Answered step by step

Verified Expert Solution

Question

1 Approved Answer

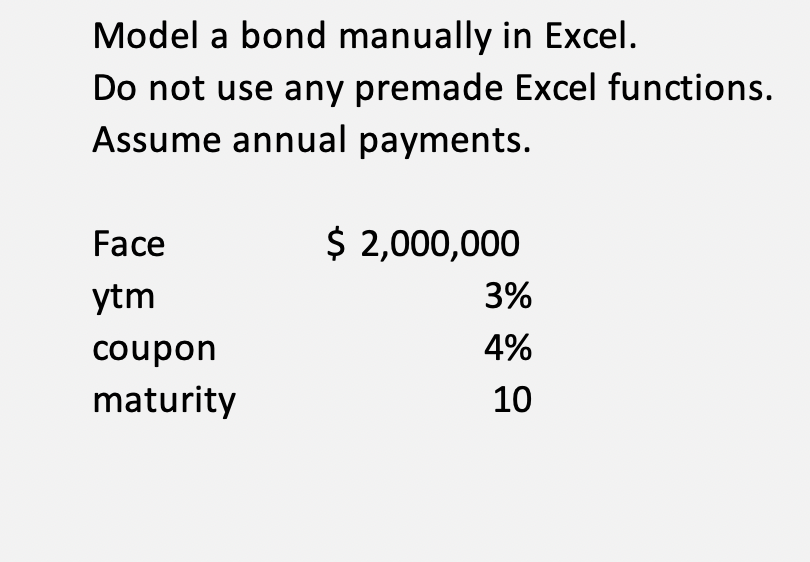

Model a bond manually in Excel. Do not use any premade Excel functions. Assume annual payments. Face ytm coupon maturity $ 2,000,000 3% 4%

