Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Monika is a single parent living in Toronto. Her husband passed away a couple years ago and left her with residential rental properties. Between

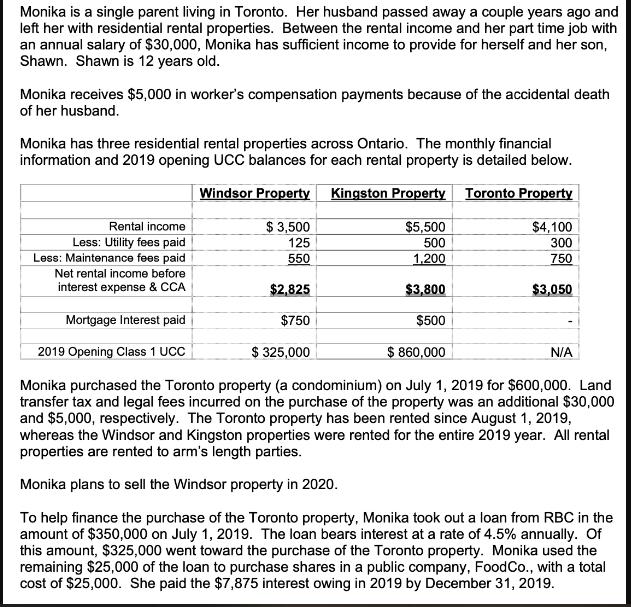

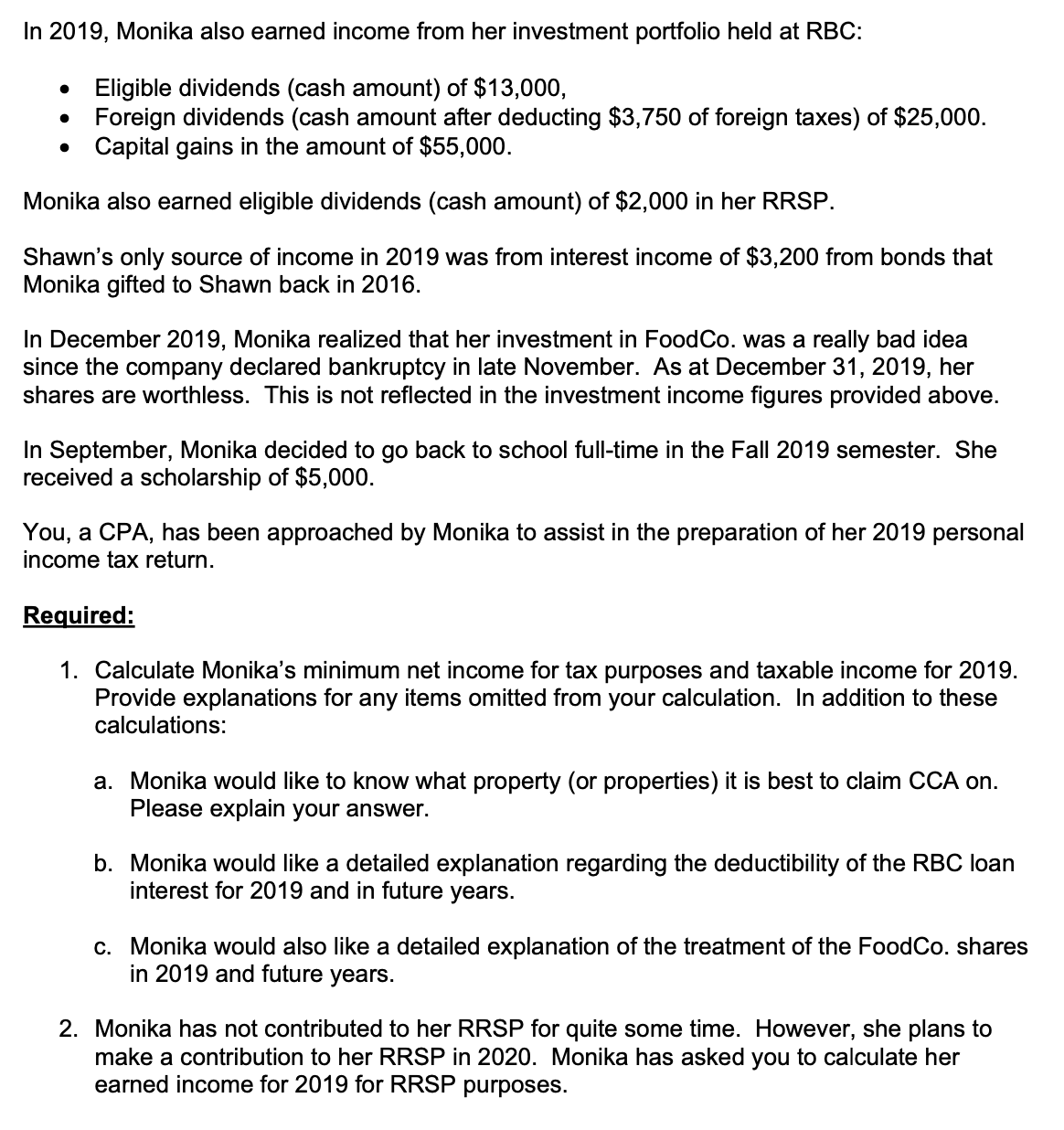

Monika is a single parent living in Toronto. Her husband passed away a couple years ago and left her with residential rental properties. Between the rental income and her part time job with an annual salary of $30,000, Monika has sufficient income to provide for herself and her son, Shawn. Shawn is 12 years old. Monika receives $5,000 in worker's compensation payments because of the accidental death of her husband. Monika has three residential rental properties across Ontario. The monthly financial information and 2019 opening UCC balances for each rental property is detailed below. Windsor Property Kingston Property Toronto Property Rental income Less: Utility fees paid Less: Maintenance fees paid Net rental income before interest expense & CCA $2,825 Mortgage Interest paid $750 2019 Opening Class 1 UCC $ 325,000 $ 860,000 Monika purchased the Toronto property (a condominium) on July 1, 2019 for $600,000. Land transfer tax and legal fees incurred on the purchase of the property was an additional $30,000 and $5,000, respectively. The Toronto property has been rented since August 1, 2019, whereas the Windsor and Kingston properties were rented for the entire 2019 year. All rental properties are rented to arm's length parties. Monika plans to sell the Windsor property in 2020. $ 3,500 125 550 $5,500 500 1,200 $3,800 $500 $4,100 300 750 $3,050 N/A To help finance the purchase of the Toronto property, Monika took out a loan from RBC in the amount of $350,000 on July 1, 2019. The loan bears interest at a rate of 4.5% annually. Of this amount, $325,000 went toward the purchase of the Toronto property. Monika used the remaining $25,000 of the loan to purchase shares in a public company, FoodCo., with