Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Modern Electronics Company purchases merchandise Inventory from several suppliers. On April 1, 2023, Modern Electronics purchased from Speedy Supplies $120,000 of inventory on account.

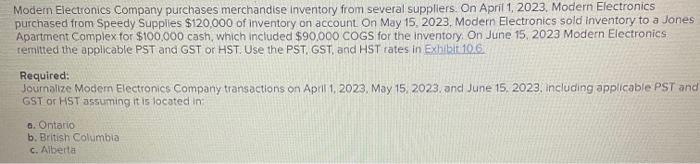

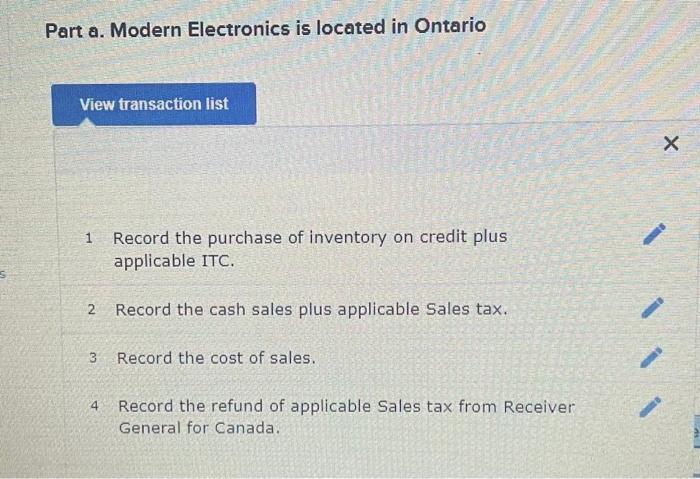

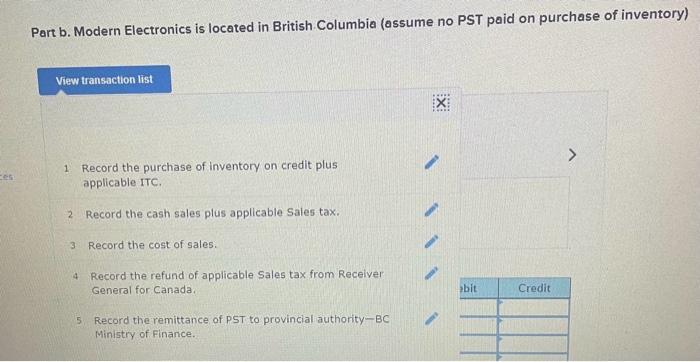

Modern Electronics Company purchases merchandise Inventory from several suppliers. On April 1, 2023, Modern Electronics purchased from Speedy Supplies $120,000 of inventory on account. On May 15, 2023, Modern Electronics sold inventory to a Jones Apartment Complex for $100,000 cash, which included $90,000 COGS for the inventory. On June 15, 2023 Modern Electronics remitted the applicable PST and GST or HST. Use the PST, GST, and HST rates in Exhibit 10.6. Required: Journalize Modem Electronics Company transactions on April 1, 2023, May 15, 2023, and June 15, 2023, including applicable PST and GST or HST assuming it is located in: a. Ontario b. British Columbia c. Alberta Part a. Modern Electronics is located in Ontario View transaction list 1 Record the purchase of inventory on credit plus applicable ITC. 2 Record the cash sales plus applicable Sales tax. 3 Record the cost of sales. 4 Record the refund of applicable Sales tax from Receiver General for Canada. Part b. Modern Electronics is located in British Columbia (assume no PST paid on purchase of inventory) View transaction list Ces 1 Record the purchase of inventory on credit plus applicable ITC. 2 Record the cash sales plus applicable Sales tax. 3 Record the cost of sales. 4 Record the refund of applicable Sales tax from Receiver General for Canada. bit Credit 5 Record the remittance of PST to provincial authority-BC Ministry of Finance. > Part c. Modern Electronics is located in Alberta View transaction list 1 Record the purchase of inventory on credit plus applicable ITC. 2 Record the cash sales plus applicable Sales tax. 3 4 Record the cost of sales. Record the refund of applicable Sales tax from Receiver General for Canada. EX:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started