Answered step by step

Verified Expert Solution

Question

1 Approved Answer

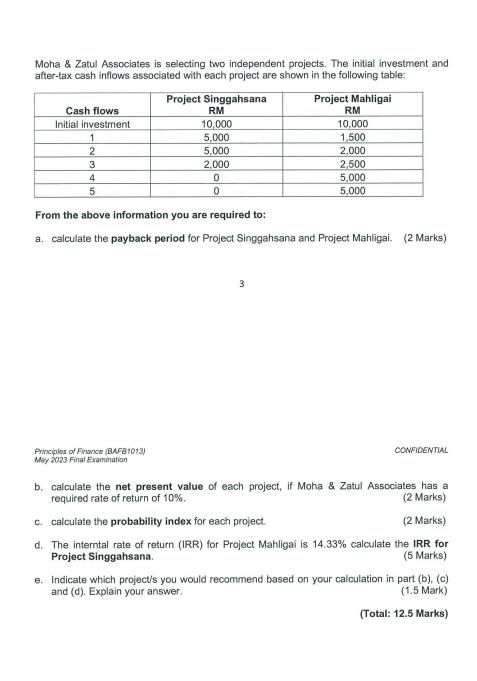

Moha & Zatul Associates is selecting two independent projects. The initial investment and after-tax cash inflows associated with each project are shown in the

Moha & Zatul Associates is selecting two independent projects. The initial investment and after-tax cash inflows associated with each project are shown in the following table: Project Mahligai RM 10,000 1,500 2,000 2,500 5,000 5,000 Cash flows Initial investment 1 2 3 4 5 Project Singgahsana RM 10,000 5,000 5,000 Principles of Finance (BAFB1013) May 2023 Final Examination 2,000 0 0 From the above information you are required to: a. calculate the payback period for Project Singgahsana and Project Mahligai. (2 Marks) 3 CONFIDENTIAL b. calculate the net present value of each project, if Moha & Zatul Associates has a required rate of return of 10%. (2 Marks) c. calculate the probability index for each project. (2 Marks) d. The interntal rate of return (IRR) for Project Mahligai is 14.33% calculate the IRR for Project Singgahsana. (5 Marks) e. Indicate which project's you would recommend based on your calculation in part (b), (c) and (d). Explain your answer. (1.5 Mark) (Total: 12.5 Marks)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the payback period for each project a Payback period for Project Singgahsana The payback period is the length of time it takes for a project to recover its initial investment In this case ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started