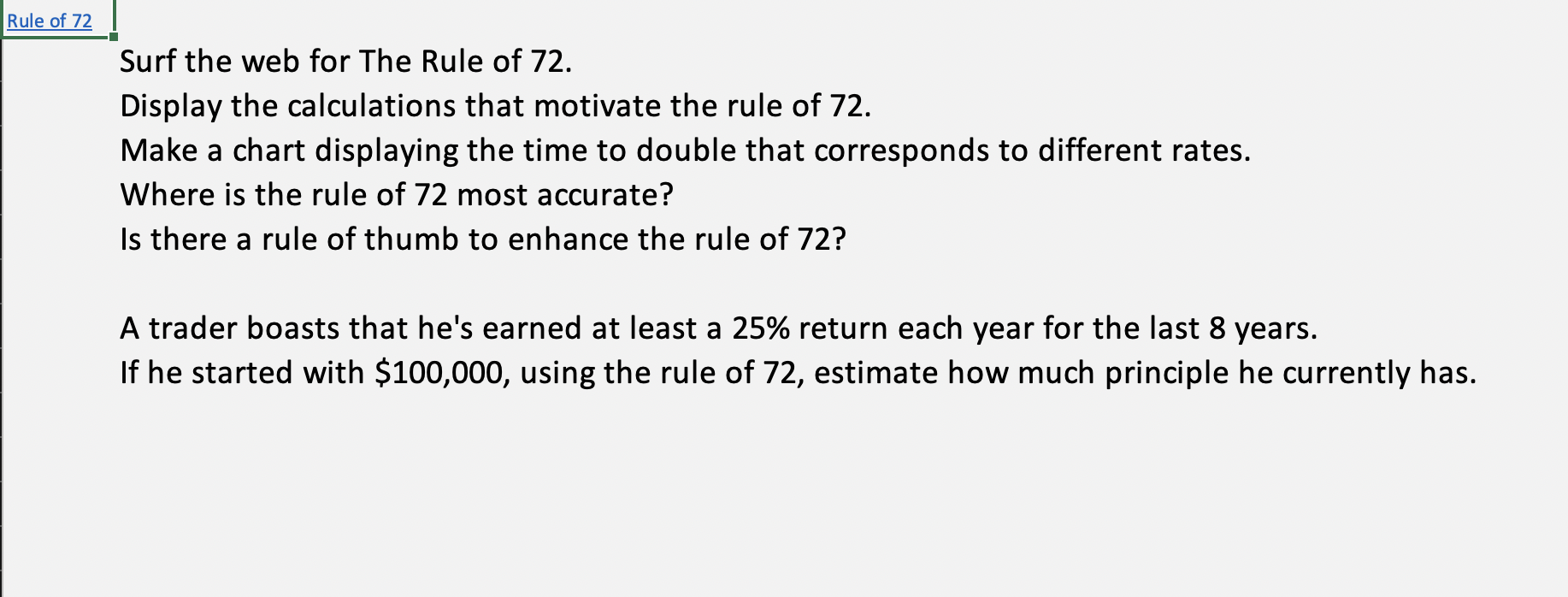

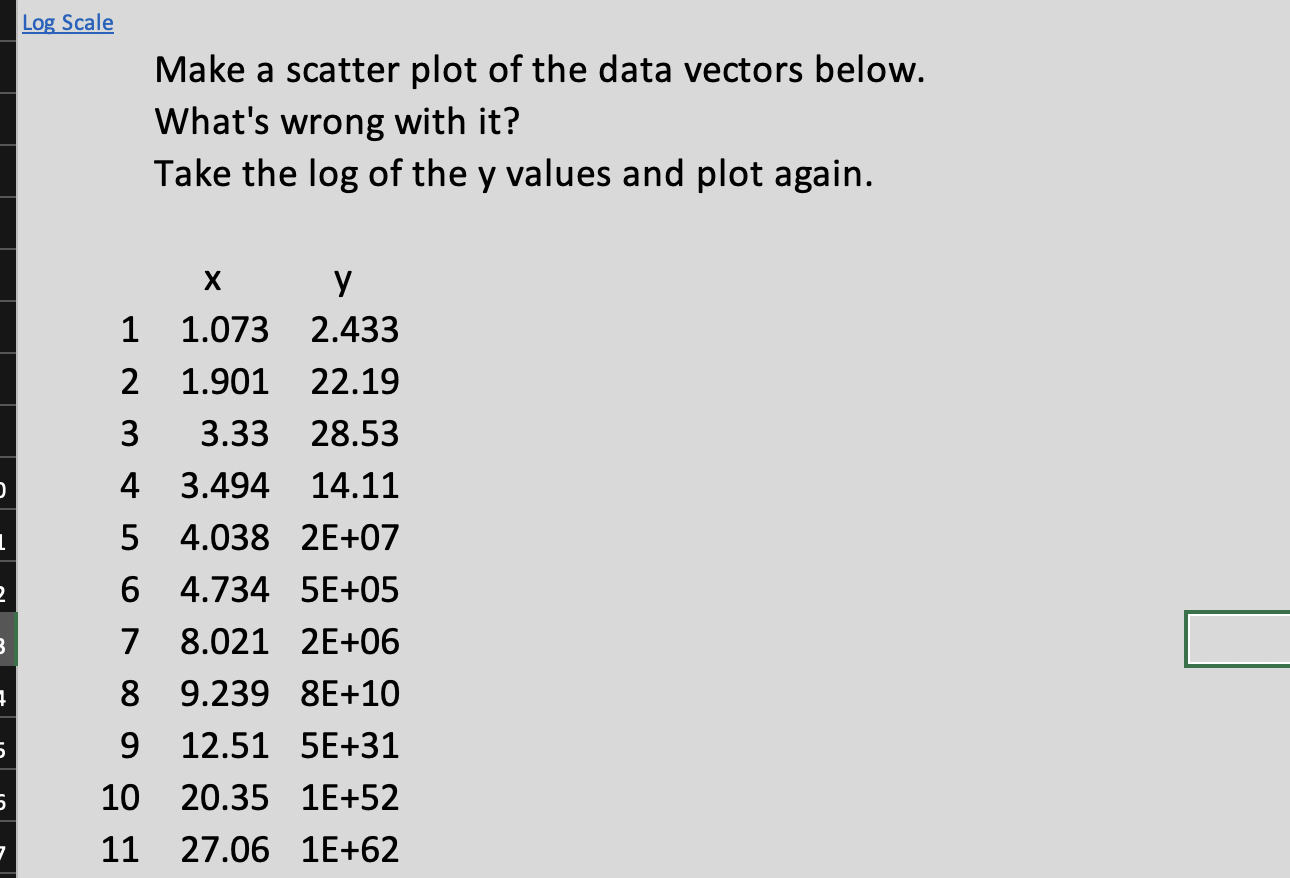

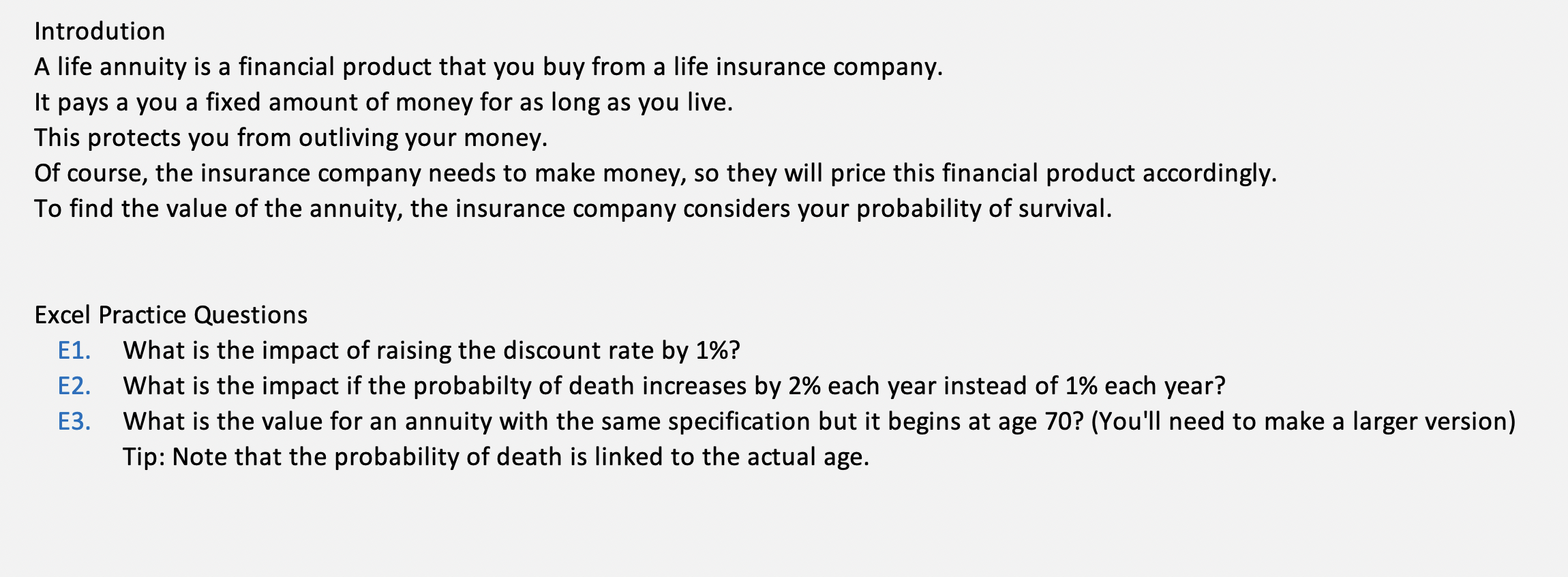

Model a bond manually in Excel. Do not use any premade Excel functions. Assume annual payments. Face ytm coupon maturity $ 2,000,000 3% 4% 10 Rule of 72 Surf the web for The Rule of 72. Display the calculations that motivate the rule of 72. Make a chart displaying the time to double that corresponds to different rates. Where is the rule of 72 most accurate? Is there a rule of thumb to enhance the rule of 72? A trader boasts that he's earned at least a 25% return each year for the last 8 years. If he started with $100,000, using the rule of 72, estimate how much principle he currently has. 2 B 5 7 Log Scale Make a scatter plot of the data vectors below. What's wrong with it? Take the log of the y values and plot again. X 1 1.073 2.433 2 1.901 22.19 3 3.33 28.53 4 3.494 14.11 5 4.038 2E+07 6 4.734 5E+05 7 8.021 2E+06 8 9.239 8E+10 9 12.51 5E+31 10 20.35 1E+52 11 27.06 1E+62 Introdution A life annuity is a financial product that you buy from a life insurance company. It pays a you a fixed amount of money for as long as you live. This protects you from outliving your money. Of course, the insurance company needs to make money, so they will price this financial product accordingly. To find the value of the annuity, the insurance company considers your probability of survival. Excel Practice Questions E1. What is the impact of raising the discount rate by 1%? E2. What is the impact if the probabilty of death increases by 2% each year instead of 1% each year? E3. What is the value for an annuity with the same specification but it begins at age 70? (You'll need to make a larger version) Tip: Note that the probability of death is linked to the actual age.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started