Answered step by step

Verified Expert Solution

Question

1 Approved Answer

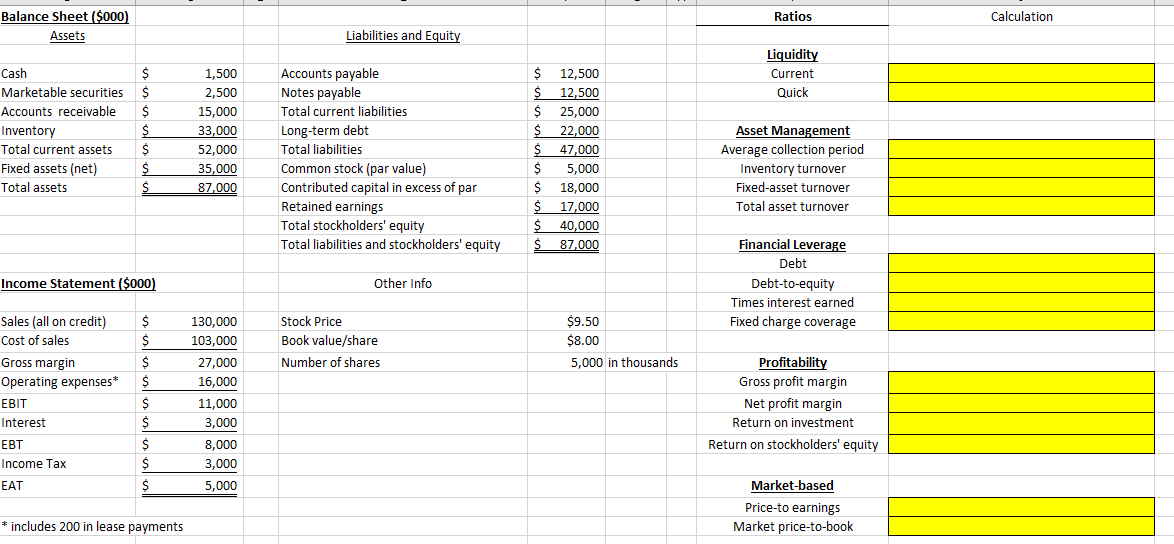

Module 2 Assignment i: FIN-751-AP1 Instructions: In your text, go through Chapter 3 ST1 through ST5 (pages 104-105). Use the Excel file M2_Problem_Set_Excel Download M2_Problem_Set_Excelthat

Module 2 Assignment i: FIN-751-AP1

Instructions:

- In your text, go through Chapter 3 ST1 through ST5 (pages 104-105). Use the Excel file M2_Problem_Set_Excel Download M2_Problem_Set_Excelthat I provide and the formula sheet in the book to make the calculations. Be sure to use cell references. (50 pts)

- See Assigned Readings Related to Excel Basics for Problem Set for tutorials on entering formulas in Excel.

- Note: You can skip ST3. part D if you want with no penalty.

- Write one sentence (in the Excel File) next to each ratio you calculated in Question 1 describing what that number means in words. (50 pts)

- For example, if you calculate the average collection period as 40, you should write something like on average, it takes 40 days for Freemont Corporation to collect its accounts receivable. -Submit your modified Excel file

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Balance Sheet (\$\$000) & & & & & & Ratios & Calculation \\ \hline \multirow[t]{2}{*}{ Assets } & & & Liabilities and Equity & & & & \\ \hline & & & & & & Liquidity & \\ \hline Cash & & 1,500 & Accounts payable & $12,500 & & Current & \\ \hline Marketable securities & $ & 2,500 & Notes payable & $12,500 & & Quick & \\ \hline Accounts receivable & & 15,000 & Total current liabilities & $25,000 & & & \\ \hline Inventory & s & 33,000 & Long-term debt & $22,000 & & Asset Management & \\ \hline Total current assets & $ & 52,000 & Total liabilities & $47,000 & & Average collection period & \\ \hline Fixed assets (net) & $ & 35,000 & Common stock (par value) & & & Inventory turnover & \\ \hline \multirow[t]{5}{*}{ Total assets } & s & 87,000 & Contributed capital in excess of par & $18,000 & & Fixed-asset turnover & \\ \hline & & & Retained earnings & $17,000 & & Total asset turnover & \\ \hline & & & Total stockholders' equity & & & & \\ \hline & & & Total liabilities and stockholders' equity & \begin{tabular}{l} 87,000 \\ S8 \end{tabular} & & Financial Leverage & \\ \hline & & & & & & Debt & \\ \hline \multicolumn{3}{|c|}{ Income Statement (\$\$000) } & Other Info & & & Debt-to-equity & \\ \hline & & & & & & Times interest earned & \\ \hline Sales (all on credit) & s & 130,000 & Stock Price & $9.50 & & Fixed charge coverage & \\ \hline Cost of sales & $ & 103,000 & Book value/share & $8.00 & & & \\ \hline Gross margin & s & 27,000 & Number of shares & 5,000 & in thousands & Profitability & \\ \hline Operating expenses* & $ & 16,000 & & & & Gross profit margin & \\ \hline EBIT & s & 11,000 & & & & Net profit margin & \\ \hline Interest & $ & 3,000 & & & & Return on investment & \\ \hline EBT & s & 8,000 & & & & Return on stockholders' equity & \\ \hline Income Tax & $ & 3,000 & & & & & \\ \hline \multirow[t]{2}{*}{ EAT } & s. & 5,000 & & & & Market-based & \\ \hline & & & & & & Price-to earnings & \\ \hline \multicolumn{3}{|c|}{ includes 200 in lease payments } & & & & Market price-to-book & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started