Answered step by step

Verified Expert Solution

Question

1 Approved Answer

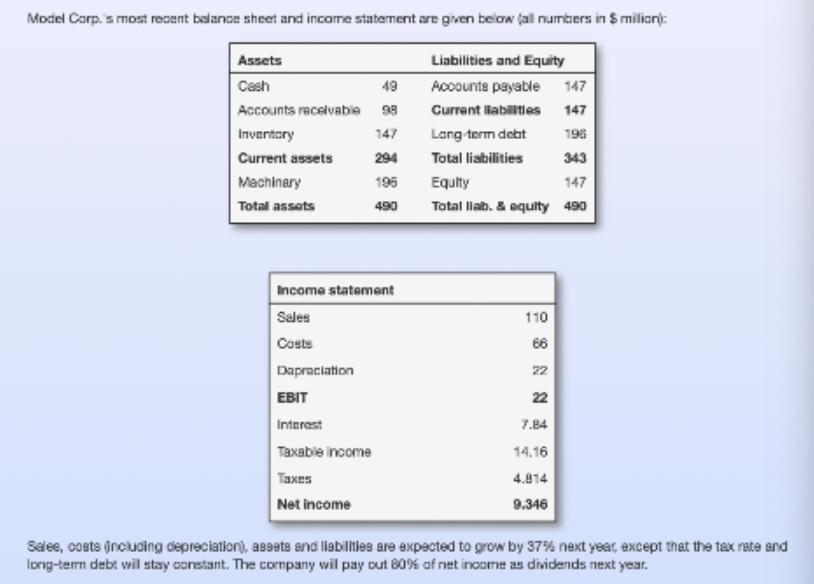

Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Liabilities and Equity Accounts payable 147 Current

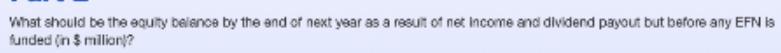

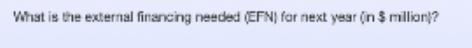

Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Liabilities and Equity Accounts payable 147 Current liabilities 147 Lang-term debt 196 Total liabilities 343 Equity 147 Total llab. & equity 490 Assets Cash 49 Accounts receivable 98 Inventory Current assets Machinery Total assets 294 195 490 Income statement Sales Costs Depreciation EBIT Interest Taxable income Taxes Net income 110 66 22 22 7.84 14.16 4.814 9.346 Sales, costs including depreciation), assets and liabilities are expected to grow by 37% next year, except that the tax rate and long-term debt wil stay constant. The company wil pay out 80% of net income as dividends next year. What will be the net income next year (in $ million)? What should be the equity balance by the end of next year as a result of net Income and dividend payout but before any EFN is funded (in $ million)? What is the external financing needed (EFN) for next year (in $ million)?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Calculation of Tax rate Total tax Taxable income 3468 102 34 Expected growth rate 28 for sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started