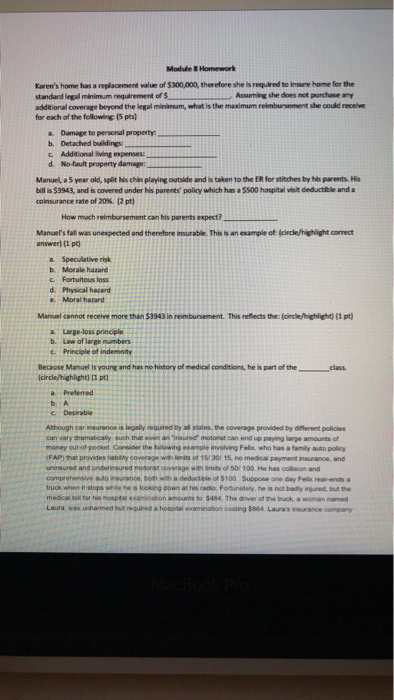

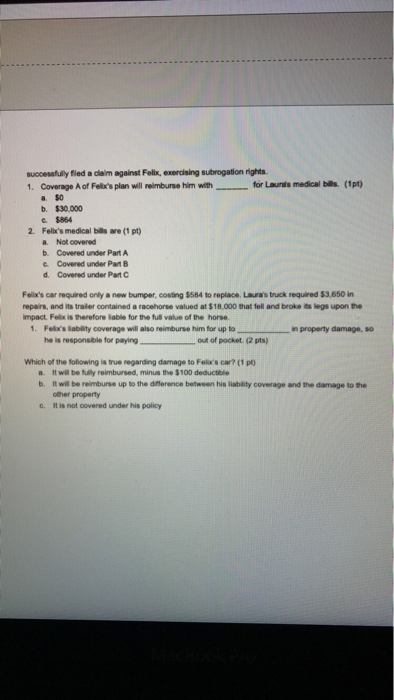

Module & Homeworl Karen's home has a replacement value of $300,000, therefore she is required to insure home for the standard legall minimum requirement ofAssuming she does not purchase any additional coverage beyond the legal minimum, what is the maximum reimbursement she could recelve for each of the following (5 pts) a Damage to personal property b. Detached buildings: d. No-fault property damage Manuel, a 5 year old, split his chin playing outside and is taken to the ER for stitches by his parents. His bill is $3943, and is covered under his parents policy which has a $500 haspital visit deductible and a coinsurance rate of 20% (2pt) How mach reimbursement can his parents expect? Manuet's fal was unexpected and therefore insurable. This is an example of: (circle/highlight comect answerl (2 pt) b. Morale hazard c Fortultous loss d. Physical hazard e Moral harard Manuel cannot receive more than $3943 in reimbursement. This reflects the: (dircle/highlight)(1 pt) Large loss principle b Law of large numbers c Principle of indemnity Because Manuel is young and has no history of medical conditions, he is part of the circle/highlight) [1 pt class a Prefered c Desirable Athough car insurance is legaly requred by all states, the coverage provided by different policles can vary dramatcaty such that even an nsured motornist can end up paying large amounts of money out-of-pocket Consider the Silowing examole involving Felix, who has a family auto policy FAP) that provides tabiy coverage with levits of 15/ 30 15, no medica payment insurance, and uninsured and underinsured motonst coverage wh amits of 50 100 He has colision and comprehensive ato insurance, both with a deductible of $100. Suppose one day Felix rear-endsa truck wihee it stops while he s locking opn at hs radio Fortunately, he is not bady injured, but the medical bil for his hospital exsinaton amounts to $484. The driver of the truck, a woman named Laura was unharmed but required a hospital examination costing $864 Laura's insurance company suocesafully filed a claim against Follx, exercising subrogation rights 1. Coverage AOf Fela's plan will reimburse him with for Launds medical bills. (1pt) a. $0 b. $30,000 .$864 2. Felx's medical bills are (1 pt) Not ered b. Covered under Part A c. Covered under Part B d. Covered under PartC Felx's car required only a new bumper, costing $584 to replace. Laura's truck required $3,650 in repairs, and its traler contained a racehorse valued at $18,000 that fell and broke its legs upon the impact. Fellx is therefore liable for the full value of the horse. 1. Felix's Sability coverage will also reimburse him for up to in property damage, so he is responsible for paying out of pocket (2 pts) Which of the tolowing is true regarding darnage to Felix's car? (1 pt) a. It will be fully reimbursed, minus the $100 deductiole b. It will be reimburse up to the diflerence between his liability coverage and the damage to the other property it is not covered 'nder his policy c. Module & Homeworl Karen's home has a replacement value of $300,000, therefore she is required to insure home for the standard legall minimum requirement ofAssuming she does not purchase any additional coverage beyond the legal minimum, what is the maximum reimbursement she could recelve for each of the following (5 pts) a Damage to personal property b. Detached buildings: d. No-fault property damage Manuel, a 5 year old, split his chin playing outside and is taken to the ER for stitches by his parents. His bill is $3943, and is covered under his parents policy which has a $500 haspital visit deductible and a coinsurance rate of 20% (2pt) How mach reimbursement can his parents expect? Manuet's fal was unexpected and therefore insurable. This is an example of: (circle/highlight comect answerl (2 pt) b. Morale hazard c Fortultous loss d. Physical hazard e Moral harard Manuel cannot receive more than $3943 in reimbursement. This reflects the: (dircle/highlight)(1 pt) Large loss principle b Law of large numbers c Principle of indemnity Because Manuel is young and has no history of medical conditions, he is part of the circle/highlight) [1 pt class a Prefered c Desirable Athough car insurance is legaly requred by all states, the coverage provided by different policles can vary dramatcaty such that even an nsured motornist can end up paying large amounts of money out-of-pocket Consider the Silowing examole involving Felix, who has a family auto policy FAP) that provides tabiy coverage with levits of 15/ 30 15, no medica payment insurance, and uninsured and underinsured motonst coverage wh amits of 50 100 He has colision and comprehensive ato insurance, both with a deductible of $100. Suppose one day Felix rear-endsa truck wihee it stops while he s locking opn at hs radio Fortunately, he is not bady injured, but the medical bil for his hospital exsinaton amounts to $484. The driver of the truck, a woman named Laura was unharmed but required a hospital examination costing $864 Laura's insurance company suocesafully filed a claim against Follx, exercising subrogation rights 1. Coverage AOf Fela's plan will reimburse him with for Launds medical bills. (1pt) a. $0 b. $30,000 .$864 2. Felx's medical bills are (1 pt) Not ered b. Covered under Part A c. Covered under Part B d. Covered under PartC Felx's car required only a new bumper, costing $584 to replace. Laura's truck required $3,650 in repairs, and its traler contained a racehorse valued at $18,000 that fell and broke its legs upon the impact. Fellx is therefore liable for the full value of the horse. 1. Felix's Sability coverage will also reimburse him for up to in property damage, so he is responsible for paying out of pocket (2 pts) Which of the tolowing is true regarding darnage to Felix's car? (1 pt) a. It will be fully reimbursed, minus the $100 deductiole b. It will be reimburse up to the diflerence between his liability coverage and the damage to the other property it is not covered 'nder his policy c