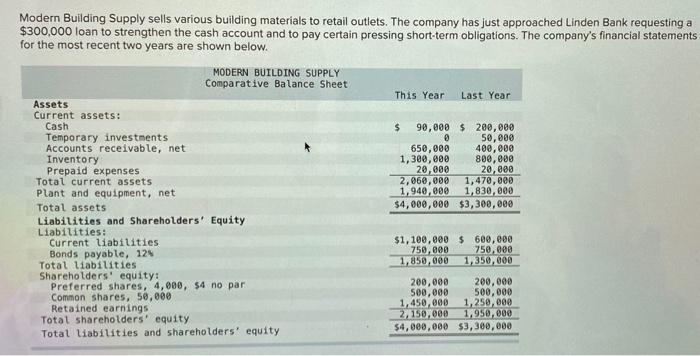

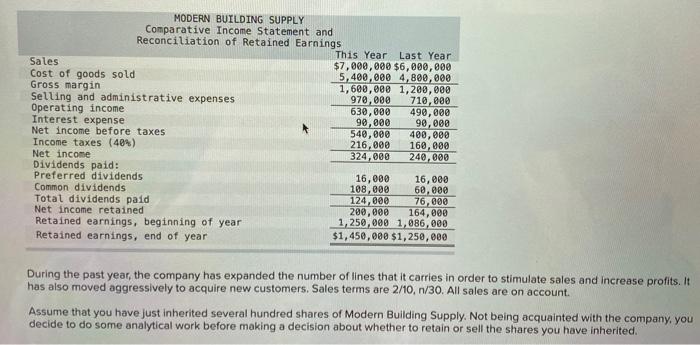

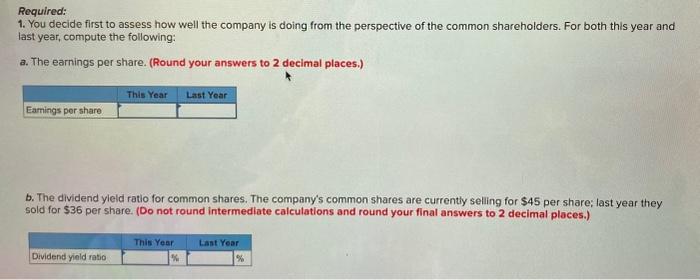

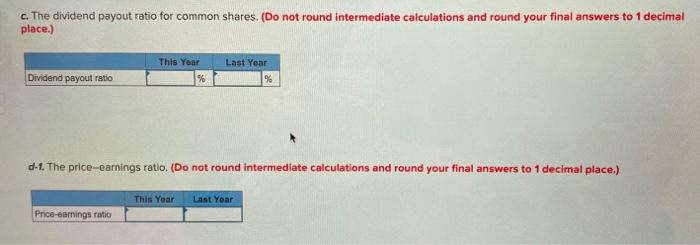

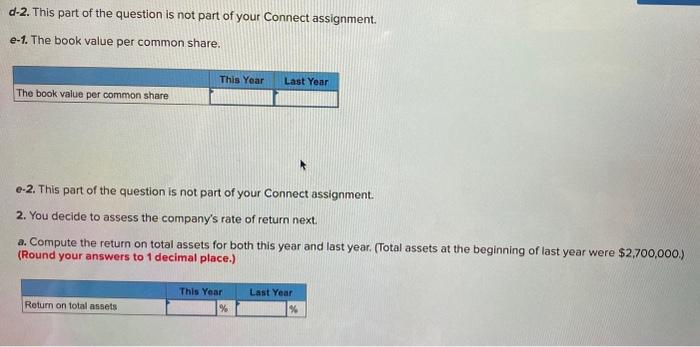

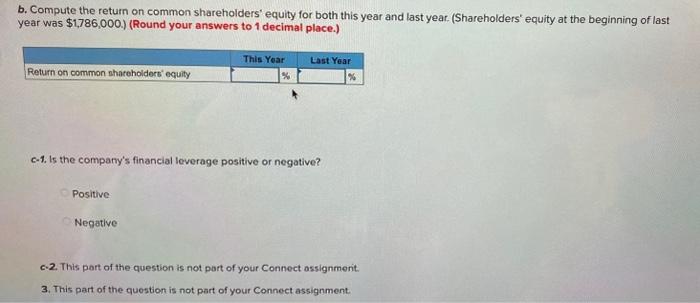

Modern Building Supply sells various building materials to retail outlets. The company has just approached Linden Bank requesting a $300,000 loan to strengthen the cash account and to pay certain pressing short-term obligations. The company's financial statements for the most recent two years are shown below. During the past year, the company has expanded the number of lines that it carries in order to stimulate sales and increase profits. It has also moved aggressively to acquire new customers. Sales terms are 2/10,n/30. All sales are on account. Assume that you have just inherited several hundred shares of Modern Building Supply. Not being acquainted with the company, you decide to do some analytical work before making a decision about whether to retain or sell the shares you have inherited. Required: 1. You decide first to assess how well the company is doing from the perspective of the common shareholders. For both this year and last year, compute the following: a. The earnings per share. (Round your answers to 2 decimal places.) b. The dividend yleld ratio for common shares. The company's common shares are currently selling for $45 per share: last year they sold for $36 per share. (Do not round intermedlate calculations and round your final answers to 2 decimal places.) c. The dividend payout ratio for common shares. (Do not round intermediate calculations and round your final answers to 1 decimal place.) d-1. The price-earnings ratio. (Do not round intermediate calculations and round your final answers to 1 decimal place.) d-2. This part of the question is not part of your Connect assignment. e-1. The book value per common share. e.2. This part of the question is not part of your Connect assignment. 2. You decide to assess the company's rate of return next. a. Compute the return on total assets for both this year and last year. (Total assets at the beginning of last year were $2,700,000.) (Round your answers to 1 decimal place.) b. Compute the return on common shareholders' equity for both this year and last year. (Shareholders' equity at the beginning of last year was $1,786,000.) (Round your answers to 1 decimal place.) c-1. Is the company's financial leverage positive or negative? Positive Negative 6.2. This part of the question is not part of your Connect assignment. 