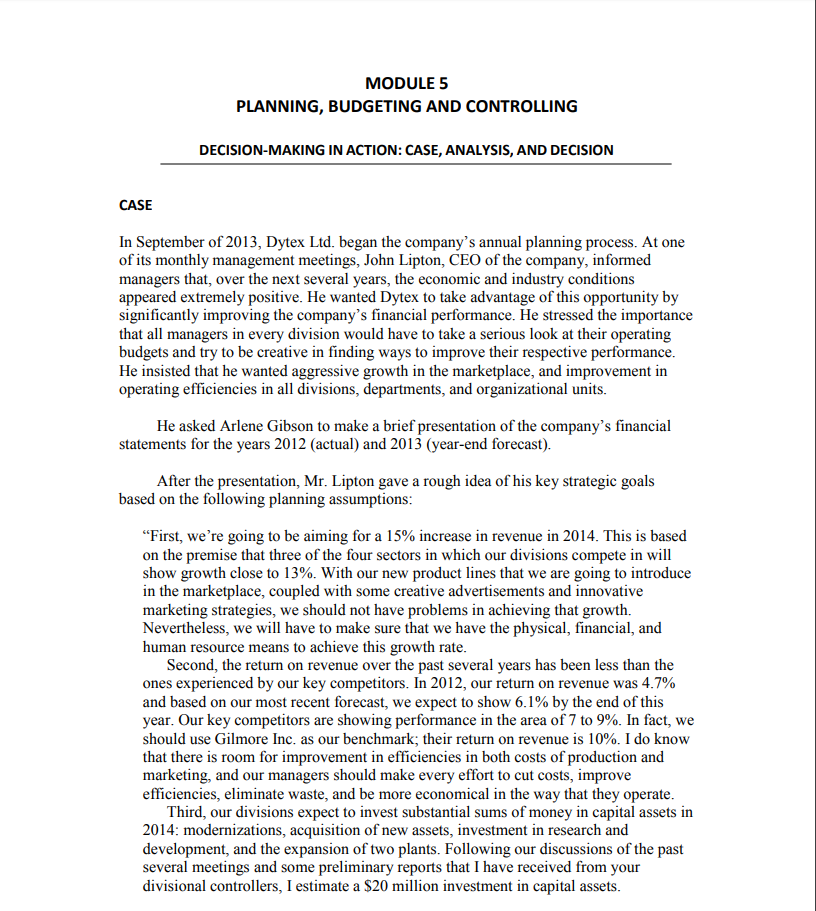

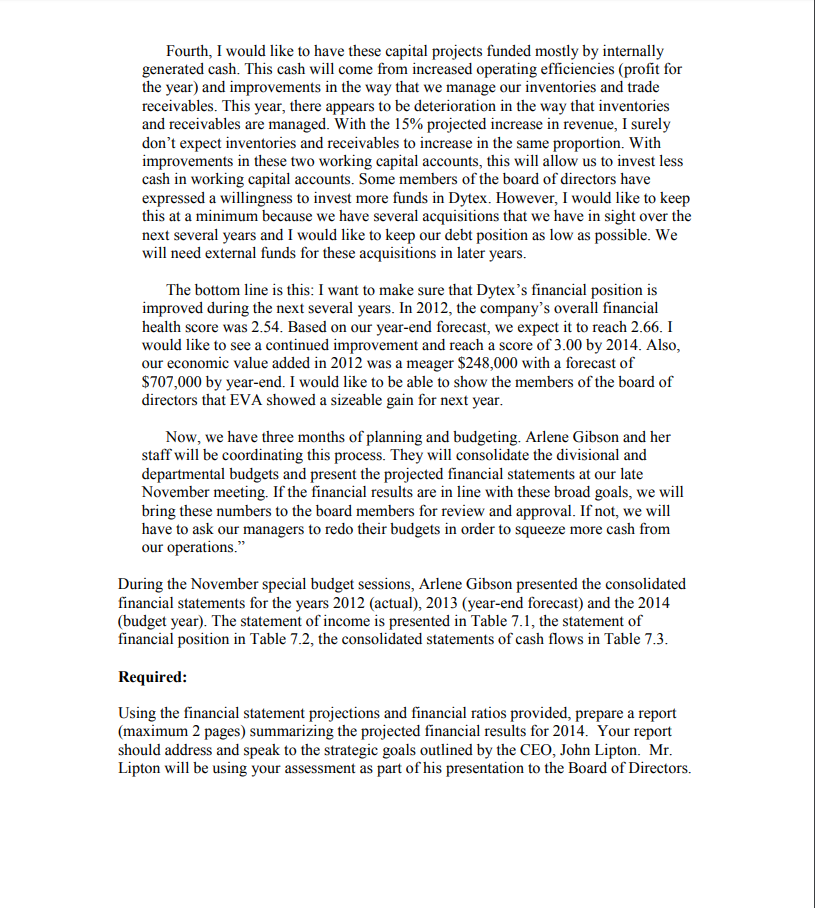

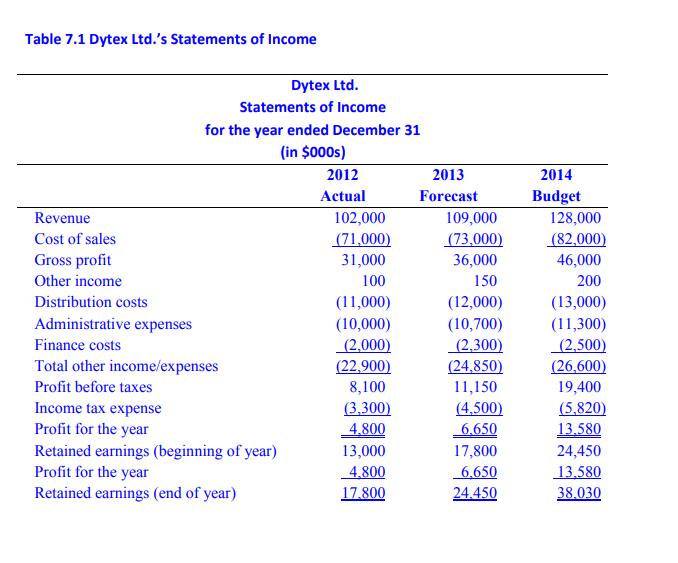

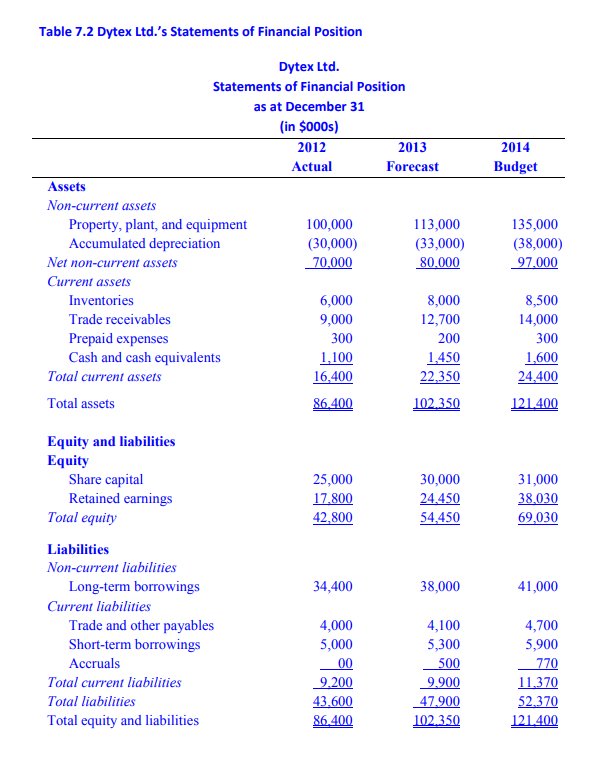

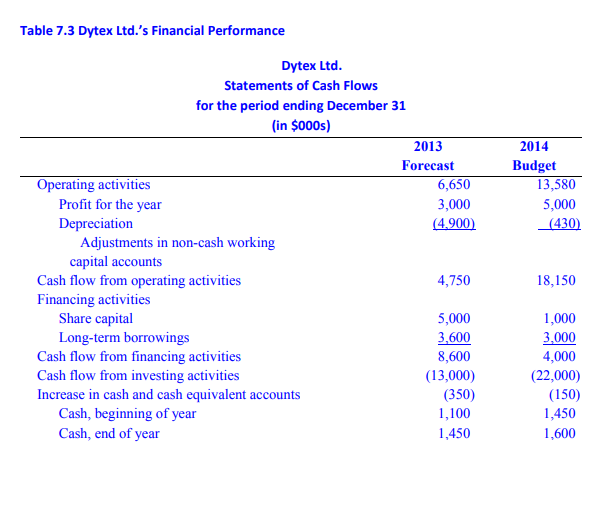

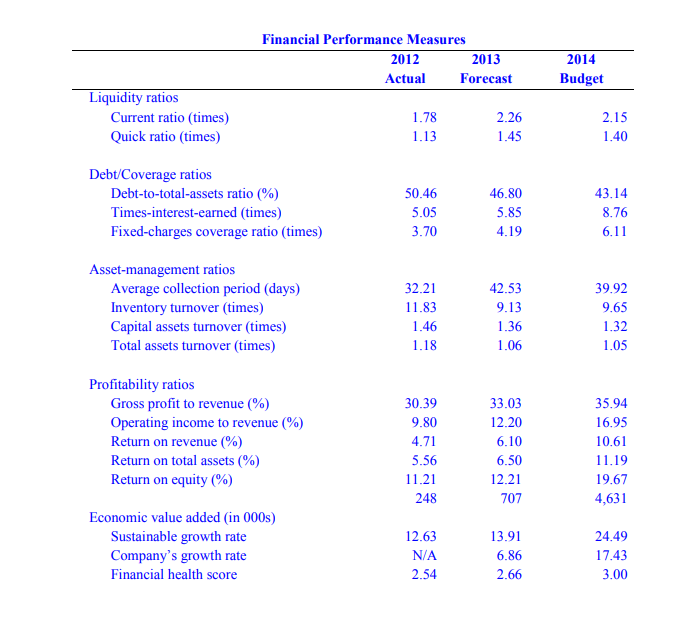

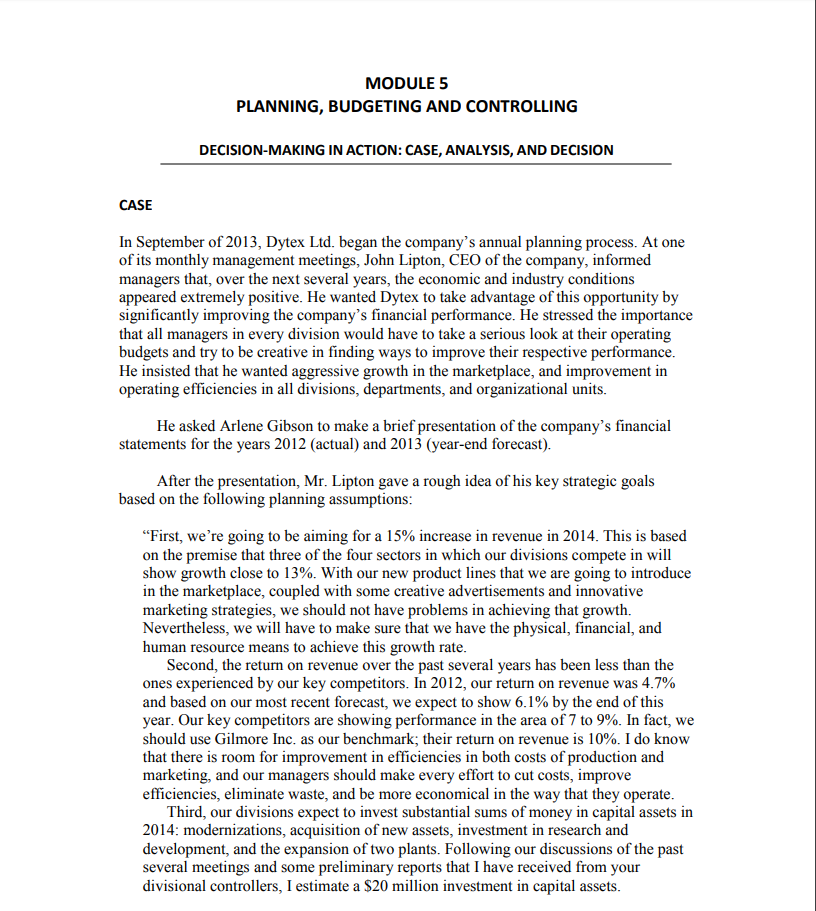

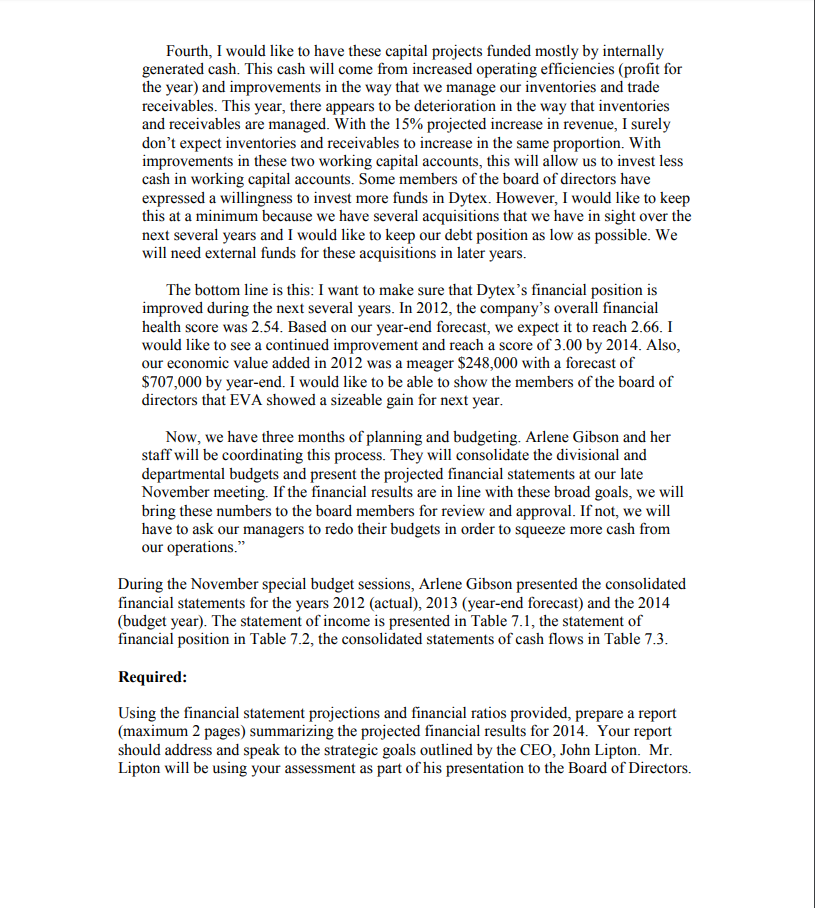

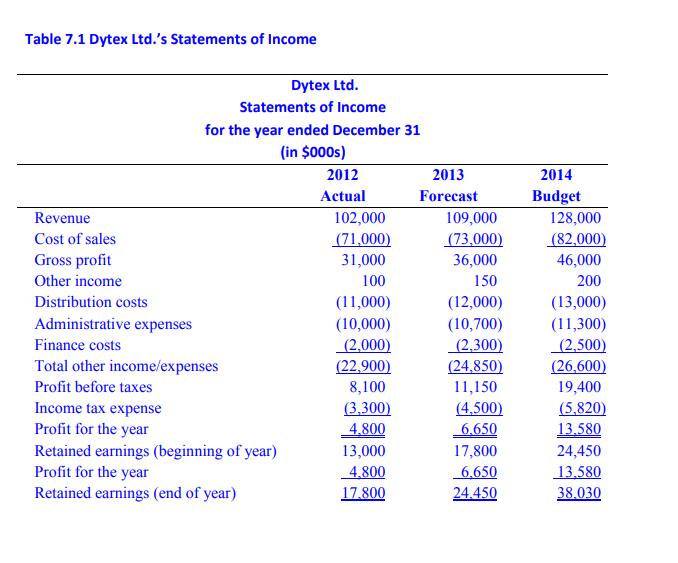

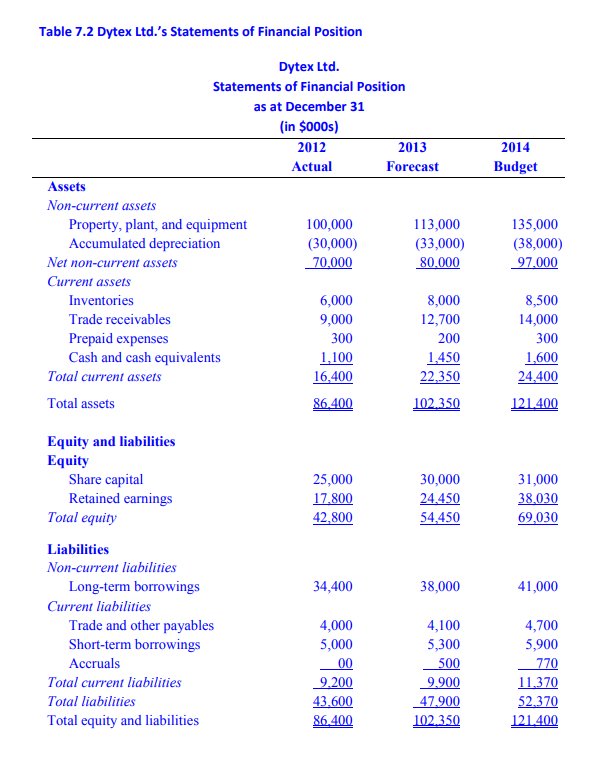

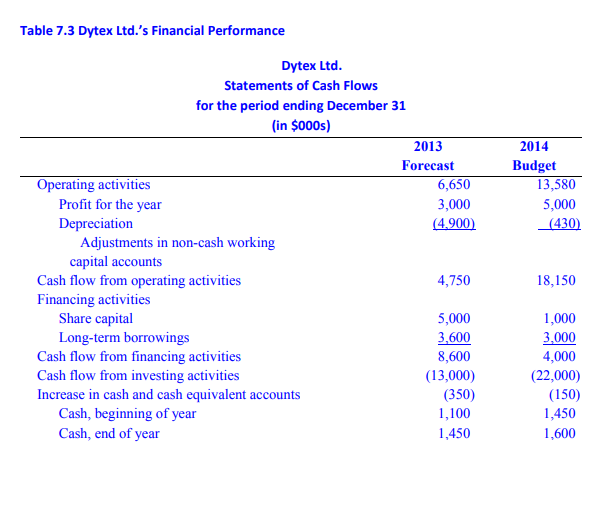

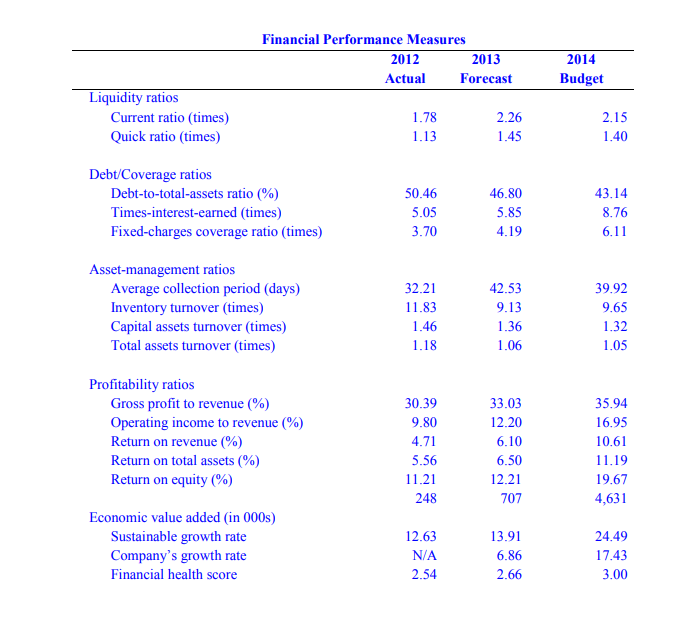

MODULE 5 PLANNING, BUDGETING AND CONTROLLING DECISION-MAKING IN ACTION: CASE, ANALYSIS, AND DECISION CASE In September of 2013, Dytex Ltd. began the company's annual planning process. At one of its monthly management meetings, John Lipton, CEO of the company, informed managers that, over the next several years, the economic and industry conditions appeared extremely positive. He wanted Dytex to take advantage of this opportunity by significantly improving the company's financial performance. He stressed the importance that all managers in every division would have to take a serious look at their operating budgets and try to be creative in finding ways to improve their respective performance. He insisted that he wanted aggressive growth in the marketplace, and improvement in operating efficiencies in all divisions, departments, and