Answered step by step

Verified Expert Solution

Question

1 Approved Answer

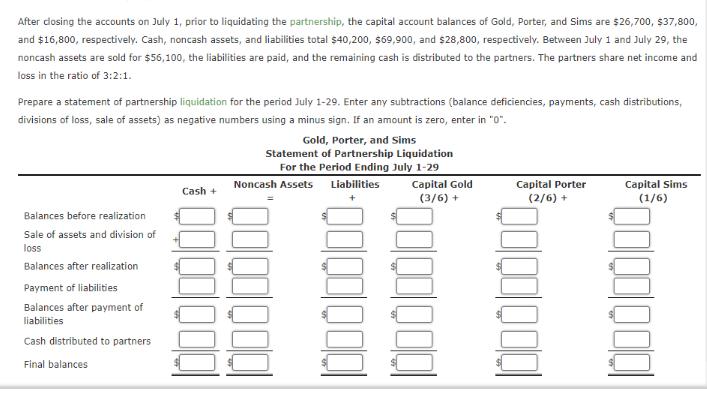

After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $26,700, $37,800,

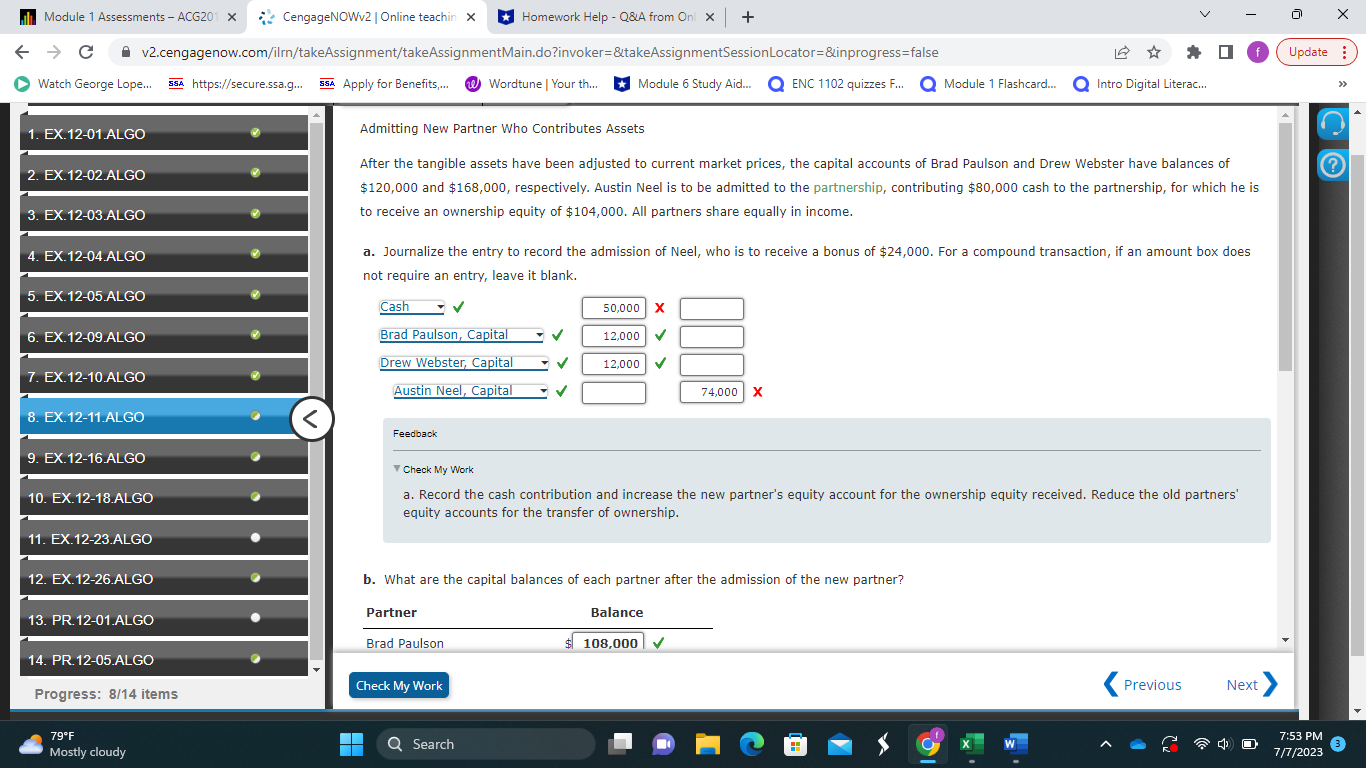

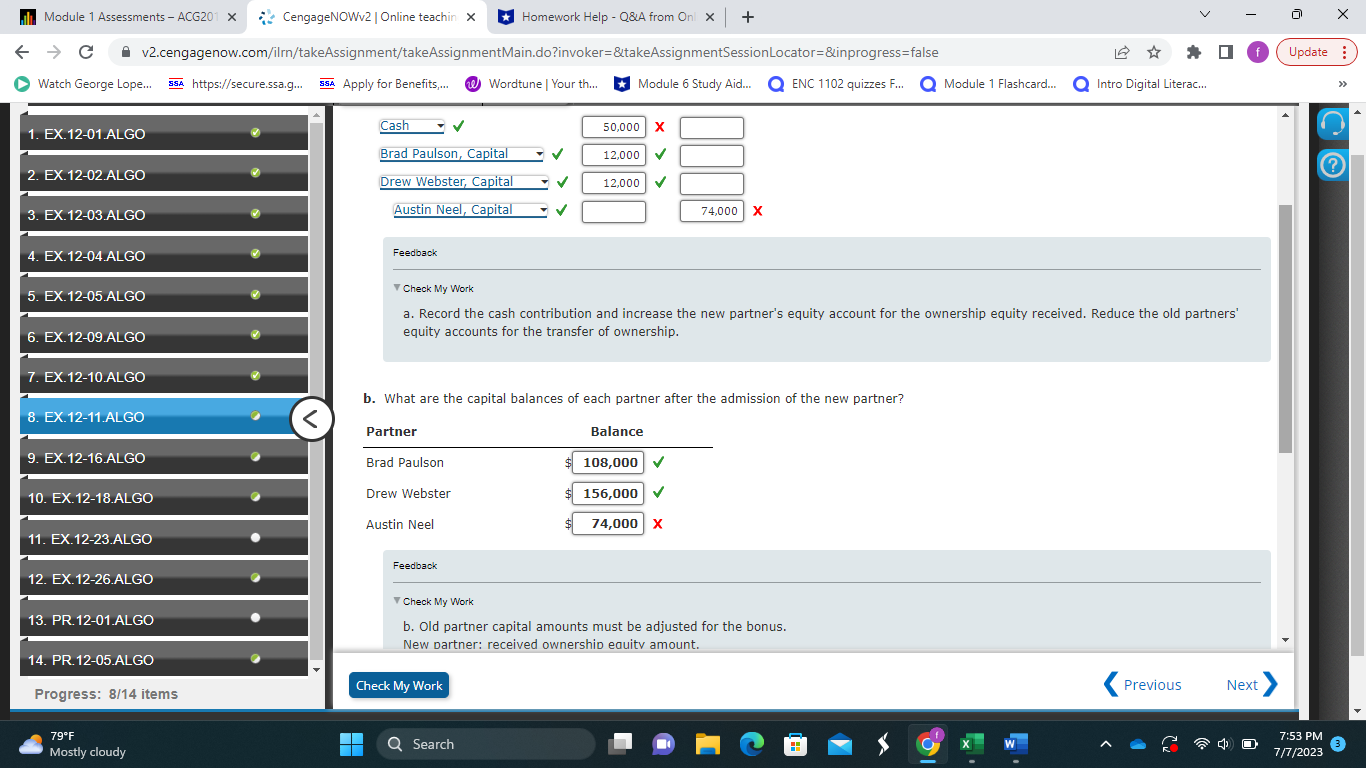

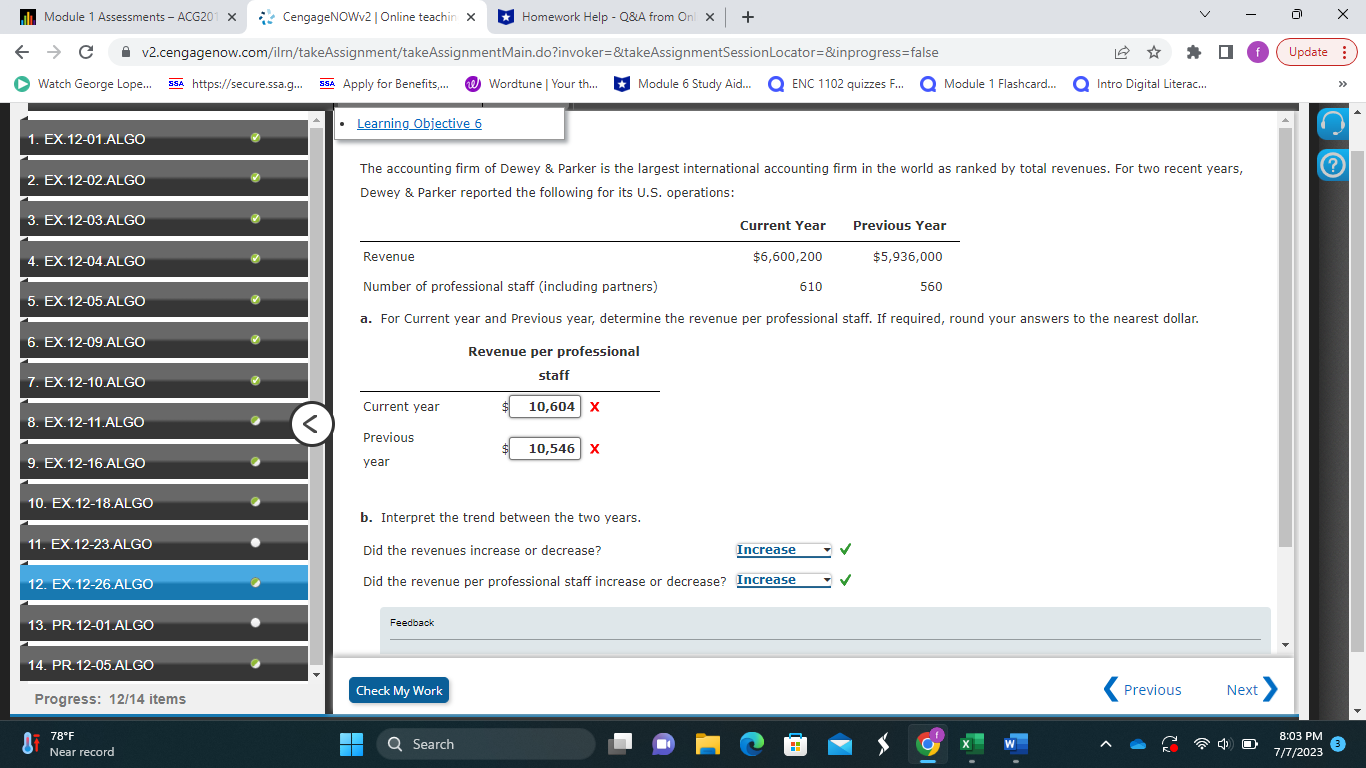

After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $26,700, $37,800, and $16,800, respectively. Cash, noncash assets, and liabilities total $40,200, $69,900, and $28,800, respectively. Between July 1 and July 29, the noncash assets are sold for $56,100, the liabilities are paid, and the remaining cash is distributed to the partners. The partners share net income and loss in the ratio of 3:2:1. Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, divisions of loss, sale of assets) as negative numbers using a minus sign. If an amount is zero, enter in "0". Gold, Porter, and Sims Statement of Partnership Liquidation For the Period Ending July 1-29 Balances before realization Sale of assets and division of loss Balances after realization Payment of liabilities Balances after payment of liabilities Cash distributed to partners Final balances Cash + Noncash Assets Liabilities Capital Gold (3/6) + Capital Porter (2/6) + Capital Sims (1/6) Module 1 Assessments - ACG201 x CengageNOWv2 | Online teachin x v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Module 6 Study Aid... Q ENC 1102 quizzes F... C Watch George Lope... SSA https://secure.ssa.g... SSA