Module Mortgages

Consolidate your understanding of the weighted average cost of capital

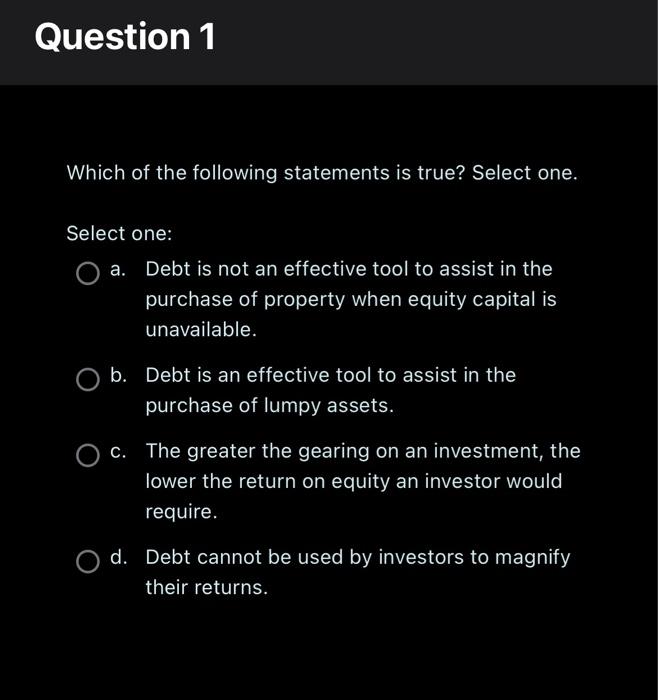

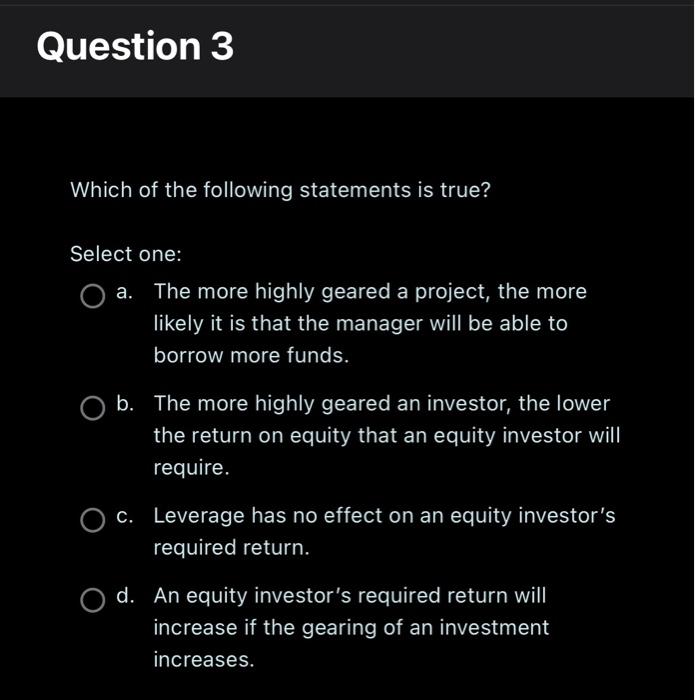

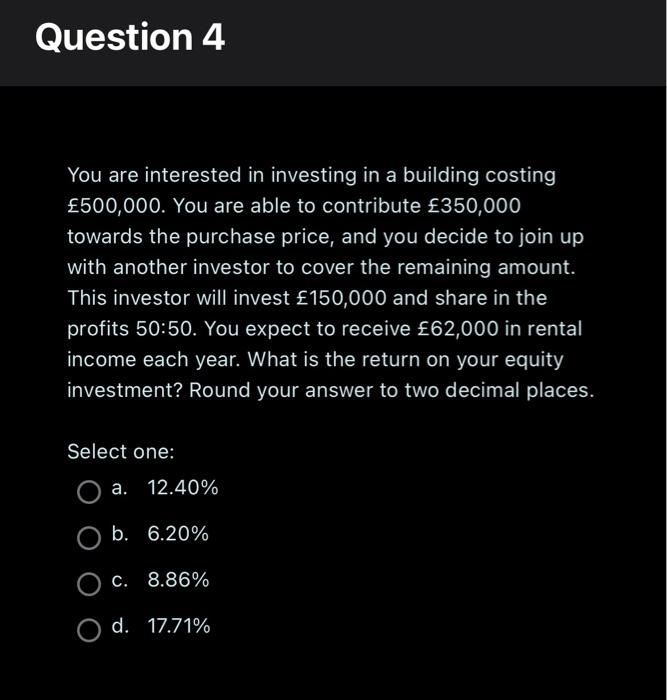

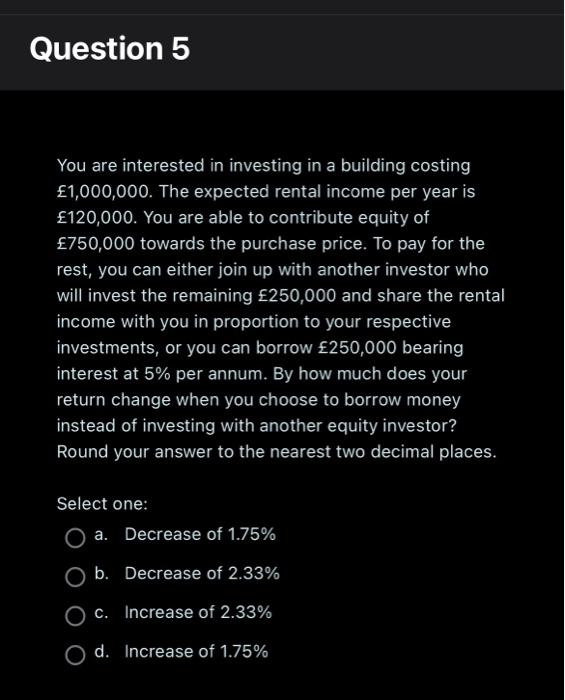

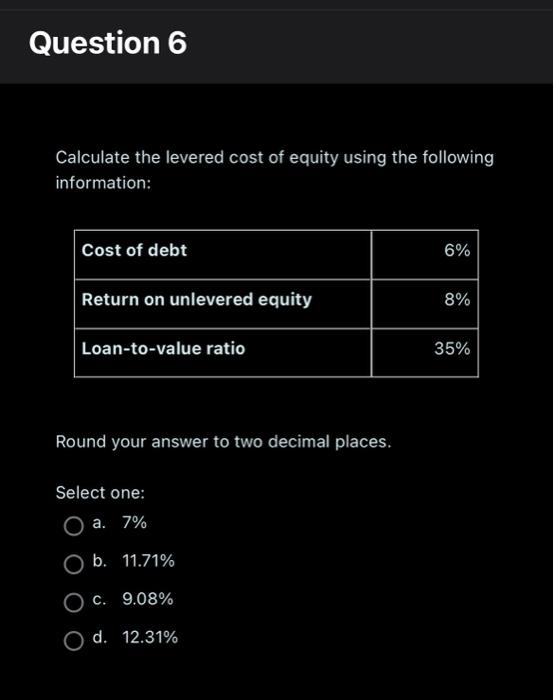

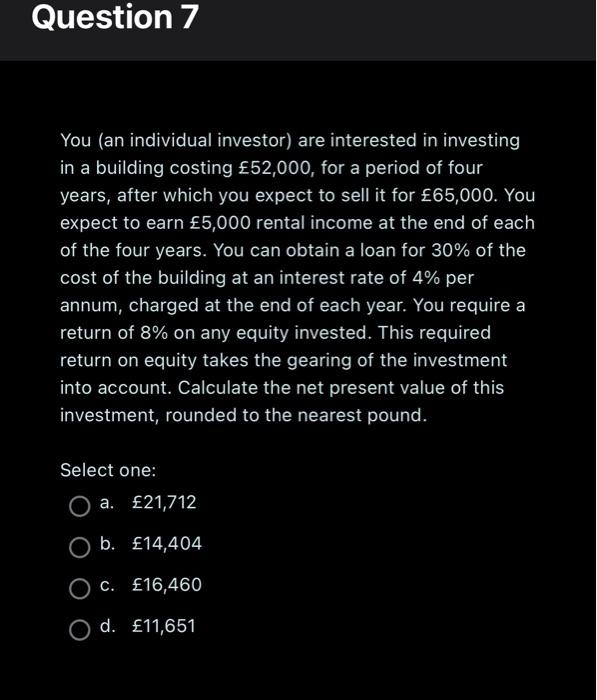

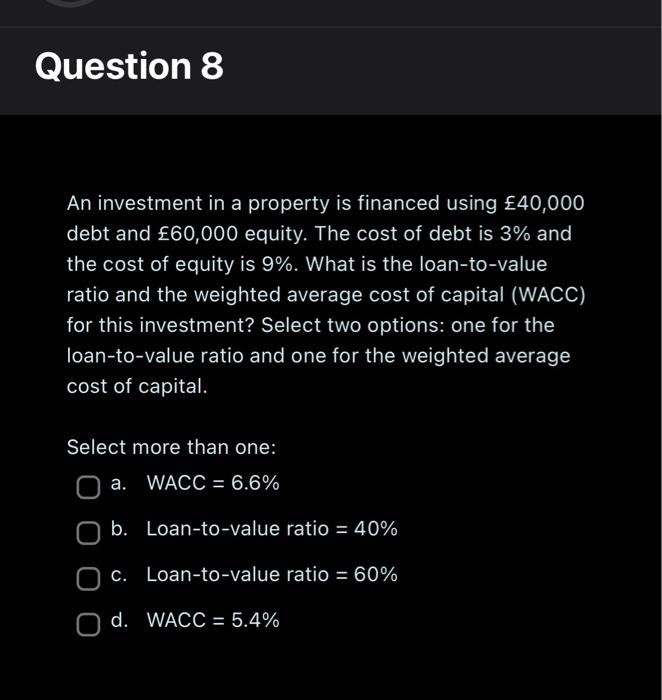

6.4 Practice quiz: Consolidate your understanding of the weighted average cost of capital Learning outcomes: LO1: Recognise the usefulness of a mortgage as a source of capital and a multiplier of returns. LO2: Identify the components that comprise the weighted average cost of capital. LO3: Apply the concept of the weighted average cost of capital. This practice quiz contains several questions. Your answers are immediately reviewed upon submission to give you an indication of where you are going right and wrong. As noted in the Course Handbook, practice quizzes do not count towards your completion status for this course. However, you are encouraged to re-attempt this quiz as many times as needed to solidify your content knowledge. Which of the following statements is true? Select one. Select one: a. Debt is not an effective tool to assist in the purchase of property when equity capital is unavailable. b. Debt is an effective tool to assist in the purchase of lumpy assets. c. The greater the gearing on an investment, the lower the return on equity an investor would require. d. Debt cannot