organizational units. He asked Arlene Gibson to make a brief presentation of the company's financial statements for the years 2012 (actual) and 2013 (year-end forecast). After the presentation, Mr. Lipton gave a rough idea of his key strategic goals based on the following planning assumptions: "First, we're going to be aiming for a 15% increase in revenue in 2014. This is based on the premise that three of the four sectors in which our divisions compete in will show growth close to 13%. With our new product lines that we are going to introduce in the marketplace, coupled with some creative advertisements and innovative marketing strategies, we should not have problems in achieving that growth. Nevertheless, we will have to make sure that we have the physical, financial, and human resource means to achieve this growth rate. Second, the return on revenue over the past several years has been less than the ones experienced by our key competitors. In 2012, our return on revenue was 4.7% and based on our most recent forecast, we expect to show 6.1% by the end of this year. Our key competitors are showing performance in the area of 7 to 9%. In fact, we should use Gilmore Inc. as our benchmark; their return on revenue is 10%. I do know that there is room for improvement in efficiencies in both costs of production and marketing, and our managers should make every effort to cut costs, improve efficiencies, eliminate waste, and be more economical in the way that they operate. Third, our divisions expect to invest substantial sums of money in capital assets in 2014: modernizations, acquisition of new assets, investment in research and development, and the expansion of two plants. Following our discussions of the past several meetings and some preliminary reports that I have received from your divisional controllers, I estimate a $20 million investment in capital assets. Fourth, I would like to have these capital projects funded mostly by internally generated cash. This cash will come from increased operating efficiencies (profit for the year) and improvements in the way that we manage our inventories and trade receivables. This year, there appears to be deterioration in the way that inventories and receivables are managed. With the 15% projected increase in revenue, I surely don't expect inventories and receivables to increase in the same proportion. With improvements in these two working capital accounts, this will allow us to invest less cash in working capital accounts. Some members of the board of directors have expressed a willingness to invest more funds in Dytex. However, I would like to keep this at a minimum because we