Question

Monica Santiago, dba, Sugar Bakery Monica, Pastry Chef, (Cook) owns a business on her own, Sugar Bakery, dedicated to the preparation and sale of biscuits

Monica Santiago, dba, Sugar Bakery

Monica, Pastry Chef, (Cook) owns a business on her own, Sugar Bakery, dedicated to the preparation and sale of biscuits and pastry items. Monica began the operation of her business on April 1, 2021 and actively participates in the business at a rate of 35 hours per week. The business is located in San Juan. The result of its operations, under the accrual method and on a tax basis, during 2021 was as follows:

Sales $70,000 (not reported in 480s)

Cost of goods sold 50,0002

Electric power 3,000

Aqueducts and sewers 2,000

Professional services 25,000

Another 15,000

The business meets all the requirements to claim all of its expenses for purposes of the regular tax and the alternate basic tax. Submitted the Agreed-Upon Procedures (AUP).

Salary Monica

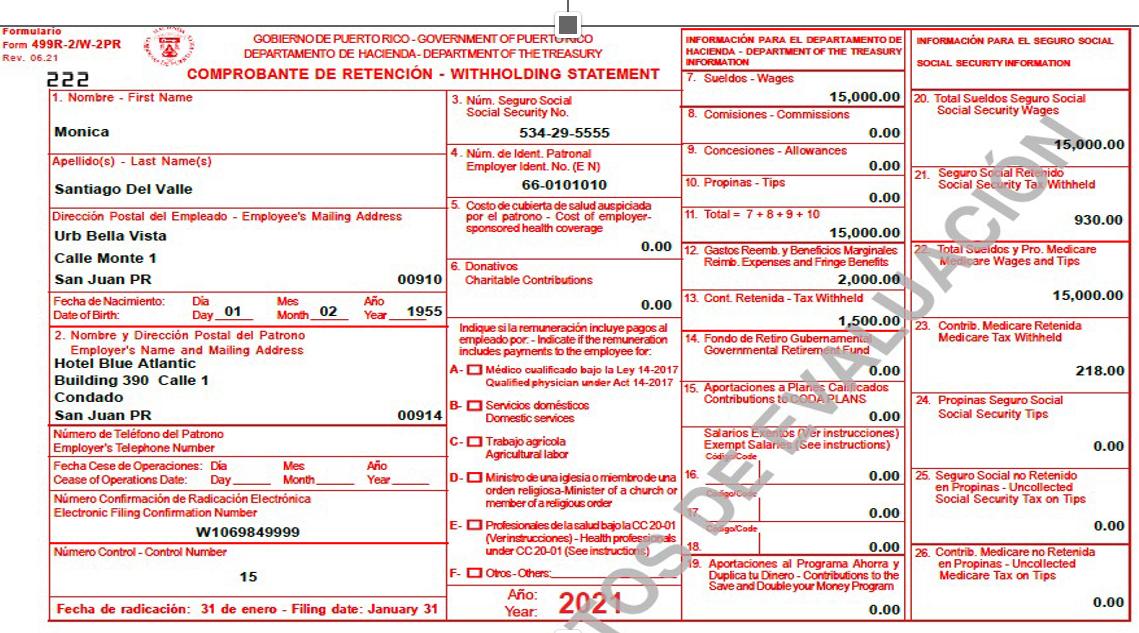

Monica worked as a Pastry Chef in a hotel until the date of her resignation on March 31, 2021. For the first three (3) months of 2021, Monica received a salary of $15,000, as shown in the following Withholding Statement:

1. Requirements: Calculate

a. the net income (loss) of Medical Equipment & Supply.

b. Sugar Bakery's net income (loss).

c. the deduction for depreciation for the property used in the rental activity.

d. the net income (loss) from the rental activity.

and. adjusted gross income for marriage in 2021.

F. the net income subject to tax for the marriage in 2021.

g. the normal tax, the preferential rate tax and the total income tax.

h. the income tax payable or the refund to be received.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started