Modest Seating Company is currently selling 1,500 oversized bean bag chairs a month at a price of $78 per chair. The variable cost of each chair sold includes $30 to purchase the bean bag chairs from suppliers and a $2 sales commission. Fixed costs are $14,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income.

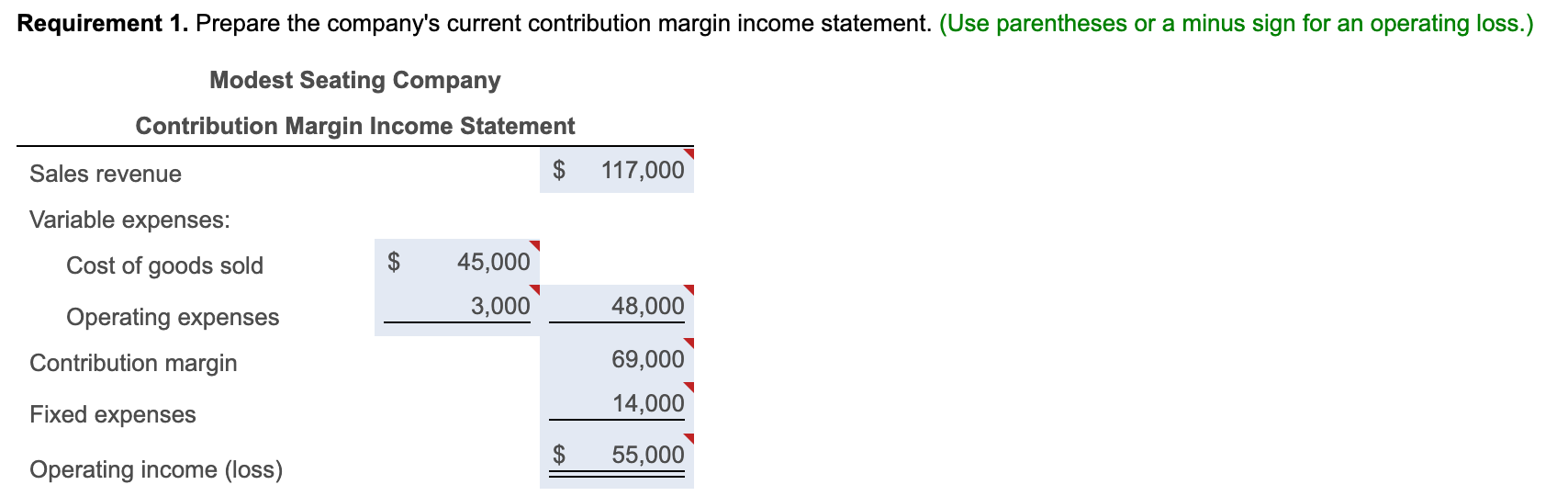

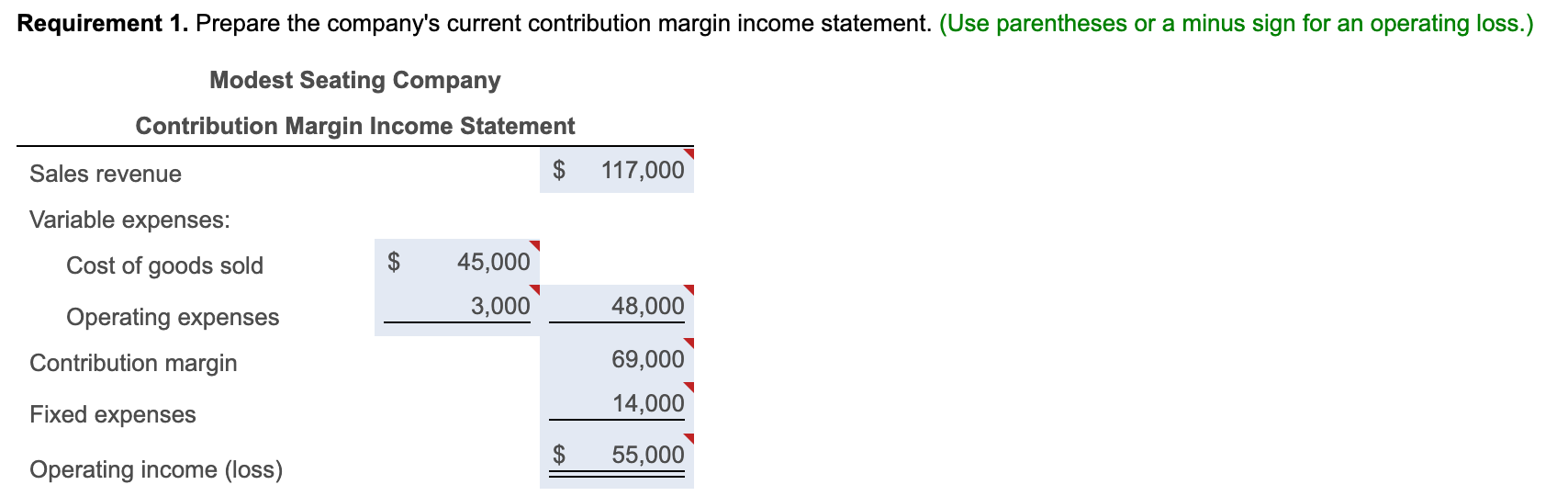

1. Prepare the company's current contribution margin income statement.

