Answered step by step

Verified Expert Solution

Question

1 Approved Answer

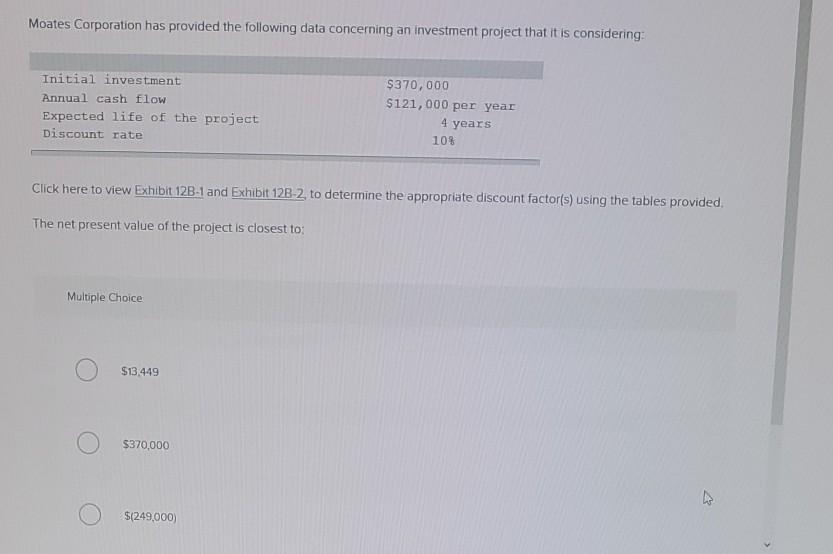

Moates Corporation has provided the following data concerning an investment project that it is considering: Initial investment Annual cash flow Expected life of the project

