this is the only information given

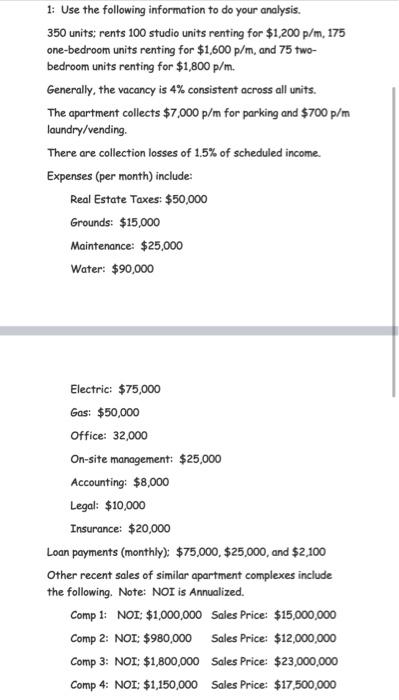

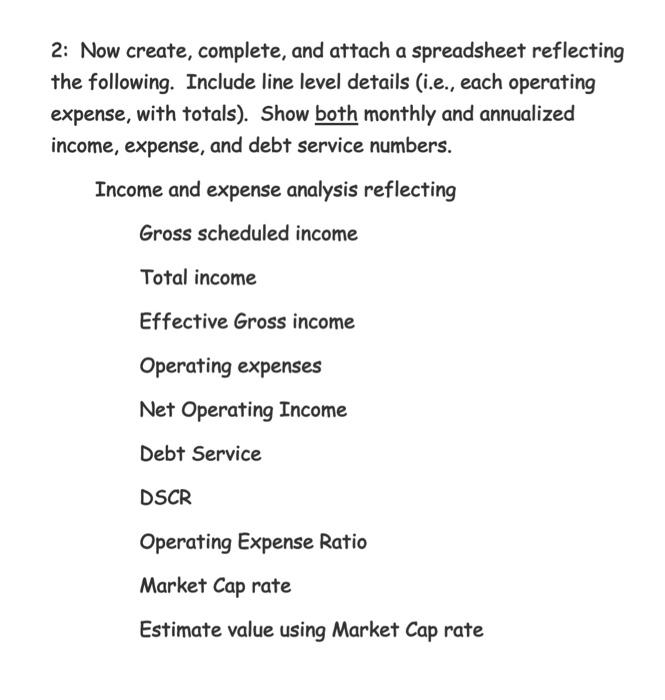

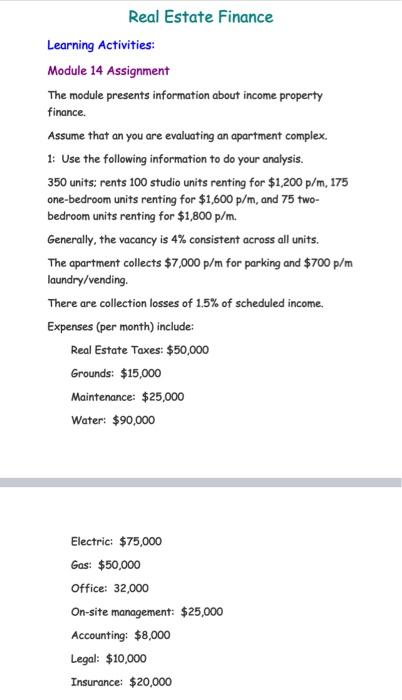

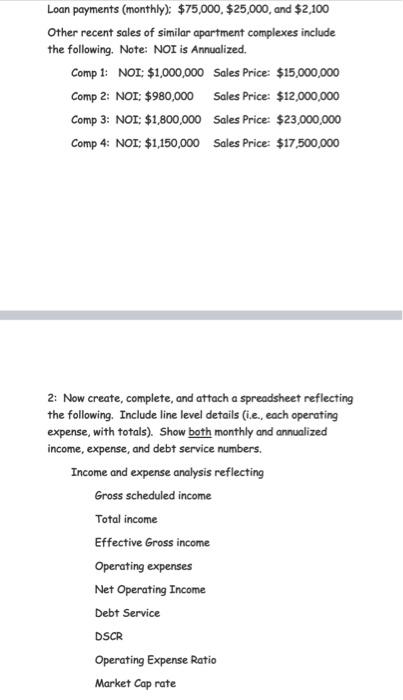

1: Use the following information to do your analysis. 350 units; rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI: $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI: $1,150,000 Sales Price: $17,500,000 2: Now create, complete, and attach a spreadsheet reflecting the following. Include line level details (i.e., each operating expense, with totals). Show both monthly and annualized income, expense, and debt service numbers. Income and expense analysis reflecting Gross scheduled income Total income Effective Gross income Operating expenses Net Operating Income Debt Service DSCR Operating Expense Ratio Market Cap rate Estimate value using Market Cap rate Real Estate Finance Learning Activities: Module 14 Assignment The module presents information about income property finance. Assume that an you are evaluating an apartment complex. 1: Use the following information to do your analysis. 350 units: rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI; $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI; $1,150,000 Sales Price: $17,500,000 2: Now create, complete, and attach a spreadsheet reflecting the following. Include line level details (i.e., each operating expense, with totals). Show both monthly and annualized income, expense, and debt service numbers. Income and expense analysis reflecting Gross scheduled income Total income Effective Gross income Operating expenses Net Operating Income Debt Service DSCR Operating Expense Ratio Market Cap rate 1: Use the following information to do your analysis. 350 units; rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI: $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI: $1,150,000 Sales Price: $17,500,000 2: Now create, complete, and attach a spreadsheet reflecting the following. Include line level details (i.e., each operating expense, with totals). Show both monthly and annualized income, expense, and debt service numbers. Income and expense analysis reflecting Gross scheduled income Total income Effective Gross income Operating expenses Net Operating Income Debt Service DSCR Operating Expense Ratio Market Cap rate Estimate value using Market Cap rate Real Estate Finance Learning Activities: Module 14 Assignment The module presents information about income property finance. Assume that an you are evaluating an apartment complex. 1: Use the following information to do your analysis. 350 units: rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI; $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI; $1,150,000 Sales Price: $17,500,000 2: Now create, complete, and attach a spreadsheet reflecting the following. Include line level details (i.e., each operating expense, with totals). Show both monthly and annualized income, expense, and debt service numbers. Income and expense analysis reflecting Gross scheduled income Total income Effective Gross income Operating expenses Net Operating Income Debt Service DSCR Operating Expense Ratio Market Cap rate