Apply for Benefits,... Wordtune | Your th... 1. EX.12-01. ALGO 2. EX.12-02.ALGO 3. EX.12-03 ALGO 4. EX.12-04. ALGO 5. EX.12-05 ALGO 6. EX.12-09.ALGO 7. EX.12-10.ALGO 8. EX.12-11.ALGO 9. EX.12-16 ALGO 10. EX.12-18.ALGO 11. EX.12-23.ALGO 12. EX.12-26.ALGO 13. PR.12-01.ALGO 14. PR.12-05.ALGO Progress: 8/14 items 79F Mostly cloudy < Cash Brad Paulson, Capital Drew Webster, Capital Austin Neel, Capital Feedback Admitting New Partner Who Contributes Assets After the tangible assets have been adjusted to current market prices, the capital accounts of Brad Paulson and Drew Webster have balances of $120,000 and $168,000, respectively. Austin Neel is to be admitted to the partnership, contributing $80,000 cash to the partnership, for which he is to receive an ownership equity of $104,000. All partners share equally in income. a. Journalize the entry to record the admission of Neel, who is to receive a bonus of $24,000. For a compound transaction, if an amount box does not require an entry, leave it blank. Homework Help - Q&A from On X + Partner Brad Paulson Check My Work Q Search 50,000 X 12,000 b. What are the capital balances of each partner after the admission of the new partner? 12,000 Check My Work a. Record the cash contribution and increase the new partner's equity account for the ownership equity received. Reduce the old partners' equity accounts for the transfer of ownership. Module 1 Flashcard... 