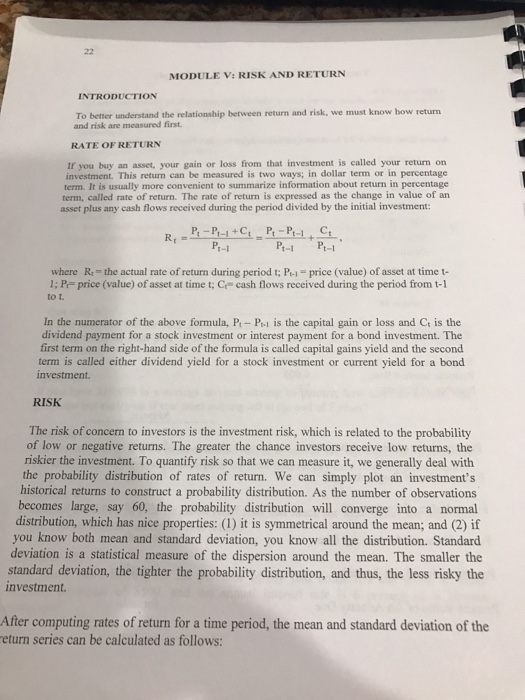

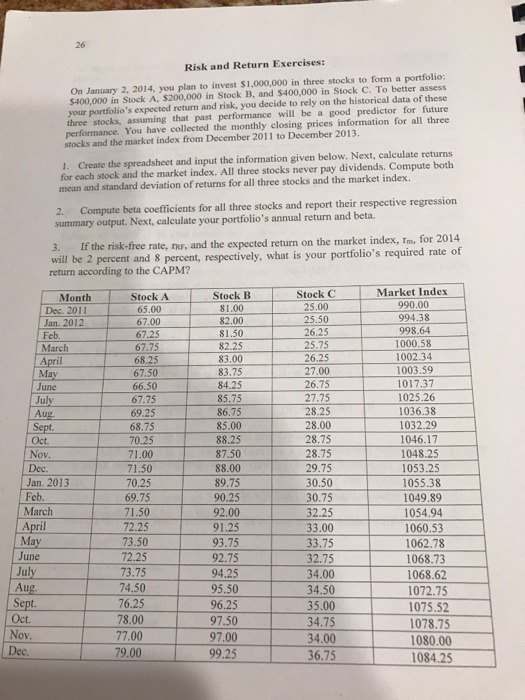

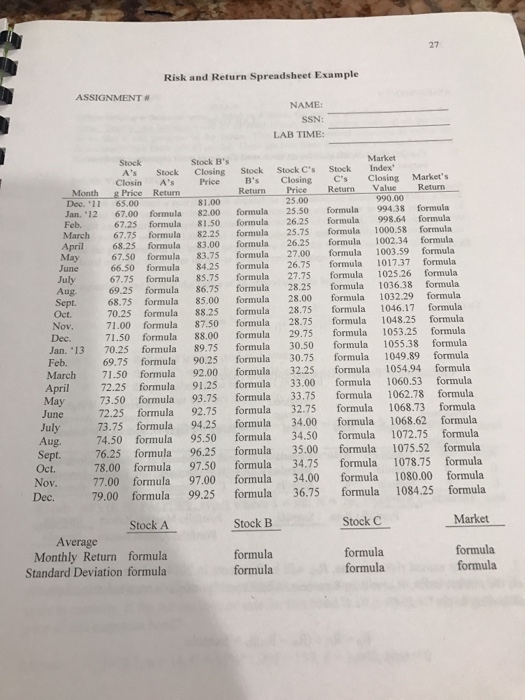

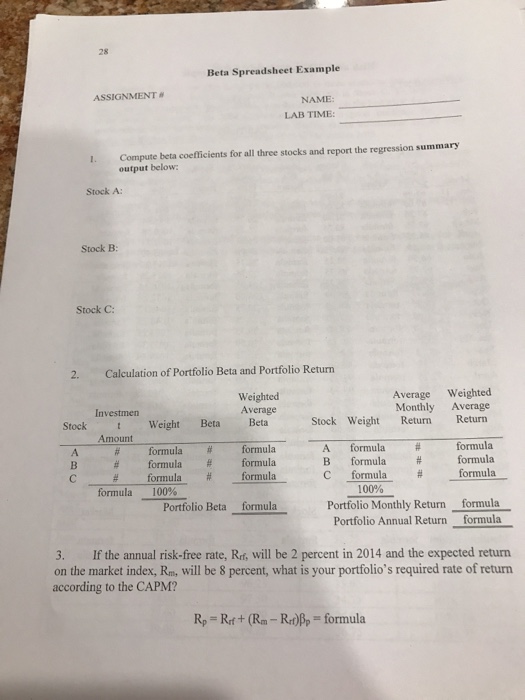

MODULE V: RISK AND RETURN INTRODUCTION we must know how return To better understand the relationship between returm and risk. and risk are measured first. RATE OF RETURN bus an asset, your gain measured is two ways; in dollar term or in percentage or loss from that investment is called your return on investment. This return can be term. It is usually more convenient to information about return term, called rate of return. The rate of return is expressed as the change in value of an asset plus any cash flows received during the period divided by the initial investment t-1 where Rt the actual rate ofreturn during period P-1 price (value) of asset at time t- 1; Pr price (value) of asset at time t; Cr cash flows received during the period from t-1 In the numerator of the above formula, P P-I is the capital gain or loss and Ct is the dividend payment for a stock investment or interest payment for a bond investment. The first term on the right-hand side of the formula is called capital gains yield and the second ed either dividend yield for a stock investment or current yield for a bond vestment. RISK The risk of concern to investors is the investment risk, which is related to the probability of low or negative returns. The greater the chance investors receive low returns, the riskier the investment. To quantify risk so that we can measure it, we generally deal with the probability distribution of rates of return. We can simply plot an investment's historical returns to construct a probability distribution. As the number of observations becomes large, say 60, the probability distribution will converge into a normal distribution, which has nice properties: it is symmetrical around the mean; and 2 if you know both mean and standard deviation, you know all the distribution. Standard deviation is a statistical measure of the dispersion around the mean. The smaller the standard deviation, the tighter the probability distribution, and thus, the less risky the investment After computing rates of return for a time period, the mean and standard deviation of the return series can be calculated as follows