have several acquisitions that we have in sight over the next several years and I would like to keep our debt position as low as possible. We will need external funds for these acquisitions in later years. The bottom line is this: I want to make sure that Dytex's financial position is improved during the next several years. In 2012, the company's overall financial health score was 2.54. Based on our year-end forecast, we expect it to reach 2.66. I would like to see a continued improvement and reach a score of 3.00 by 2014. Also, our economic value added in 2012 was a meager $248,000 with a forecast of $707,000 by year-end. I would like to be able to show the members of the board of directors that EVA showed a sizeable gain for next year. Now, we have three months of planning and budgeting. Arlene Gibson and her staff will be coordinating this process. They will consolidate the divisional and departmental budgets and present the projected financial statements at our late November meeting. If the financial results are in line with these broad goals, we will bring these numbers to the board members for review and approval. If not, we will have to ask our managers to redo their budgets in order to squeeze more cash from our operations." During the November special budget sessions, Arlene Gibson presented the consolidated financial statements for the years 2012 (actual), 2013 (year-end forecast) and the 2014 (budget year). The statement of income is presented in Table 7.1, the statement of financial position in Table 7.2, the consolidated statements of cash flows in Table 7.3. Required: Using the financial statement projections and financial ratios provided, prepare a report (maximum 2 pages) summarizing the projected financial results for 2014. Your report should address and speak to the strategic goals outlined by the CEO, John Lipton. Mr. Lipton will be using your assessment as part of his presentation to the Board of Directors. Table 7.1 Dytex Ltd.'s Statements of Income Dytex Ltd. Statements of Income for the year ended December 31 (in $000s) 2012 2013 Actual Forecast Revenue 102,000 109,000 Cost of sales (71,000) (73,000) Gross profit 31,000 36,000 Other income 100 150 Distribution costs (11,000) (12,000) Administrative expenses (10,000) (10,700) Finance costs (2,000) (2,300) Total other income/expenses (22,900) (24,850) Profit before taxes 8,100 11,150 Income tax expense (3,300) (4,500) Profit for the year 4.800 6.650 Retained earnings (beginning of year) 13,000 17,800 Profit for the year 4.800 6,650 Retained earnings (end of year) 17.800 24.450 2014 Budget 128,000 (82,000) 46,000 200 (13,000) (11,300) (2,500) (26,600) 19,400 (5,820) 13.580 24,450 | 13.580 38.030 Table 7.2 Dytex Ltd.'s Statements of Financial Position 2014 Budget Dytex Ltd. Statements of Financial Position as at December 31 (in $000s) 2012 2013 Actual Forecast Assets Non-current assets Property, plant, and equipment 100,000 113,000 Accumulated depreciation (30,000) (33,000) Net non-current assets 70,000 80,000 Current assets Inventories 6,000 8,000 Trade receivables 9,000 12,700 Prepaid expenses 300 200 Cash and cash equivalents 1,100 1,450 Total current assets 16,400 22,350 Total assets 86.400 102.350 135,000 (38,000) 97,000 8,500 14,000 300 1,600 24,400 121.400 25,000 17.800 42,800 30,000 24.450 54.450 31,000 38.030 69,030 Equity and liabilities Equity Share capital Retained earnings Total equity Liabilities Non-current liabilities Long-term borrowings Current liabilities Trade and other payables Short-term borrowings Accruals Total current liabilities Total liabilities Total equity and liabilities 34,400 38,000 41,000 4,100 5,300 500 4,000 5,000 00 9.200 43.600 86.400 9.900 47.900 102.350 4,700 5,900 770 11,370 52.370 121.400 Table 7.3 Dytex Ltd.'s Financial Performance 2014 Budget 13,580 5,000 (430) Dytex Ltd. Statements of Cash Flows for the period ending December 31 (in $000s) 2013 Forecast Operating activities 6,650 Profit for the year 3,000 Depreciation (4,900) Adjustments in non-cash working capital accounts Cash flow from operating activities 4,750 Financing activities Share capital 5,000 Long-term borrowings 3,600 Cash flow from financing activities 8,600 Cash flow from investing activities (13,000) Increase in cash and cash equivalent accounts (350) Cash, beginning of year 1,100 Cash, end of year 1,450 18,150 1,000 3,000 4,000 (22,000) (150) 1,450 1,600 Financial Performance Measures 2012 2013 Actual Forecast 2014 Budget Liquidity ratios Current ratio (times) Quick ratio (times) 1.78 1.13 2.26 1.45 2.15 1.40 Debt/Coverage ratios Debt-to-total-assets ratio (%) Times-interest-earned (times) Fixed-charges coverage ratio (times) 50.46 5.05 3.70 46.80 5.85 4.19 43.14 8.76 6.11 Asset-management ratios Average collection period (days) Inventory turnover (times) Capital assets turnover times) Total assets turnover times) 32.21 11.83 1.46 1.18 42.53 9.13 1.36 1.06 39.92 9.65 1.32 1.05 Profitability ratios Gross profit to revenue (%) Operating income to revenue (%) Return on revenue (%) Return on total assets (%) Return on equity (%) 30.39 9.80 4.71 5.56 11.21 248 33.03 12.20 6.10 6.50 12.21 707 35.94 16.95 10.61 11.19 19.67 4,631 Economic value added (in 000s) Sustainable growth rate Company's growth rate Financial health score 12.63 N/A 2.54 13.91 6.86 2.66 24.49 17.43 3.00