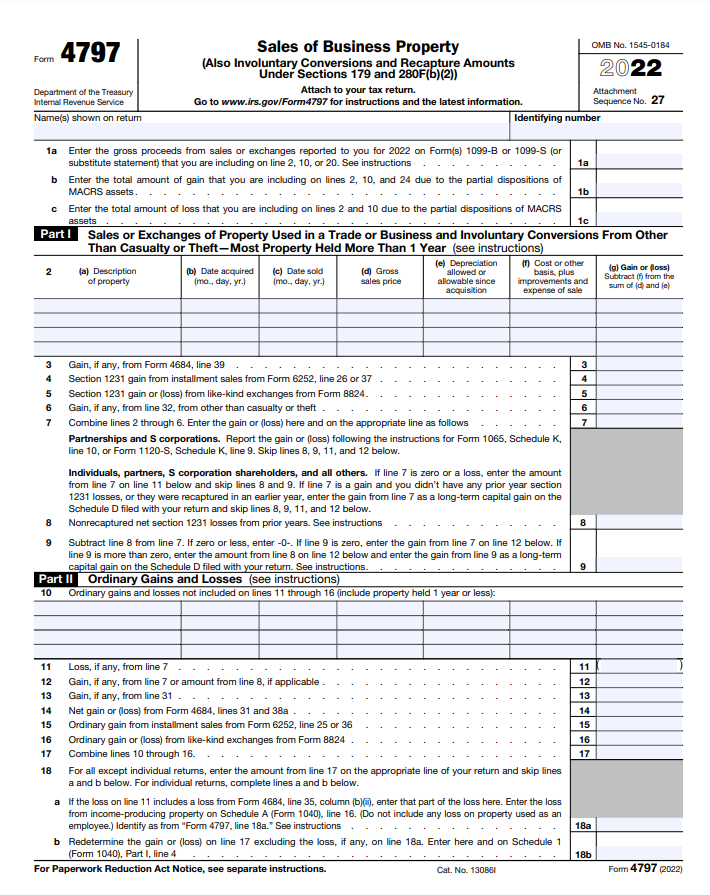

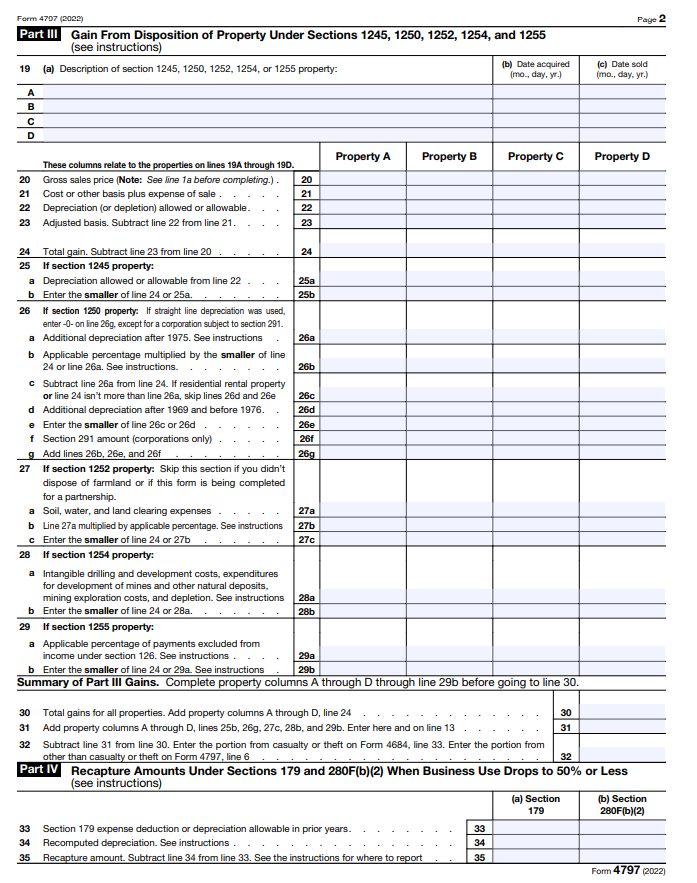

Complete Moab Incorporated's Form 4797 for the year.

