Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed

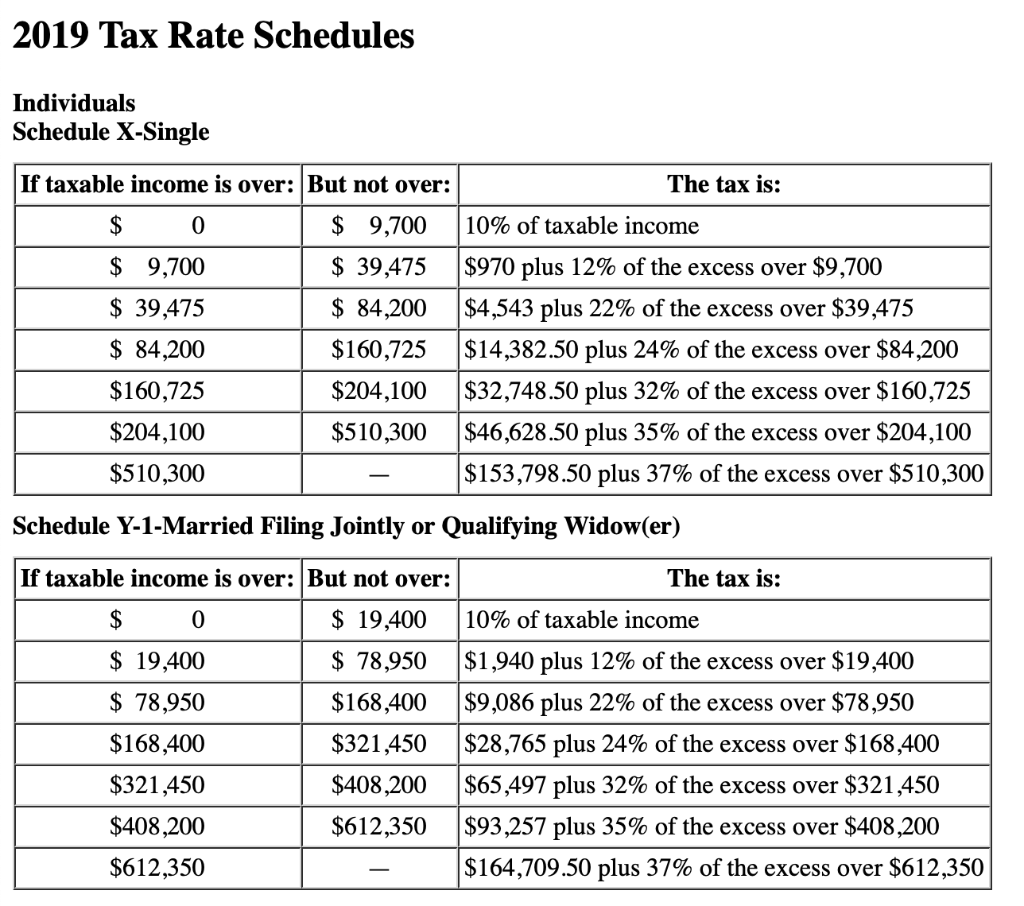

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed to her sole proprietorship. Moana is contemplating incorporating her sole proprietorship. Tax Rate schedule below.

a. Using the single individual tax brackets and the corporate tax rate of 21 percent, find out how much current tax this strategy could save Moana (ignore any Social Security, Medicare, or self-employment tax issues).

b. How much income should be left in the corporation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started