Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MODULE: ACCOUNTING 1 TOTAL MARKS: 50 QUESTION ONE [12] 1.1 Define an asset in terms of the International Financial Reporting Standards. (2) 1.2 Assess, with

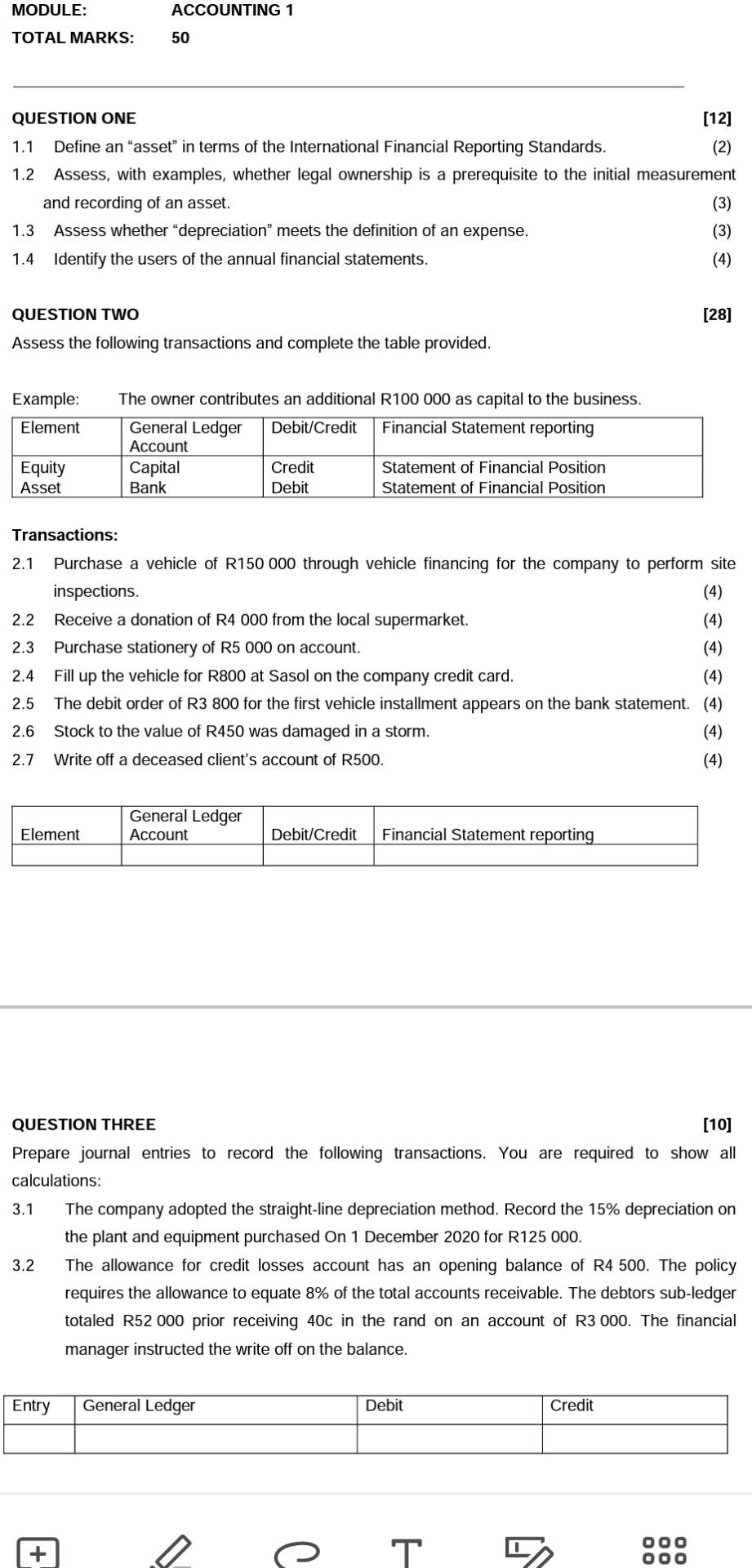

MODULE: ACCOUNTING 1 TOTAL MARKS: 50 QUESTION ONE [12] 1.1 Define an "asset" in terms of the International Financial Reporting Standards. (2) 1.2 Assess, with examples, whether legal ownership is a prerequisite to the initial measurement and recording of an asset. 1.3 Assess whether "depreciation" meets the definition of an expense. (3) 1.4 Identify the users of the annual financial statements. QUESTION TWO [28] Assess the following transactions and complete the table provided. Example: The owner contributes an additional R100 000 as capital to the business. Transactions: 2.1 Purchase a vehicle of R150 000 through vehicle financing for the company to perform site inspections. (4) 2.2 Receive a donation of R4 000 from the local supermarket. (4) 2.3 Purchase stationery of R5 000 on account. (4) 2.4 Fill up the vehicle for R800 at Sasol on the company credit card. (4) 2.5 The debit order of R3 800 for the first vehicle installment appears on the bank statement. (4) 2.6 Stock to the value of R450 was damaged in a storm. (4) 2.7 Write off a deceased client's account of R500. (4) QUESTION THREE [10] Prepare journal entries to record the following transactions. You are required to show all calculations: 3.1 The company adopted the straight-line depreciation method. Record the 15% depreciation on the plant and equipment purchased On 1 December 2020 for R125 000. 3.2 The allowance for credit losses account has an opening balance of R4 500. The policy requires the allowance to equate 8% of the total accounts receivable. The debtors sub-ledger totaled R52 000 prior receiving 40c in the rand on an account of R3 000 . The financial manager instructed the write off on the balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started