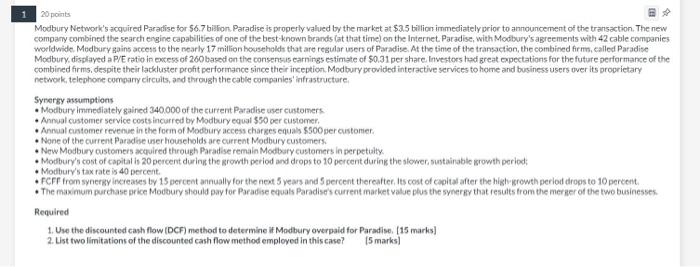

Modbury Network's acquired Paradise for $6.7 bifion. Paradise is properly valued by the market at $3.5 bilion immediately orior to announcement of the transaction. The new compary combined the search engine capabilities of one of the best-known brands (at that time) on the internet. Patadise, with Modbury's agreements with 42 cable companies woridwide. Modbury sains access to the nearly 17 million househelds that are resular wers of Paradise. At the tinte of the transaction, the combined firm, ealled Paradise Modbury, displayed a P/E ratio in evess of 260 based on the consensus earmings estimate of $0.31 per share. Invetors tad great copectations for the future performance of the combined frms, despite their lackluster profit performance since their inception. Modbury browided interactive services to home and business users over its proprietary netwoek, telephone compary circults, and throush the cable companies' infrastructure. Synergy aveumptions - Modbury immediately gained 340000 of the current Paradise user customers - Annual customer service costs incurred by Modbury equal $50 oer custemer. - Annual cuntomer revenue in the foem of Modary access charzes equals $500 per customer. - None of the current Paradise uner households are current Modbury customers. - New Modbury oustomers acuuired through Paradise remain Modbsry eustomers in perpetialty. * Mosbury's cost of capital is 20 percent during the growth period and drops to 10 percent during the slower, sustainable growth period: - Mostbury's tax rate is 40 percent. - FCFf from synergy increases by 15 percent annualiy for the next 5 years and 5 percent thereafter, its cost of copital after the highigrewth period drops to 10 percent. - The maximum purchase price Modbury should pay for Paradise equats Paradise's current market value plus the synerfy that results trom the meraer of the two businesses. Required 1. Use the distounted caph flow (DCF) method to determine if Modbury overpaid for Paradise. [15 marks] 2. List two limitations of the discounted cash flow method employed in this case? [5 marks] Modbury Network's acquired Paradise for $6.7 bifion. Paradise is properly valued by the market at $3.5 bilion immediately orior to announcement of the transaction. The new compary combined the search engine capabilities of one of the best-known brands (at that time) on the internet. Patadise, with Modbury's agreements with 42 cable companies woridwide. Modbury sains access to the nearly 17 million househelds that are resular wers of Paradise. At the tinte of the transaction, the combined firm, ealled Paradise Modbury, displayed a P/E ratio in evess of 260 based on the consensus earmings estimate of $0.31 per share. Invetors tad great copectations for the future performance of the combined frms, despite their lackluster profit performance since their inception. Modbury browided interactive services to home and business users over its proprietary netwoek, telephone compary circults, and throush the cable companies' infrastructure. Synergy aveumptions - Modbury immediately gained 340000 of the current Paradise user customers - Annual customer service costs incurred by Modbury equal $50 oer custemer. - Annual cuntomer revenue in the foem of Modary access charzes equals $500 per customer. - None of the current Paradise uner households are current Modbury customers. - New Modbury oustomers acuuired through Paradise remain Modbsry eustomers in perpetialty. * Mosbury's cost of capital is 20 percent during the growth period and drops to 10 percent during the slower, sustainable growth period: - Mostbury's tax rate is 40 percent. - FCFf from synergy increases by 15 percent annualiy for the next 5 years and 5 percent thereafter, its cost of copital after the highigrewth period drops to 10 percent. - The maximum purchase price Modbury should pay for Paradise equats Paradise's current market value plus the synerfy that results trom the meraer of the two businesses. Required 1. Use the distounted caph flow (DCF) method to determine if Modbury overpaid for Paradise. [15 marks] 2. List two limitations of the discounted cash flow method employed in this case? [5 marks]