Answered step by step

Verified Expert Solution

Question

1 Approved Answer

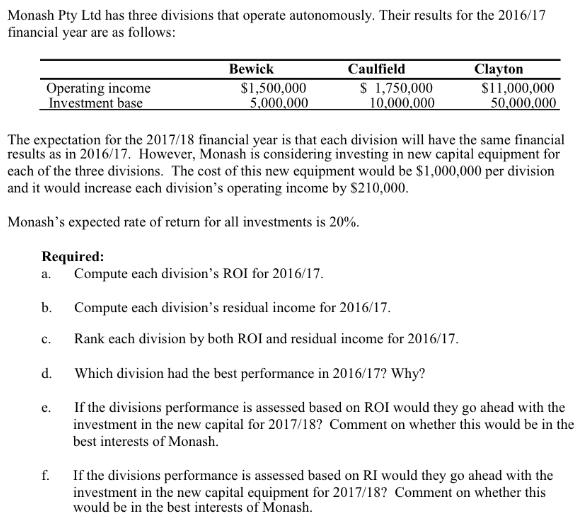

Monash Pty Ltd has three divisions that operate autonomously. Their results for the 2016/17 financial year are as follows: Operating income Investment base Required:

Monash Pty Ltd has three divisions that operate autonomously. Their results for the 2016/17 financial year are as follows: Operating income Investment base Required: a. b. C. The expectation for the 2017/18 financial year is that each division will have the same financial results as in 2016/17. However, Monash is considering investing in new capital equipment for each of the three divisions. The cost of this new equipment would be $1,000,000 per division and it would increase each division's operating income by $210,000. Monash's expected rate of return for all investments is 20%. d. e. Bewick f. $1,500,000 5,000,000 Caulfield $ 1,750,000 10,000,000 Clayton $11,000,000 50,000,000 Compute each division's ROI for 2016/17. Compute each division's residual income for 2016/17. Rank each division by both ROI and residual income for 2016/17. Which division had the best performance in 2016/17? Why? If the divisions performance is assessed based on ROI would they go ahead with the investment in the new capital for 2017/18? Comment on whether this would be in the best interests of Monash. If the divisions performance is assessed based on RI would they go ahead with the investment in the new capital equipment for 2017/18? Comment on whether this would be in the best interests of Monash.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Requirement A ROI operating incomeinvestment base ROI for bewick division for 201617 15000005000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started