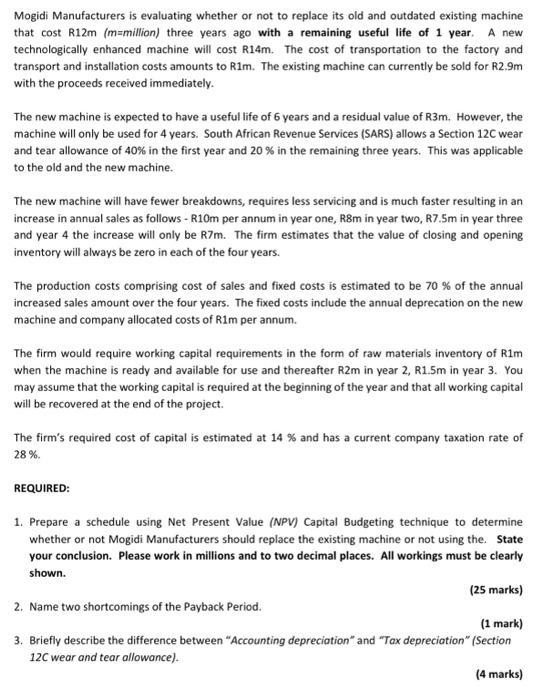

Mogidi Manufacturers is evaluating whether or not to replace its old and outdated existing machine that cost R12m (m=million) three years ago with a remaining useful life of 1 year. A new technologically enhanced machine will cost R14m. The cost of transportation to the factory and transport and installation costs amounts to Rim. The existing machine can currently be sold for R2.9m with the proceeds received immediately. The new machine is expected to have a useful life of 6 years and a residual value of R3m. However, the machine will only be used for 4 years. South African Revenue Services (SARS) allows a Section 12C wear and tear allowance of 40% in the first year and 20% in the remaining three years. This was applicable to the old and the new machine. The new machine will have fewer breakdowns, requires less servicing and is much faster resulting in an increase in annual sales as follows - R10m per annum in year one, R&m in year two, R7.5m in year three and year 4 the increase will only be R7m. The firm estimates that the value of closing and opening inventory will always be zero in each of the four years. The production costs comprising cost of sales and fixed costs is estimated to be 70 % of the annual increased sales amount over the four years. The fixed costs include the annual deprecation on the new machine and company allocated costs of Rim per annum. The firm would require working capital requirements in the form of raw materials inventory of Rim when the machine is ready and available for use and thereafter R2m in year 2, R1.5m in year 3. You may assume that the working capital is required at the beginning of the year and that all working capital will be recovered at the end of the project. The firm's required cost of capital is estimated at 14 % and has a current company taxation rate of 28% REQUIRED: 1. Prepare a schedule using Net Present Value (NPV) Capital Budgeting technique to determine whether or not Mogidi Manufacturers should replace the existing machine or not using the State your conclusion. Please work in millions and to two decimal places. All workings must be clearly shown. (25 marks) 2. Name two shortcomings of the Payback Period. (1 mark) 3. Briefly describe the difference between "Accounting depreciation" and "Tax depreciation" (Section 12C wear and tear allowance). (4 marks) Mogidi Manufacturers is evaluating whether or not to replace its old and outdated existing machine that cost R12m (m=million) three years ago with a remaining useful life of 1 year. A new technologically enhanced machine will cost R14m. The cost of transportation to the factory and transport and installation costs amounts to Rim. The existing machine can currently be sold for R2.9m with the proceeds received immediately. The new machine is expected to have a useful life of 6 years and a residual value of R3m. However, the machine will only be used for 4 years. South African Revenue Services (SARS) allows a Section 12C wear and tear allowance of 40% in the first year and 20% in the remaining three years. This was applicable to the old and the new machine. The new machine will have fewer breakdowns, requires less servicing and is much faster resulting in an increase in annual sales as follows - R10m per annum in year one, R&m in year two, R7.5m in year three and year 4 the increase will only be R7m. The firm estimates that the value of closing and opening inventory will always be zero in each of the four years. The production costs comprising cost of sales and fixed costs is estimated to be 70 % of the annual increased sales amount over the four years. The fixed costs include the annual deprecation on the new machine and company allocated costs of Rim per annum. The firm would require working capital requirements in the form of raw materials inventory of Rim when the machine is ready and available for use and thereafter R2m in year 2, R1.5m in year 3. You may assume that the working capital is required at the beginning of the year and that all working capital will be recovered at the end of the project. The firm's required cost of capital is estimated at 14 % and has a current company taxation rate of 28% REQUIRED: 1. Prepare a schedule using Net Present Value (NPV) Capital Budgeting technique to determine whether or not Mogidi Manufacturers should replace the existing machine or not using the State your conclusion. Please work in millions and to two decimal places. All workings must be clearly shown. (25 marks) 2. Name two shortcomings of the Payback Period. (1 mark) 3. Briefly describe the difference between "Accounting depreciation" and "Tax depreciation" (Section 12C wear and tear allowance). (4 marks)