Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Molson-Coors Brewing Company reported the following operating information for a recent year (in millions): Net sales Cost of goods sold Marketing, general, and admin.

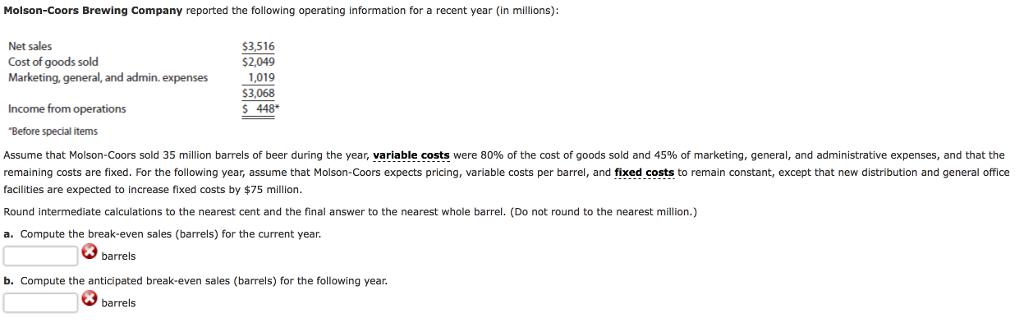

Molson-Coors Brewing Company reported the following operating information for a recent year (in millions): Net sales Cost of goods sold Marketing, general, and admin. expenses Income from operations "Before special items $3,516 $2,049 1,019 $3,068 $ 448* Assume that Molson-Coors sold 35 million barrels of beer during the year, variable costs were 80% of the cost of goods sold and 45% of marketing, general, and administrative expenses, and that the remaining costs are fixed. For the following year, assume that Molson-Coors expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $75 million. Round intermediate calculations to the nearest cent and the final answer to the nearest whole barrel. (Do not round to the nearest million.) a. Compute the break-even sales (barrels) for the current year. barrels b. Compute the anticipated break-even sales (barrels) for the following year. barrels

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req a Net sales 3516 Millions Sales in numbers 35 million barrels Selling price per barrel ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started