Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moe Glee's business acquired a group of assets two years ago to help with expansion plans, but Moe would now like to review the

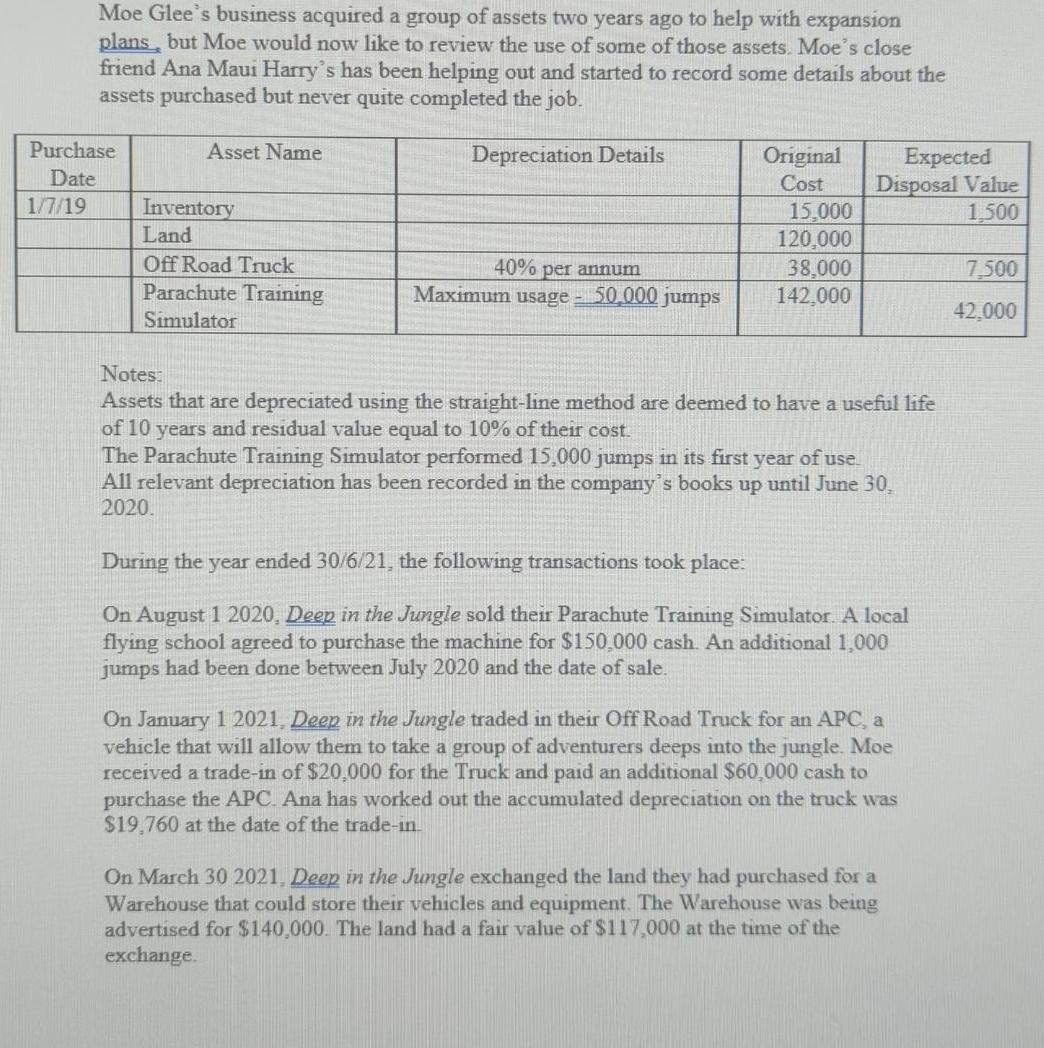

Moe Glee's business acquired a group of assets two years ago to help with expansion plans, but Moe would now like to review the use of some of those assets. Moe's close friend Ana Maui Harry's has been helping out and started to record some details about the assets purchased but never quite completed the job. Purchase Depreciation Details Asset Name Original Expected Date Cost Disposal Value 1/7/19 Inventory Land 15,000 1.500 120,000 Off Road Truck Parachute Training Simulator Maximum usage- 40% per annum 50,000 jumps 38,000 7,500 142,000 42.000 Notes: Assets that are depreciated using the straight-line method are deemed to have a useful life of 10 years and residual value equal to 10% of their cost. The Parachute Training Simulator performed 15,000 jumps in its first year of use. All relevant depreciation has been recorded in the company's books up until June 30, 2020. During the year ended 30/6/21, the following transactions took place: On August 1 2020, Deep in the Jungle sold their Parachute Training Simulator. A local flying school agreed to purchase the machine for $150,000 cash. An additional 1,000 jumps had been done between July 2020 and the date of sale. On January 1 2021, Deep in the Jungle traded in their Off Road Truck for an APC, a vehicle that will allow them to take a group of adventurers deeps into the jungle. Moe received a trade-in of $20,000 for the Truck and paid an additional $60,000 cash to purchase the APC. Ana has worked out the accumulated depreciation on the truck was $19,760 at the date of the trade-in. On March 30 2021, Deep in the Jungle exchanged the land they had purchased for a Warehouse that could store their vehicles and equipment. The Warehouse was being advertised for $140,000. The land had a fair value of $117,000 at the time of the exchange.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information here is a breakdown of the assets and their related transactions f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started