74,000 X Intro Digital Literac... Balance $ 108,000 f Previous Next Update 7:53 PM 7/7/2023 X Module 1 Assessments - ACG201 x CengageNOWv2 | Online teachin x v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Module 6 Study Aid... Q ENC 1102 quizzes F... C Watch George Lope... SSA https://secure.ssa.g... SSA Apply for Benefits,... Wordtune | Your th... 1. EX.12-01. ALGO 2. EX.12-02.ALGO 3. EX.12-03 ALGO 4. EX.12-04. ALGO 5. EX.12-05 ALGO 6. EX.12-09.ALGO 7. EX.12-10.ALGO 8. EX.12-11.ALGO 9. EX.12-16 ALGO 10. EX.12-18.ALGO 11. EX.12-23.ALGO 12. EX.12-26.ALGO 13. PR. 12-01.ALGO 14. PR.12-05.ALGO Progress: 8/14 items 79F Mostly cloudy < Cash Brad Paulson, Capital Drew Webster, Capital Austin Neel, Capital Feedback Partner Brad Paulson Drew Webster Austin Neel Feedback Homework Help - Q&A from On X + b. What are the capital balances of each partner after the admission of the new partner? Check My Work Check My Work a. Record the cash contribution and increase the new partner's equity account for the ownership equity received. Reduce the old partners' equity accounts for the transfer of ownership. 50,000 X Q Search 12,000 12,000 74,000 X Balance 108,000 $ 156,000 74,000 X Check My Work b. Old partner capital amounts must be adjusted for the bonus. New partner: received ownership equity amount. Module 1 Flashcard... Intro Digital Literac... Previous f Update Next 7:53 PM 7/7/2023 X Module 1 Assessments - ACG201 x 1. EX.12-01. ALGO C v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Watch George Lope... SSA