Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Monarch Construction Limited (MCL) is developing a multi-unit townhouse complex at the edge of the Lochdale area in the City of Burnaby. All townhouse units

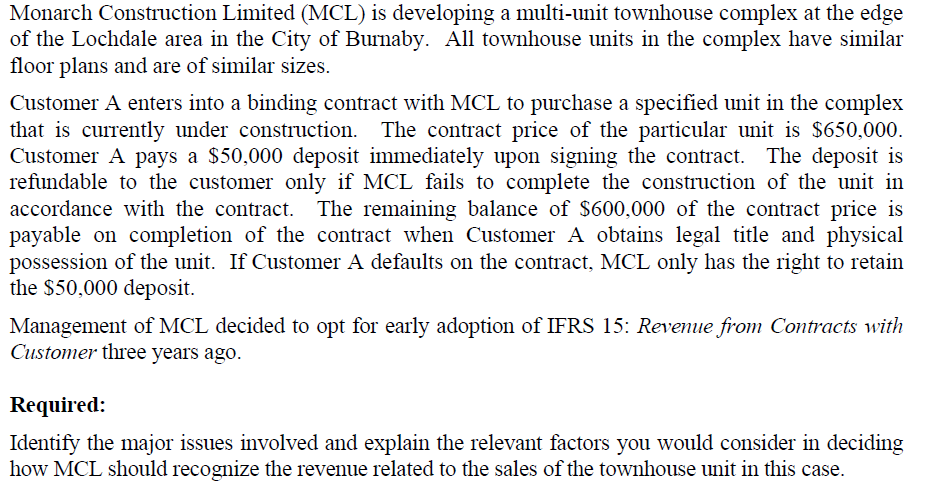

Monarch Construction Limited (MCL) is developing a multi-unit townhouse complex at the edge of the Lochdale area in the City of Burnaby. All townhouse units in the complex have similar floor plans and are of similar sizes. Customer A enters into a binding contract with MCL to purchase a specified unit in the complex that is currently under construction. The contract price of the particular unit is S650,000. Customer A pays a S50,000 deposit immediately upon signing the contract. The deposit is refundable to the customer only if MCL fails to complete the construction of the unit in accordance with the contract. The remaining balance of S600,000 of the contract price is payable on completionof the contract when Customer A obtains legal title and physical possession of the unit. If Customer A defaults on the contract, MCL only has the right to retain the S50,000 deposit. Management of MCL decided to opt for early adoption of IFRS 15: Revenue from Contracts with Customer three years ago. Required: Identify the major issues involved and explain the relevant factors you would consider in deciding how MCL should recognize the revenue related to the sales of the townhouse unit in this case

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started