a total cost of $25,000. She paid the $7,875 interest owing in 2019 by December 31, 2019. In 2019, Monika also earned income from her investment portfolio held at RBC: Eligible dividends (cash amount) of $13,000, Foreign dividends (cash amount after deducting $3,750 of foreign taxes) of $25,000. Capital gains in the amount of $55,000. Monika also earned eligible dividends (cash amount) of $2,000 in her RRSP. Shawn's only source of income in 2019 was from interest income of $3,200 from bonds that Monika gifted to Shawn back in 2016. In December 2019, Monika realized that her investment in Food Co. was a really bad idea since the company declared bankruptcy in late November. As at December 31, 2019, her shares are worthless. This is not reflected in the investment income figures provided above. In September, Monika decided to go back to school full-time in the Fall 2019 semester. She received a scholarship of $5,000. You, a CPA, has been approached by Monika to assist in the preparation of her 2019 personal income tax return. Required: 1. Calculate Monika's minimum net income for tax purposes and taxable income for 2019. Provide explanations for any items omitted from your calculation. In addition to these calculations: a. Monika would like to know what property (or properties) it is best to claim CCA on. Please explain your answer. b. Monika would like a detailed explanation regarding the deductibility of the RBC loan interest for 2019 and in future years. c. Monika would also like a detailed explanation of the treatment of the FoodCo. shares in 2019 and future years. 2. Monika has not contributed to her RRSP for quite some time. However, she plans to make a contribution to her RRSP in 2020. Monika has asked you to calculate her earned income for 2019 for RRSP purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the responses to Monikas questions 1 Calculations of minimum net income and taxable income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started