3. This part of the question is not part of your Connect assignment. Modern Building Supply sells various building materials to retail outlets. The company has just approached Linden Bank requesting a $300,000 loan to strengthen the cash account and to pay certain pressing short-term obligations. The company's financial statements for the most recent two years are shown below. During the past year, the company has expanded the number of lines that it carries in order to stimulate sales and increase profits. It has also moved aggressively to acquire new customers. Sales terms are 2/10,n/30. All sales are on account. Assume that you have just inherited several hundred shares of Modern Building Supply. Not being acquainted with the company, you decide to do some analytical work before making a decision about whether to retain or sell the shares you have inherited. Required: 1. You decide first to assess how well the company is doing from the perspective of the common shareholders. For both this year and last year, compute the following: a. The earnings per share. (Round your answers to 2 decimal places.) b. The dividend yleld ratio for common shares. The company's common shares are currently selling for $45 per share: last year they sold for $36 per share. (Do not round intermedlate calculations and round your final answers to 2 decimal places.) c. The dividend payout ratio for common shares. (Do not round intermediate calculations and round your final answers to 1 decimal place.) d-1. The price-earnings ratio. (Do not round intermediate calculations and round your final answers to 1 decimal place.) d-2. This part of the question is not part of your Connect assignment. e-1. The book value per common share. e.2. This part of the question is not part of your Connect assignment. 2. You decide to assess the company's rate of return next. a. Compute the return on total assets for both this year and last year. (Total assets at the beginning of last year were $2,700,000.) (Round your answers to 1 decimal place.) b. Compute the return on common shareholders' equity for both this year and last year. (Shareholders' equity at the beginning of last year was $1,786,000.) (Round your answers to 1 decimal place.) c-1. Is the company's financial leverage positive or negative? Positive Negative 6.2. This part of the question is not part of your Connect assignment. 3. This part of the question is not part of your Connect assignment