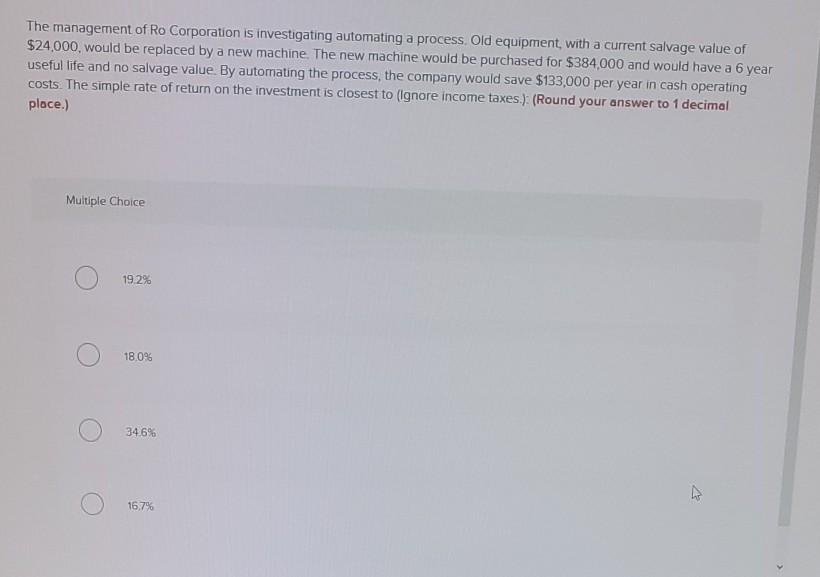

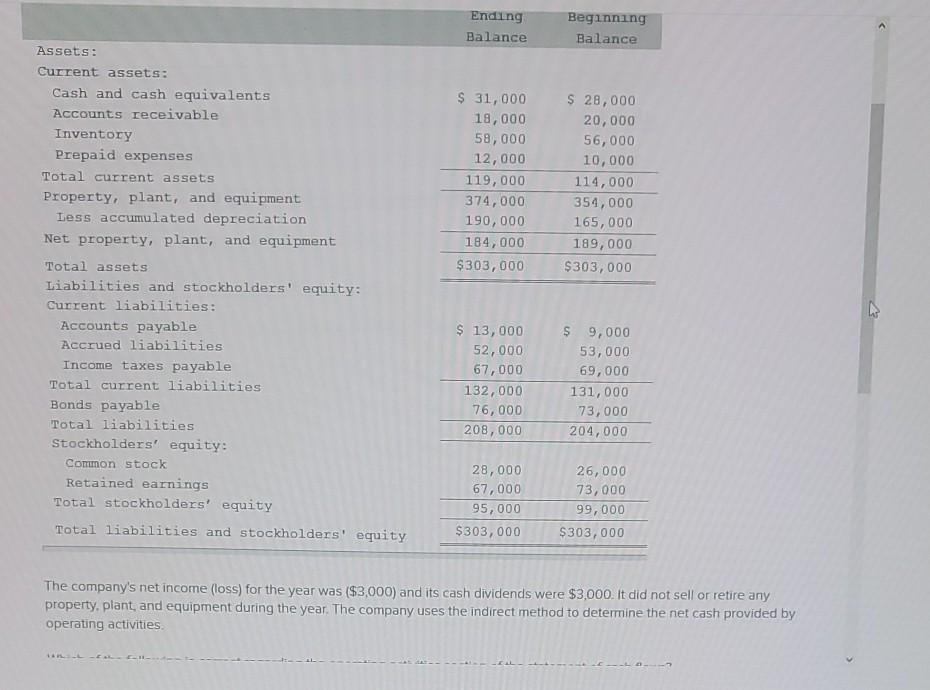

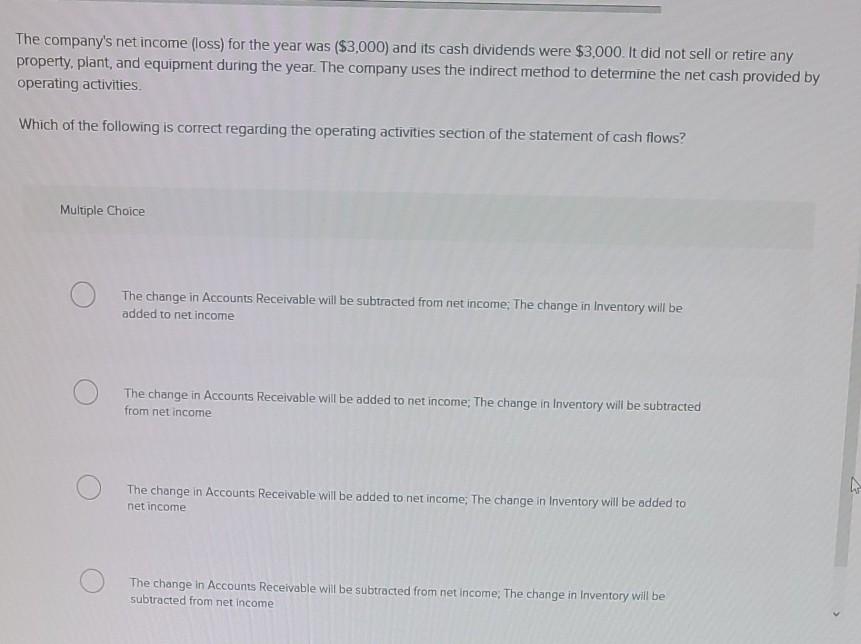

Moates Corporation has provided the following data concerning an investment project that it is considering: Initial investment Annual cash flow Expected life of the project Discount rate $370,000 $121,000 per year 4 years 10% Click here to view Exhibit 12B-1 and Exhibit 12B-2 to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to: Multiple Choice $13.449 $370,000 $(249,000) The management of Ro Corporation is investigating automating a process Old equipment, with a current salvage value of $24,000, would be replaced by a new machine. The new machine would be purchased for $384,000 and would have a 6 year useful life and no salvage value. By automating the process, the company would save $133,000 per year in cash operating costs. The simple rate of return on the investment is closest to (Ignore income taxes.): (Round your answer to 1 decimal ploce.) Multiple Choice 19.2% 18.0% 34.6% 16,7% Ending Balance Beginning Balance $ 31,000 $ 28,000 18,000 20,000 58,000 56,000 12,000 10,000 119,000 114,000 374,000 354,000 190,000 165,000 184,000 189,000 $303,000 $303,000 Assets: Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and stockholders' equity: Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 13,000 52,000 67,000 132,000 76,000 208,000 $ 9,000 53,000 69,000 131,000 73,000 204,000 28,000 67,000 95,000 $303,000 26,000 73,000 99,000 $303,000 The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities Which of the following is correct regarding the operating activities section of the statement of cash flows? Multiple Choice The change in Accounts Receivable will be subtracted from net income: The change in Inventory will be added to net income The change in Accounts Receivable will be added to net income: The change in Inventory will be subtracted from net income The change in Accounts Receivable will be added to net income: The change in Inventory will be added to net income The change in Accounts Receivable will be subtracted from net income. The change in Inventory will be subtracted from net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started