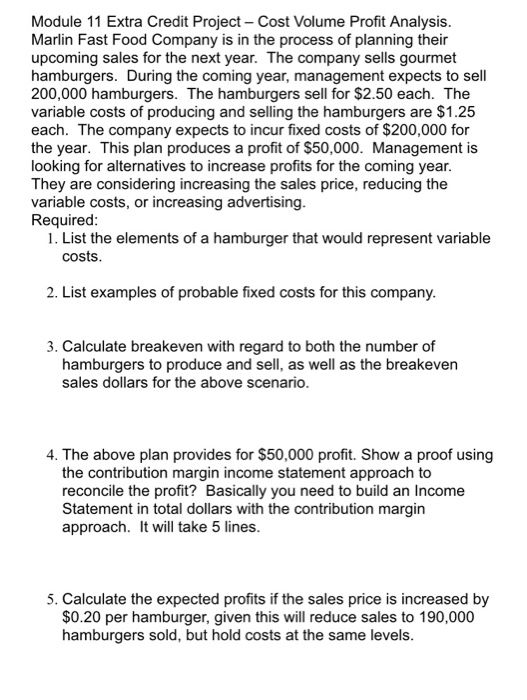

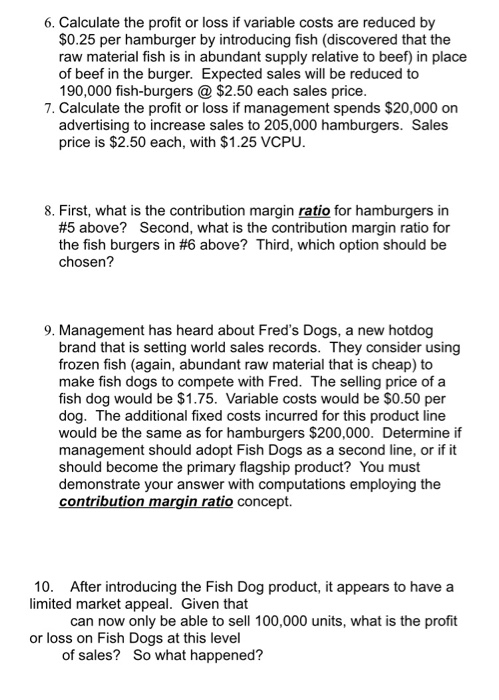

Module 11 Extra Credit Project Cost Volume Profit Analysis. Marlin Fast Food Company is in the process of planning their upcoming sales for the next year. The company sells gourmet hamburgers. During the coming year, management expects to sell 200,000 hamburgers. The hamburgers sell for $2.50 each. The variable costs of producing and selling the hamburgers are $1.25 each. The company expects to incur fixed costs of $200,000 for the year. This plan produces a profit of $50,000. Management is looking for alternatives to increase profits for the coming year. They are considering increasing the sales price, reducing the variable costs, or increasing advertising. Required: 1. List the elements of a hamburger that would represent variable costs. 2. List examples of probable fixed costs for this company. 3. Calculate breakeven with regard to both the number of hamburgers to produce and sell, as well as the breakeven sales dollars for the above scenario. 4. The above plan provides for $50,000 profit. Show a proof using the contribution margin income statement approach to reconcile the profit? Basically you need to build an Income Statement in total dollars with the contribution margin approach. It will take 5 lines. 5. Calculate the expected profits if the sales price is increased by $0.20 per hamburger, given this will reduce sales to 190,000 hamburgers sold, but hold costs at the same levels. 6. Calculate the profit or loss if variable costs are reduced by $0.25 per hamburger by introducing fish (discovered that the raw material fish is in abundant supply relative to beef) in place of beef in the burger. Expected sales will be reduced to 190,000 fish-burgers @ $2.50 each sales price. 7. Calculate the profit or loss if management spends $20,000 on advertising to increase sales to 205,000 hamburgers. Sales price is $2.50 each, with $1.25 VCPU. 8. First, what is the contribution margin ratio for hamburgers in #5 above? Second, what is the contribution margin ratio for the fish burgers in #6 above? Third, which option should be chosen? 9. Management has heard about Fred's Dogs, a new hotdog brand that is setting world sales records. They consider using frozen fish (again, abundant raw material that is cheap) to make fish dogs to compete with Fred. The selling price of a fish dog would be $1.75. Variable costs would be $0.50 per dog. The additional fixed costs incurred for this product line would be the same as for hamburgers $200,000. Determine if management should adopt Fish Dogs as a second line, or if it should become the primary flagship product? You must demonstrate your answer with computations employing the contribution margin ratio concept. 10. After introducing the Fish Dog product, it appears to have a limited market appeal. Given that can now only be able to sell 100,000 units, what is the profit or loss on Fish Dogs at this level of sales? So what happened