Question

Mondesto Company has the following debts: Unsecured creditors Liabilities with priority Secured liabilities: Debt 1, $250,000; value of pledged asset Debt 2, $210,000; value

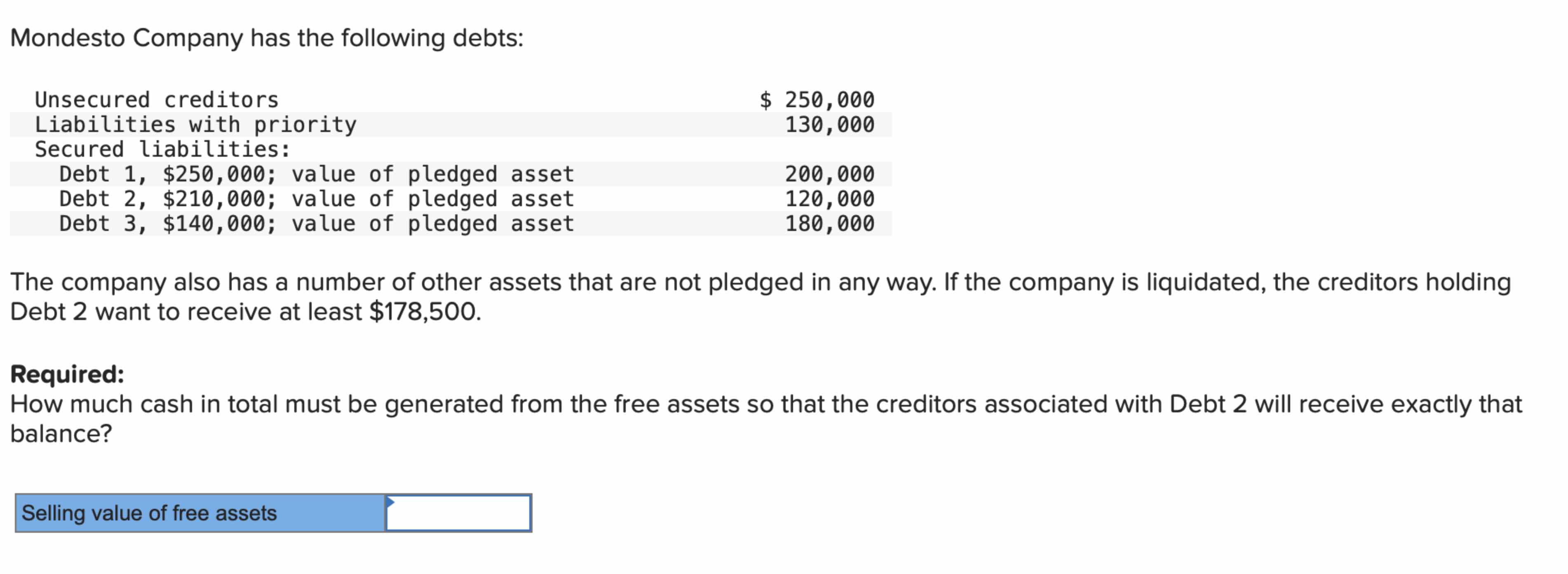

Mondesto Company has the following debts: Unsecured creditors Liabilities with priority Secured liabilities: Debt 1, $250,000; value of pledged asset Debt 2, $210,000; value of pledged asset Debt 3, $140,000; value of pledged asset $ 250,000 130,000 200,000 120,000 180,000 The company also has a number of other assets that are not pledged in any way. If the company is liquidated, the creditors holding Debt 2 want to receive at least $178,500. Selling value of free assets Required: How much cash in total must be generated from the free assets so that the creditors associated with Debt 2 will receive exactly that balance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the selling value of free assets needed for the credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

10th edition

0-07-794127-6, 978-0-07-79412, 978-0077431808

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App