From 4797 Department of the Treasury Internal Revenue Service Name(s) shown on retum Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form 4797 for instructions and the latest information. OMB No. 1545-0184 2022 Attachment Sequence No. 27 Identifying number 1a Enter the gross proceeds from sales or exchanges reported to you for 2022 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20 . See instructions b Enter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. c Enter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS assets Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 130861 Form 4797 (2022) Ferm 4707 (2002) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (see instructions) 30 Total gains for all properties. Add property columns A through D, line 24 . . . . . . . . . . . . . . 31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b. Enter here and on line 13 32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 33. Enter the portion from other than casualty or theft on Form 4797 , line 6 \\begin{tabular}{|l|l} 30 & \\\\ \\hline 31 & \\\\ \\hline & \\\\ \\hline 32 & \\\\ \\hline \\end{tabular} Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to \50 or Less (see instructions) (a) Section 179 (b) Section \\( 280 \\mathrm{~F}(\\mathrm{~b})(2) \\) 33 Section 179 expense deduction or depreciation allowable in prior years. 34 Recomputed depreciation. See instructions. 35 Recapture amount. Subtract line 34 from line 33 . See the instructions for where to report . . 35. Form 4797 (2022) From 4797 Department of the Treasury Internal Revenue Service Name(s) shown on retum Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form 4797 for instructions and the latest information. OMB No. 1545-0184 2022 Attachment Sequence No. 27 Identifying number 1a Enter the gross proceeds from sales or exchanges reported to you for 2022 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20 . See instructions b Enter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. c Enter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS assets Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 130861 Form 4797 (2022) Ferm 4707 (2002) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (see instructions) 30 Total gains for all properties. Add property columns A through D, line 24 . . . . . . . . . . . . . . 31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b. Enter here and on line 13 32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 33. Enter the portion from other than casualty or theft on Form 4797 , line 6 \\begin{tabular}{|l|l} 30 & \\\\ \\hline 31 & \\\\ \\hline & \\\\ \\hline 32 & \\\\ \\hline \\end{tabular} Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to \50 or Less (see instructions) (a) Section 179 (b) Section \\( 280 \\mathrm{~F}(\\mathrm{~b})(2) \\) 33 Section 179 expense deduction or depreciation allowable in prior years. 34 Recomputed depreciation. See instructions. 35 Recapture amount. Subtract line 34 from line 33 . See the instructions for where to report . . 35. Form 4797 (2022)

From 4797 Department of the Treasury Internal Revenue Service Name(s) shown on retum Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form 4797 for instructions and the latest information. OMB No. 1545-0184 2022 Attachment Sequence No. 27 Identifying number 1a Enter the gross proceeds from sales or exchanges reported to you for 2022 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20 . See instructions b Enter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. c Enter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS assets Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 130861 Form 4797 (2022) Ferm 4707 (2002) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (see instructions) 30 Total gains for all properties. Add property columns A through D, line 24 . . . . . . . . . . . . . . 31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b. Enter here and on line 13 32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 33. Enter the portion from other than casualty or theft on Form 4797 , line 6 \\begin{tabular}{|l|l} 30 & \\\\ \\hline 31 & \\\\ \\hline & \\\\ \\hline 32 & \\\\ \\hline \\end{tabular} Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to \50 or Less (see instructions) (a) Section 179 (b) Section \\( 280 \\mathrm{~F}(\\mathrm{~b})(2) \\) 33 Section 179 expense deduction or depreciation allowable in prior years. 34 Recomputed depreciation. See instructions. 35 Recapture amount. Subtract line 34 from line 33 . See the instructions for where to report . . 35. Form 4797 (2022) From 4797 Department of the Treasury Internal Revenue Service Name(s) shown on retum Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form 4797 for instructions and the latest information. OMB No. 1545-0184 2022 Attachment Sequence No. 27 Identifying number 1a Enter the gross proceeds from sales or exchanges reported to you for 2022 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20 . See instructions b Enter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. c Enter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS assets Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 130861 Form 4797 (2022) Ferm 4707 (2002) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (see instructions) 30 Total gains for all properties. Add property columns A through D, line 24 . . . . . . . . . . . . . . 31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b. Enter here and on line 13 32 Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 33. Enter the portion from other than casualty or theft on Form 4797 , line 6 \\begin{tabular}{|l|l} 30 & \\\\ \\hline 31 & \\\\ \\hline & \\\\ \\hline 32 & \\\\ \\hline \\end{tabular} Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to \50 or Less (see instructions) (a) Section 179 (b) Section \\( 280 \\mathrm{~F}(\\mathrm{~b})(2) \\) 33 Section 179 expense deduction or depreciation allowable in prior years. 34 Recomputed depreciation. See instructions. 35 Recapture amount. Subtract line 34 from line 33 . See the instructions for where to report . . 35. Form 4797 (2022)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started