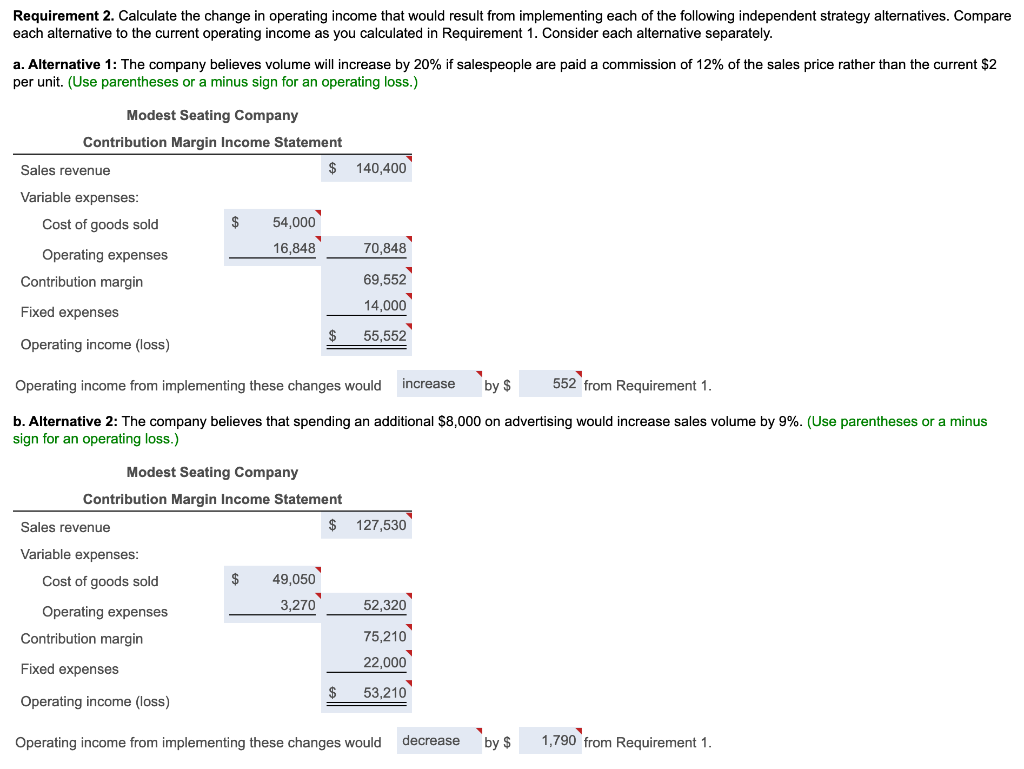

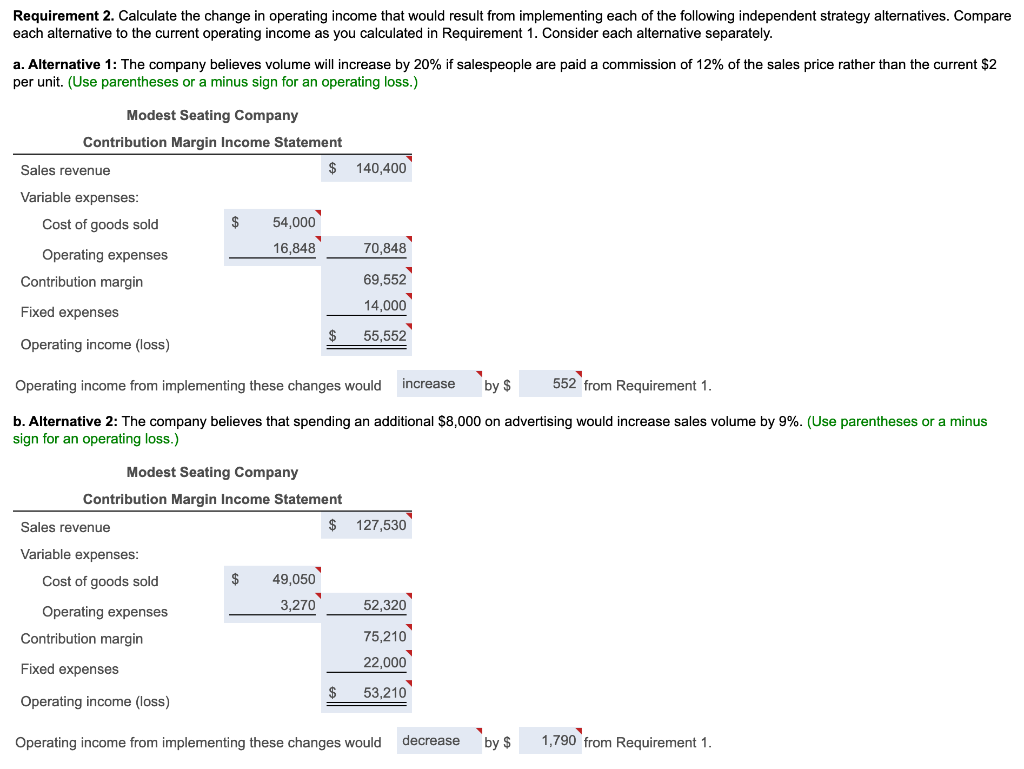

2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement

1. Consider each alternative separately.

a. Alternative 1: The company believes volume will increase by 20% if salespeople are paid a commission of 12% of the sales price rather than the current $2 per unit.

b. Alternative 2: The company believes that spending an additional $8,000 on advertising would increase sales volume by 9%.

