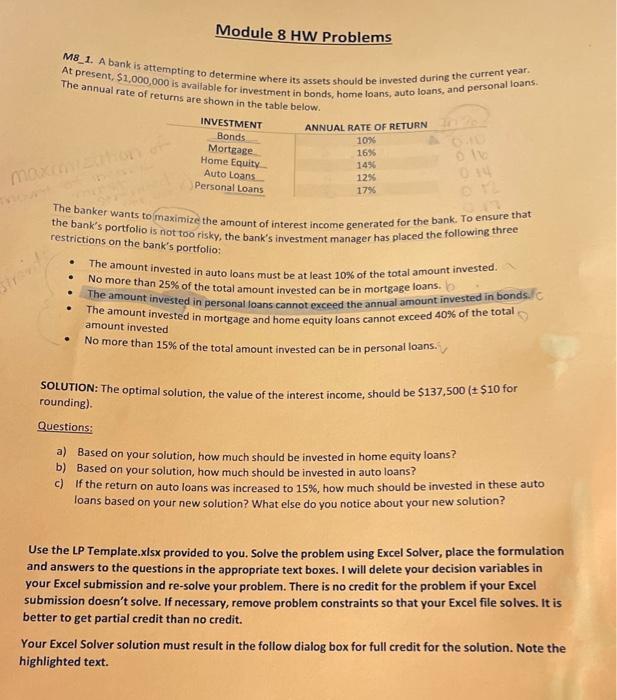

Module 8 HW Problems M8_1. A bank is attempting to determine where its assets should be invested during the current vear. At present, $1,000,000 is avallable for investment in bonds, home loans, auto loans, and personal loans. The annual rate of returns are shown in the table below. The banker wants to maximizes the amount of interest income generated for the bank. To ensure that the bank's portfolio is not too risky, the bank's investment manager has placed the following three restrictions on the bank's portfolio: - The amount invested in auto loans must be at least 10% of the total amount invested. - No more than 25% of the total amount invested can be in mortgage loans. - The amount invested in personal loans cannot exceed the annual amount invested in bonds. ic - The amount invested in mortgage and home equity loans cannot exceed 40% of the total rs amount invested - No more than 15% of the total amount invested can be in personal loans. SOLUTION: The optimal solution, the value of the interest income, should be $137,500($10 for rounding). Questions: a) Based on your solution, how much should be invested in home equity loans? b) Based on your solution, how much should be invested in auto loans? c) If the return on auto loans was increased to 15%, how much should be invested in these auto loans based on your new solution? What else do you notice about your new solution? Use the LP Template.xlsx provided to you. Solve the problem using Excel Solver, place the formulation and answers to the questions in the appropriate text boxes. I will delete your decision variables in your Excel submission and re-solve your problem. There is no credit for the problem if your Excel submission doesn't solve. If necessary, remove problem constraints so that your Excel file solves. It is better to get partial credit than no credit. Your Excel Solver solution must result in the follow dialog box for full credit for the solution. Note the highlighted text. Module 8 HW Problems M8_1. A bank is attempting to determine where its assets should be invested during the current vear. At present, $1,000,000 is avallable for investment in bonds, home loans, auto loans, and personal loans. The annual rate of returns are shown in the table below. The banker wants to maximizes the amount of interest income generated for the bank. To ensure that the bank's portfolio is not too risky, the bank's investment manager has placed the following three restrictions on the bank's portfolio: - The amount invested in auto loans must be at least 10% of the total amount invested. - No more than 25% of the total amount invested can be in mortgage loans. - The amount invested in personal loans cannot exceed the annual amount invested in bonds. ic - The amount invested in mortgage and home equity loans cannot exceed 40% of the total rs amount invested - No more than 15% of the total amount invested can be in personal loans. SOLUTION: The optimal solution, the value of the interest income, should be $137,500($10 for rounding). Questions: a) Based on your solution, how much should be invested in home equity loans? b) Based on your solution, how much should be invested in auto loans? c) If the return on auto loans was increased to 15%, how much should be invested in these auto loans based on your new solution? What else do you notice about your new solution? Use the LP Template.xlsx provided to you. Solve the problem using Excel Solver, place the formulation and answers to the questions in the appropriate text boxes. I will delete your decision variables in your Excel submission and re-solve your problem. There is no credit for the problem if your Excel submission doesn't solve. If necessary, remove problem constraints so that your Excel file solves. It is better to get partial credit than no credit. Your Excel Solver solution must result in the follow dialog box for full credit for the solution. Note the highlighted text