https://secure.ssa.g... SSA Apply for Benefits,... Wordtune | Your th... Module 6 Study Aid... QENC 1102 quizzes F... 2. EX.12-02.ALGO 3. EX.12-03 ALGO 4. EX.12-04.ALGO 5. EX.12-05 ALGO 6. EX.12-09 ALGO 7. EX.12-10.ALGO 8. EX.12-11.ALGO 9. EX.12-16 ALGO 10. EX.12-18.ALGO 11. EX.12-23.ALGO 12. EX.12-26.ALGO 13. PR.12-01.ALGO 14. PR.12-05.ALGO Progress: 12/14 items 8F CengageNOWv2 | Online teachin X 78F Near record < Learning Objective 6 Revenue The accounting firm of Dewey & Parker is the largest international accounting firm in the world as ranked by total revenues. For two recent years, Dewey & Parker reported the following for its U.S. operations: Current year Previous year Homework Help - Q&A from On X + Feedback Check My Work Q Search Number of professional staff (including partners) a. For Current year and Previous year, determine the revenue per professional staff. If required, round your answers to the nearest dollar. Revenue per professional staff 10,604 X b. Interpret the trend between the two years. Did the revenues increase or decrease? Increase Did the revenue per professional staff increase or decrease? Increase Current Year 10,546 X $6,600,200 610 Module 1 Flashcard... Previous Year $5,936,000 Intro Digital Literac... 560 Previous f 4 Next t> Update 8:03 PM 7/7/2023 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information we can calculate the revenue per professional staff for the current y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started