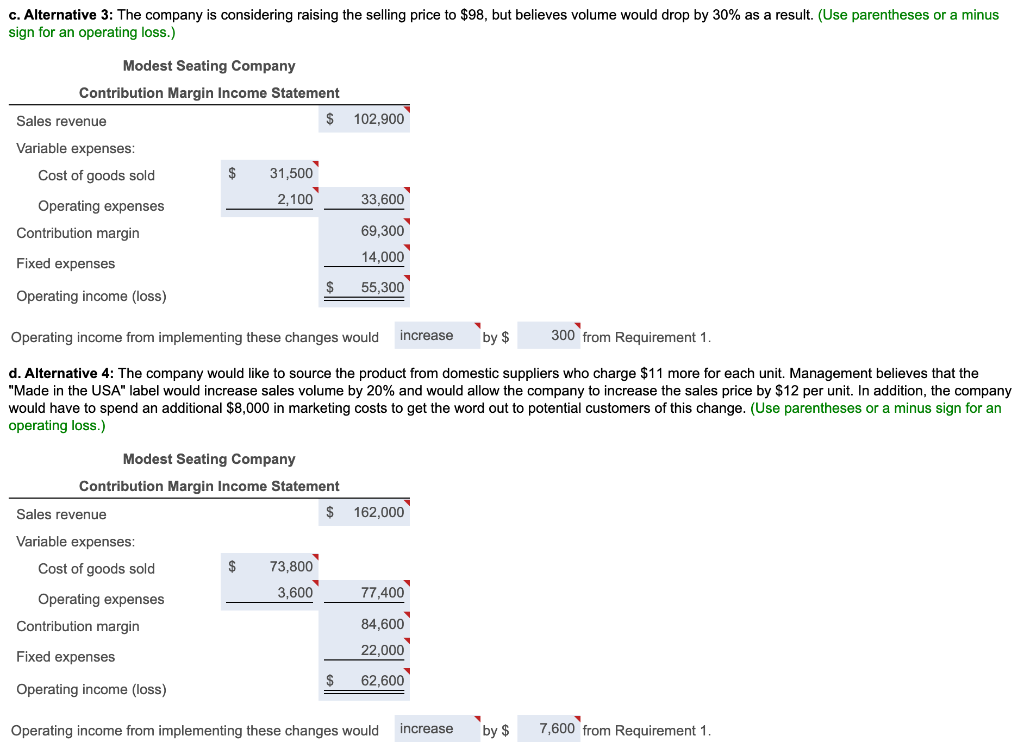

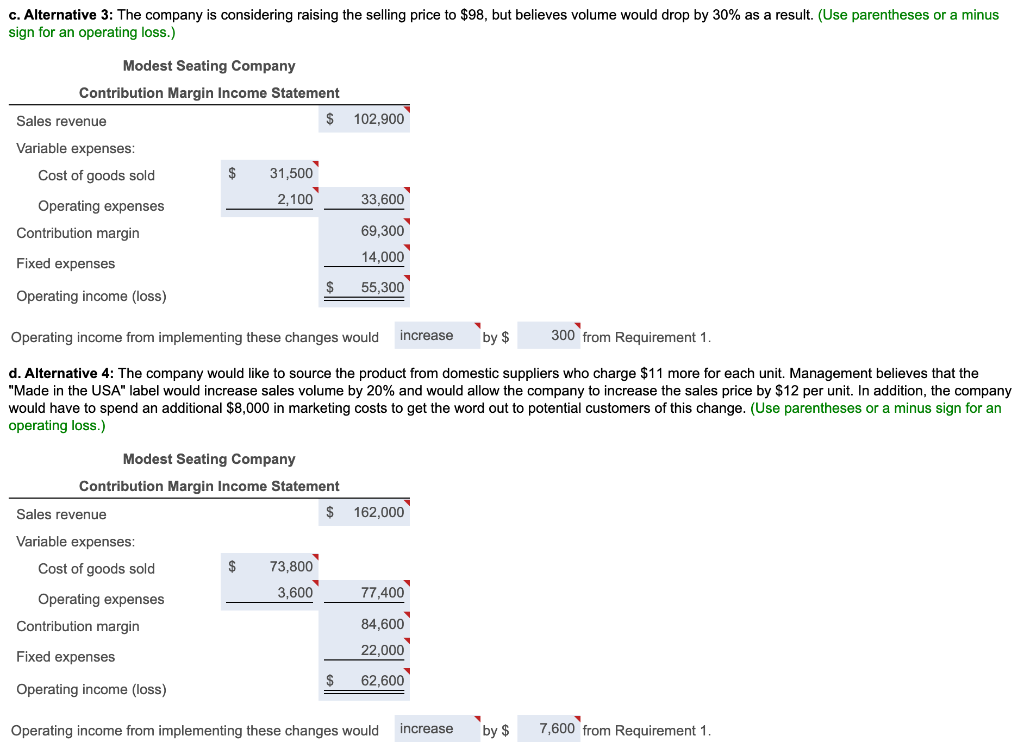

c. Alternative 3: The company is considering raising the selling price to $98, but believes volume would drop by 30% as a result.

d. Alternative 4: The company would like to source the product from domestic suppliers who charge $11 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 20% and would allow the company to increase the sales price by $12 per unit. In addition, the company would have to spend an additional $8,000 in marketing costs to get the word out to potential customers of this change.

The answers are below, I just need to see the work for them

Requirement 1. Prepare the company's current contribution margin income statement. (Use parentheses or a minus sign for an operating loss.) 117,000 Modest Seating Company Contribution Margin Income Statement Sales revenue $ Variable expenses: Cost of goods sold $ 45,000 Operating expenses 3,000 Contribution margin 48,000 Fixed expenses 69,000 14,000 55,000 $ Operating income (loss) Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 20% if salespeople are paid a commission of 12% of the sales price rather than the current $2 per unit. (Use parentheses or a minus sign for an operating loss.) Modest Seating Company Contribution Margin Income Statement Sales revenue $ 140,400 Variable expenses: Cost of goods sold $ _ 54,000 16,848' Operating expenses Contribution margin 70,848 69,552 14,000 55,552 Fixed expenses Operating income (loss) $ Operating income from implementing these changes would increase by $ 552 from Requirement 1. b. Alternative 2: The company believes that spending an additional $8,000 on advertising would increase sales volume