Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moffett Industries is considering new equipment. The equipment can be purchased from an overseas supplier for $3,220. The freight and installation costs for the

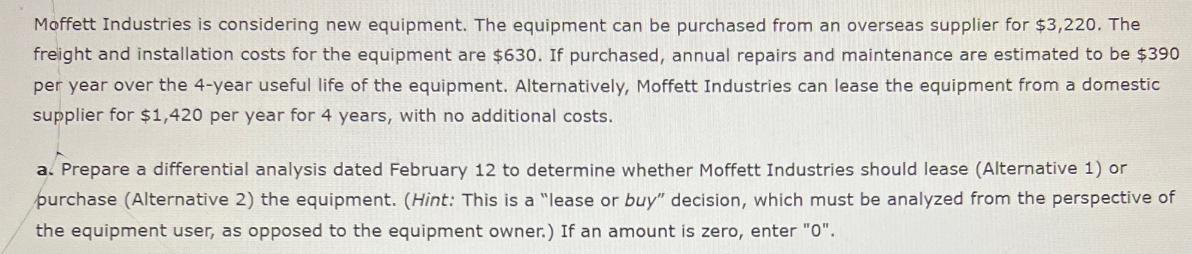

Moffett Industries is considering new equipment. The equipment can be purchased from an overseas supplier for $3,220. The freight and installation costs for the equipment are $630. If purchased, annual repairs and maintenance are estimated to be $390 per year over the 4-year useful life of the equipment. Alternatively, Moffett Industries can lease the equipment from a domestic supplier for $1,420 per year for 4 years, with no additional costs. a. Prepare a differential analysis dated February 12 to determine whether Moffett Industries should lease (Alternative 1) or purchase (Alternative 2) the equipment. (Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter "0".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started