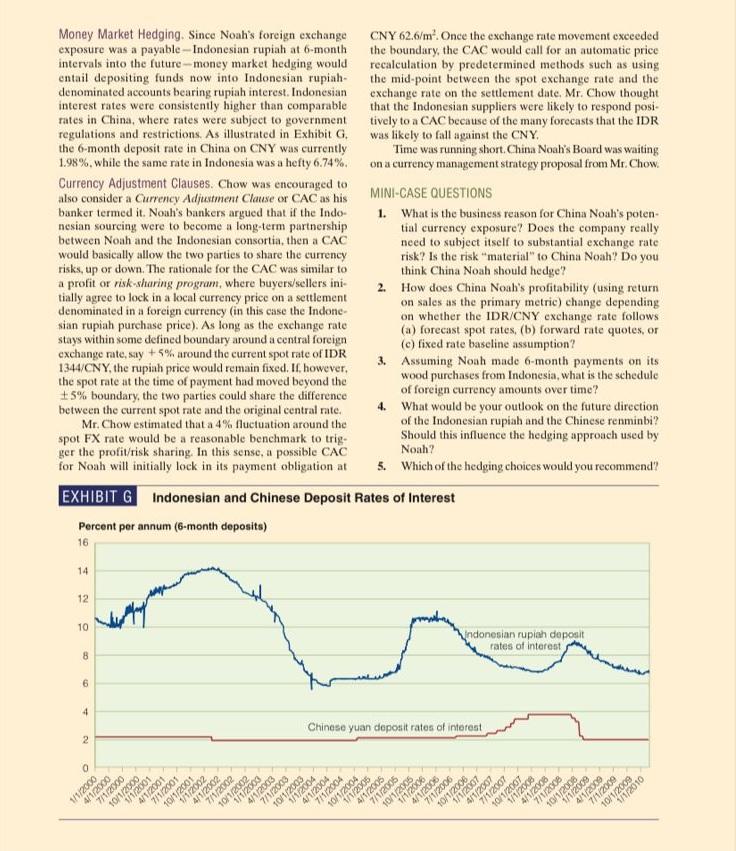

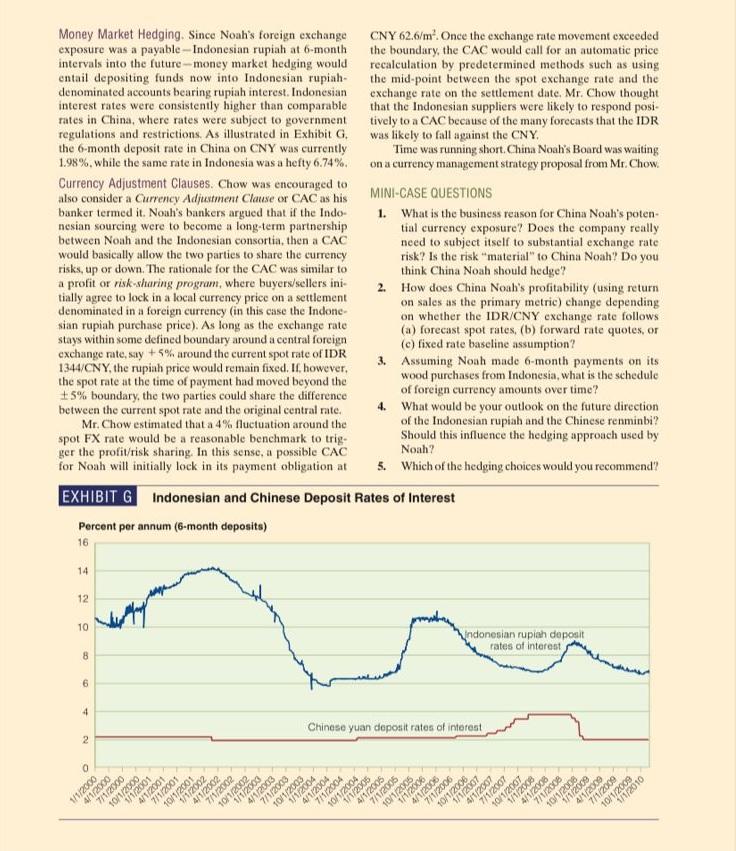

Money Market Hedging. Since Noah's foreign exchange CNY 62.6/m2. Once the exchange rate movement exceeded exposure was a payable - Indonesian rupiah at 6 -month the boundary, the CAC would call for an automatic price intervals into the future-money market hedging would recalculation by predetermined methods such as using entail depositing funds now into Indonesian rupiah- the mid-point between the spot exchange rate and the denominated accounts bearing rupiah interest. Indonesian exchange rate on the settement date. Mr. Chow thought interest rates were consistently higher than comparable that the Indonesian suppliers were likely to respond posirates in China, where rates were subject to government tively to a CAC because of the many forecasts that the IDR regulations and restrictions. As illustrated in Exhibit G, was likely to fall against the CNY. the 6-month deposit rate in China on CNY was currently Time was running short. China Noah's Board was waiting 1.98%, while the same rate in Indonesia was a hefty 6.74%. on a currency management strategy proposal from Mr. Chow. Currency Adjustment Clauses. Chow was encouraged to also consider a Currency Adjustment Clause or CAC as his MINI-CASE QUESTIONS banker termed it. Noah's bankers argued that if the Indo- 1. What is the business reason for China Noah's potennesian sourcing were to become a long-term partnership tial currency exposure? Docs the company really between Noah and the Indonesian consortia, then a CAC need to subject itself to substantial exchange rate would basically allow the two parties to share the currency_risk? Is the risk "material" to China Noah"? Do you risks, up or down. The rationale for the CAC was similar to think China Noah should hedge? a profit or risk-sharing program, where buyers/sellers initially agree to lock in a local currency price on a settlement 2. How does China Noah's profitability (using return denominated in a foreign currency (in this case the Indoneon sales as the primary metric) change depending sian rupiah purchase price). As long as the exchange rate on whether the IDR/CNY exchange rate follows stays within some defined boundary around a central forcign (a) forecast spot rates, (b) forward rate quotes, or exchange rate, siy +5% around the current spot rate of IDR (c) fixed rate baseline assumption? 1344/CNY, the rupiah price would remain fixed. If, however. 3. Assuming Noah made 6-month payments on its the spot rate at the time of payment had moved beyond the wood purchases from Indonesia, what is the sehedule 5% boundary, the two parties could share the difference of foreign currency amounts over time? between the current spot rate and the original central rate. 4. What would be your outlook on the future direction Mr. Chow estimated that a 4% fluctuation around the of the Indonesian rupiah and the Chinese renminbi? spot FX rate would be a reasonable benchmark to trigShould this influence the hedging approach used by ger the profit/risk sharing. In this sense, a possible CAC Noah? for Noah will initially lock in its payment obligation at 5. Which of the hedging choices would you recommend?? EXHIB|T G Indonesian and Chinese Deposit Rates of Interest Percent per annum (6-month deposits)