Answered step by step

Verified Expert Solution

Question

1 Approved Answer

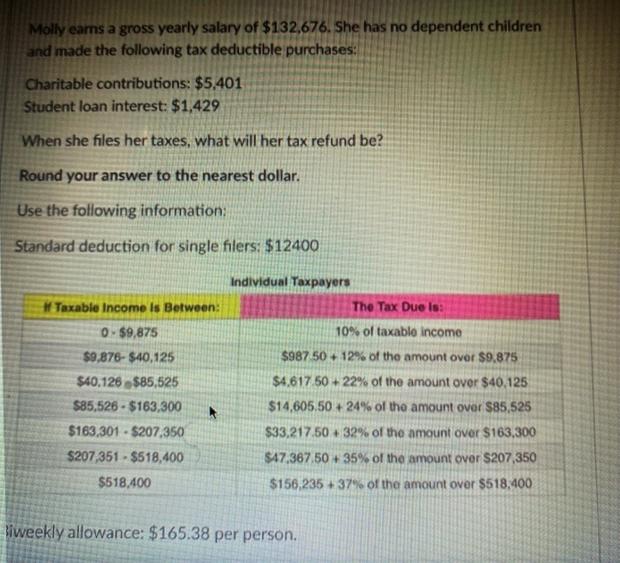

Molly earns a gross yearly salary of $132,676. She has no dependent children and made the following tax deductible purchases: Charitable contributions: $5,401 Student

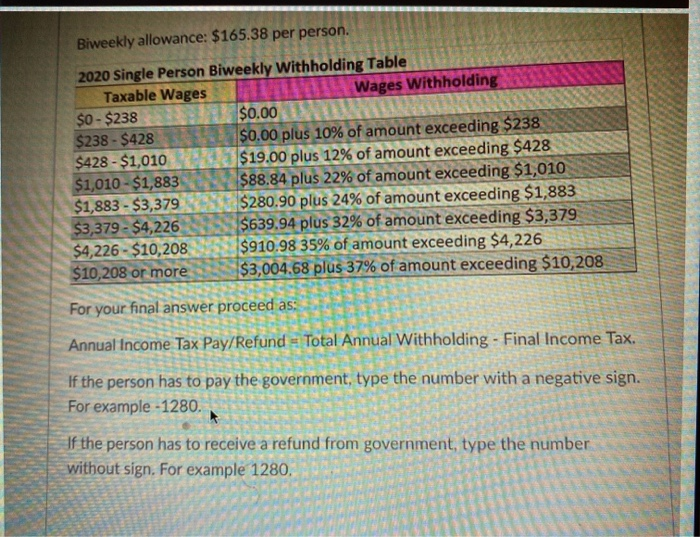

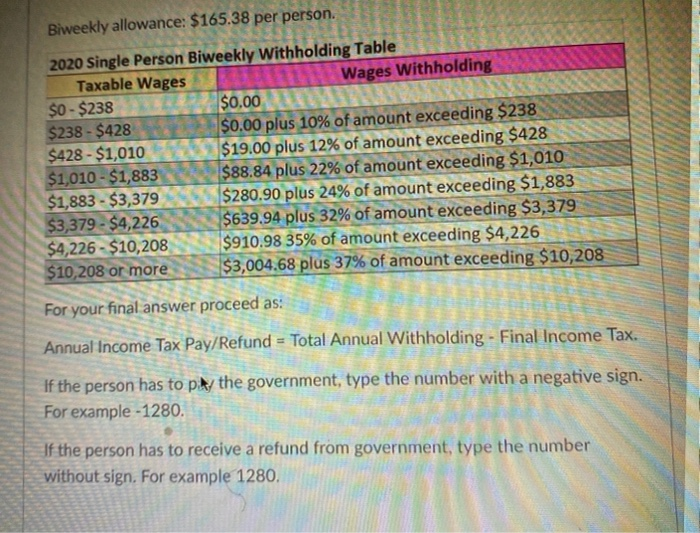

Molly earns a gross yearly salary of $132,676. She has no dependent children and made the following tax deductible purchases: Charitable contributions: $5,401 Student loan interest: $1,429 When she files her taxes, what will her tax refund be? Round your answer to the nearest dollar. Use the following information: Standard deduction for single filers: $12400 If Taxable Income is Between: 0-$9,875 $9,876-$40,125 $40.126 $85,525 $85,526-$163,300 $163,301-$207,350 $207,351 $518,400 $518,400 iweekly allowance: $165.38 per person. Individual Taxpayers The Tax Due is: 10% of taxable income $987.50+12% of the amount over $9,875 $4,617.50+22% of the amount over $40,125 $14,605.50 +24% of the amount over $85,525 $33,217.50+32% of the amount over $163,300 $47,367.50+ 35% of the amount over $207,350 $156,235 +37% of the amount over $518,400 Biweekly allowance: $165.38 per person. 2020 Single Person Biweekly Withholding Table Taxable Wages Wages Withholding $0-$238 $0.00 $238-$428 $428-$1,010 $1,010-$1,883 $1,883-$3,379 $3,379-$4,226 $0.00 plus 10% of amount exceeding $238 $19.00 plus 12% of amount exceeding $428 $88.84 plus 22% of amount exceeding $1,010 $280.90 plus 24% of amount exceeding $1,883 $639.94 plus 32% of amount exceeding $3,379 $910.98 35% of amount exceeding $4,226 $3,004.68 plus 37% of amount exceeding $10,208 $4,226-$10,208 $10,208 or more For your final answer proceed as: Annual Income Tax Pay/Refund Total Annual Withholding - Final Income Tax. If the person has to pay the government, type the number with a negative sign. For example -1280. If the person has to receive a refund from government, type the number without sign. For example 1280. Biweekly allowance: $165.38 per person. 2020 Single Person Biweekly Withholding Table Taxable Wages Wages Withholding $0-$238 $0.00 $238-$428 $428-$1,010 $1,010-$1,883 $1,883-$3,379 $3,379-$4,226 $0.00 plus 10% of amount exceeding $238 $19.00 plus 12% of amount exceeding $428 $88.84 plus 22% of amount exceeding $1,010 $280.90 plus 24% of amount exceeding $1,883 $639.94 plus 32% of amount exceeding $3,379 $910.98 35% of amount exceeding $4,226 $3,004.68 plus 37% of amount exceeding $10,208 $4,226-$10,208 $10,208 or more For your final answer proceed as: Annual Income Tax Pay/Refund = Total Annual Withholding - Final Income Tax. If the person has to pay the government, type the number with a negative sign. For example -1280. If the person has to receive a refund from government, type the number without sign. For example 1280.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given Molly yearly Salary 132676 Deductable purchases JAWATA charitable contribution 5401 7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started