be used by investors to magnify their returns. Question 2 The cost of equity is usually lower than the cost of debt. Select one: True False Which of the following statements is true? Select one: a. The more highly geared a project, the more likely it is that the manager will be able to borrow more funds. b. The more highly geared an investor, the lower the return on equity that an equity investor will require. c. Leverage has no effect on an equity investor's required return. d. An equity investor's required return will increase if the gearing of an investment increases. You are interested in investing in a building costing 500,000. You are able to contribute 350,000 towards the purchase price, and you decide to join up with another investor to cover the remaining amount. This investor will invest 150,000 and share in the profits 50:50. You expect to receive 62,000 in rental income each year. What is the return on your equity investment? Round your answer to two decimal places. Select one: a. 12.40% b. 6.20% c. 8.86% d. 17.71% You are interested in investing in a building costing 1,000,000. The expected rental income per year is 120,000. You are able to contribute equity of 750,000 towards the purchase price. To pay for the rest, you can either join up with another investor who will invest the remaining 250,000 and share the rental income with you in proportion to your respective investments, or you can borrow 250,000 bearing interest at 5% per annum. By how much does your return change when you choose to borrow money instead of investing with another equity investor? Round your answer to the nearest two decimal places. Select one: a. Decrease of 1.75% b. Decrease of 2.33% c. Increase of 2.33% d. Increase of 1.75% Calculate the levered cost of equity using the following information: Round your answer to two decimal places. Select one: a. 7% b. 11.71% c. 9.08% d. 12.31% You (an individual investor) are interested in investing in a building costing 52,000, for a period of four years, after which you expect to sell it for 65,000. You expect to earn 5,000 rental income at the end of each of the four years. You can obtain a loan for 30% of the cost of the building at an interest rate of 4% per annum, charged at the end of each year. You require a return of 8% on any equity invested. This required return on equity takes the gearing of the investment into account. Calculate the net present value of this investment, rounded to the nearest pound. Select one: a. 21,712 b. 14,404 c. 16,460 d. 11,651 An investment in a property is financed using 40,000 debt and 60,000 equity. The cost of debt is 3% and the cost of equity is 9%. What is the loan-to-value ratio and the weighted average cost of capital (WACC) for this investment? Select two options: one for the loan-to-value ratio and one for the weighted average cost of capital. Select more than one: a. WACC =6.6% b. Loan-to-value ratio =40% c. Loan-to-value ratio =60% d. WACC =5.4%