Question

Mohan Ltd. has an existing freehold factory property, which it intends to knock down and redevelop. During the redevelopment period the company will move

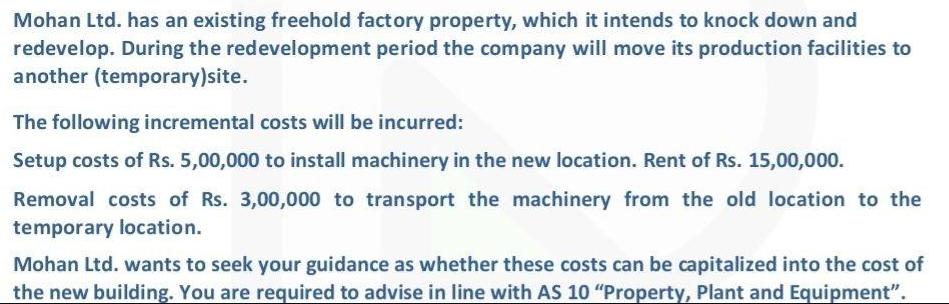

Mohan Ltd. has an existing freehold factory property, which it intends to knock down and redevelop. During the redevelopment period the company will move its production facilities to another (temporary)site. The following incremental costs will be incurred: Setup costs of Rs. 5,00,000 to install machinery in the new location. Rent of Rs. 15,00,000. Removal costs of Rs. 3,00,000 to transport the machinery from the old location to the temporary location. Mohan Ltd. wants to seek your guidance as whether these costs can be capitalized into the cost of the new building. You are required to advise in line with AS 10 "Property, Plant and Equipment".

Step by Step Solution

3.66 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Constructing or acquiring a new asset may result in increment...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mergers Acquisition And Other Restructuring Activities

Authors: Donald M. Depamphilis

6th Edition

123854857, 978-0123854858

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App