by 9%. (Use parentheses or a minus sign for an operating loss.) 127,530 Modest Seating Company Contribution Margin Income Statement Sales revenue $ Variable expenses: Cost of goods sold $ 49,050 Operating expenses 3,270 Contribution margin Fixed expenses Operating income (loss) $ 52,320 75,210 22,000 53,210 Operating income from implementing these changes would changes would decrease by $ 1,790 from Requirement 1. c. Alternative 3: The company is considering raising the selling price to $98, but believes volume would drop by 30% as a result. (Use parentheses or a minus sign for an operating loss.) 102,900 Modest Seating Company Contribution Margin Income Statement Sales revenue $ Variable expenses: Cost of goods sold $ 31,500 Operating expenses 2,100 Contribution margin Fixed expenses Operating income (loss) $ 33,600 69,300 14,000 55,300 Operating income from implementing these changes would increase by $ 300 from Requirement 1. d. Alternative 4: The company would like to source the product from domestic suppliers who charge $11 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 20% and would allow the company to increase the sales price by $12 per unit. In addition, the company would have to spend an additional $8,000 in marketing costs to get the word out to potential customers of this change. (Use parentheses or a minus sign for an operating loss.) 162,000 Modest Seating Company Contribution Margin Income Statement Sales revenue $ Variable expenses: Cost of goods sold 73,800 Operating expenses 3,600 Contribution margin Fixed expenses $ Operating income (loss) 77,400 84,600 22,000 62,600 Operating income from implementing these changes would increase by $ 7,600 from Requirement 1